After twenty years of compounding sales, profits and share price at a double-digit rate, 4imprint has reached a $2bn market value. Yet the company remains poorly understood and widely ignored. This creates an opportunity for further upside.

In this post I will cover 4imprint’s track record and history. I will then delve into the business model and sources of competitive advantage, including a peer comparison. I will conclude with some forecast scenarios and thoughts on valuation.

There are some great write-ups of 4imprint out there already, many of which I link to below. UK sellside firms such as Liberum and Barclays also provide good coverage. What is new and different in this write-up?

· I used 25 years of annual reports to construct a full financial history of the direct marketing business, which I’ve not seen presented before.

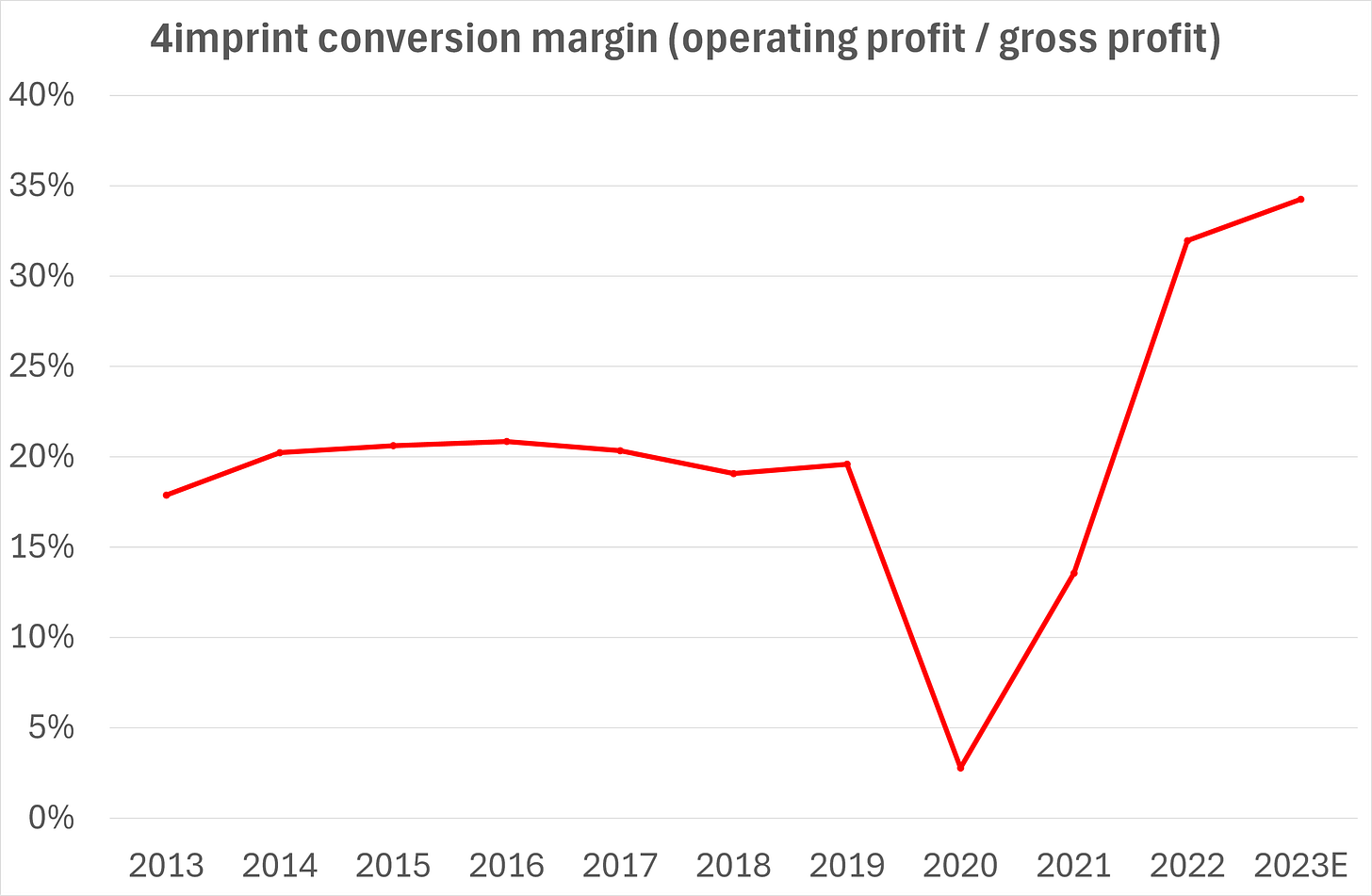

· I suggest a conversion margin analysis (operating profit to gross profit) to help understand 4imprint’s profit structure. This is as used by Pagegroup, IMCD and Azelis among others.

· I point out that on the current trajectory, 4imprint would be on track to double profits by 2027! Nobody talks about this. While not my base case, it is worth discussing this scenario, if only to draw out bears on why that couldn’t happen.

Disclosure: 4imprint is one of my top holdings. I’m grateful for all feedback, especially any negatives or bear points that I may have missed.

Track record

4imprint is a US distributor of promotional goods, based in the small town of Oshkosh, Wisconsin. The CEO Kevin Lyons-Tarr has been with the business since 1991, taking the lead role in 2004, and has led its substantial growth with an owner-operator mindset. He and his team have grown sales from $49m in 2002 to $1.3bn in 2023, for a CAGR of 16.9%. This growth has been purely organic, with essentially no acquisitions in the direct marketing business throughout the period. (A tiny screen-printing acquisition in April 2022 had the effect of bringing in-house a previously outsourced activity, and contributed nothing by way of revenue.)

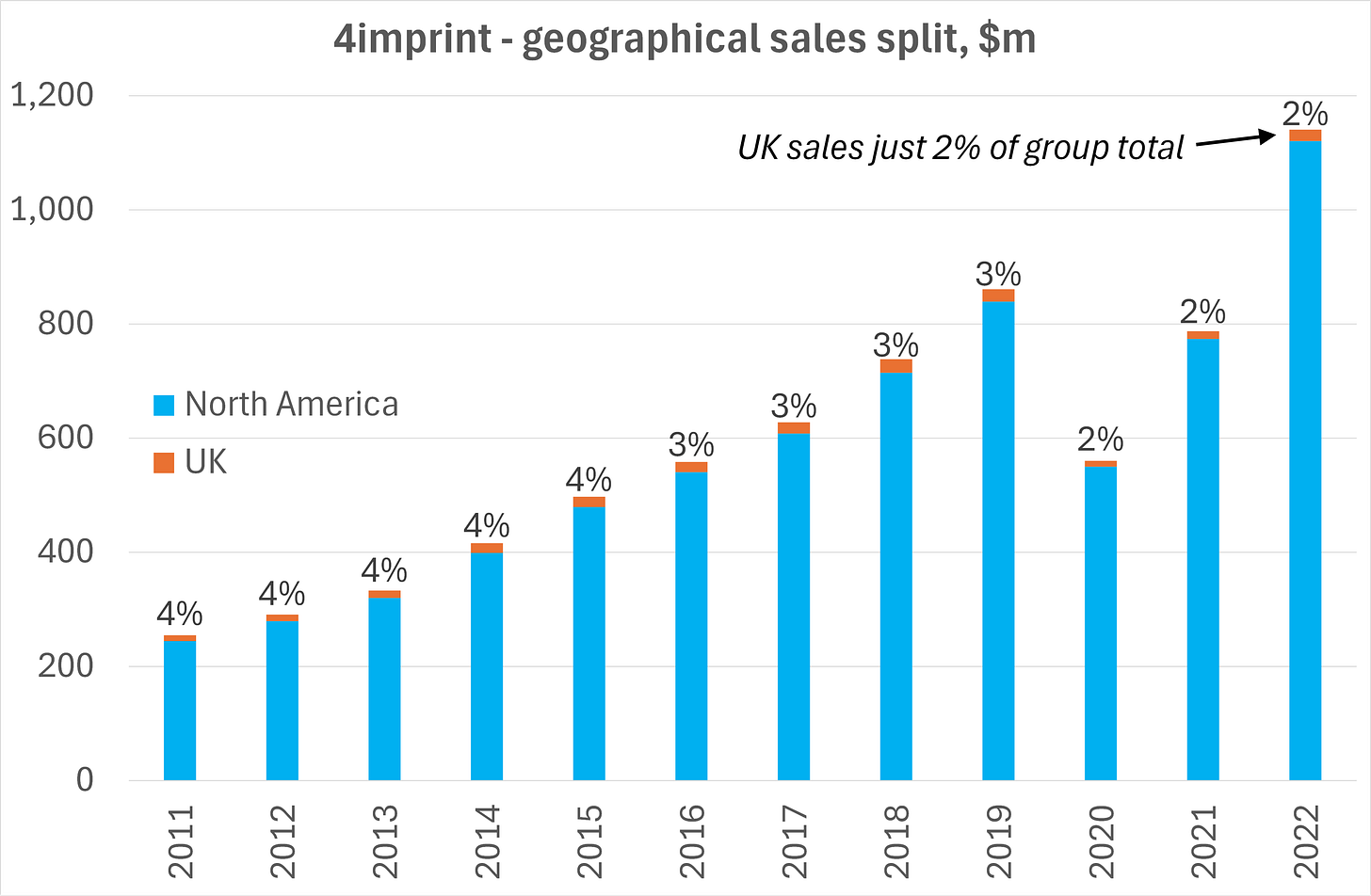

North America accounts for 98% of group sales, with just 2% from the tiny UK business following the same model.

Orders received is an operational KPI that 4imprint has reported consistently since 2011. The chart below shows the track record of growth in order numbers. Implied average order value was flat throughout the deflationary 2010s, and has moved up recently alongside the return of inflation in general, as well as some mix shift towards higher-priced items.

The business has been profitable every year. The operating profit margin stayed in a tight range of around 6-8% for most of this period, excepting the recession years of 2009 and 2020. Since 2022 the margin has broken out to the upside – more on this below.

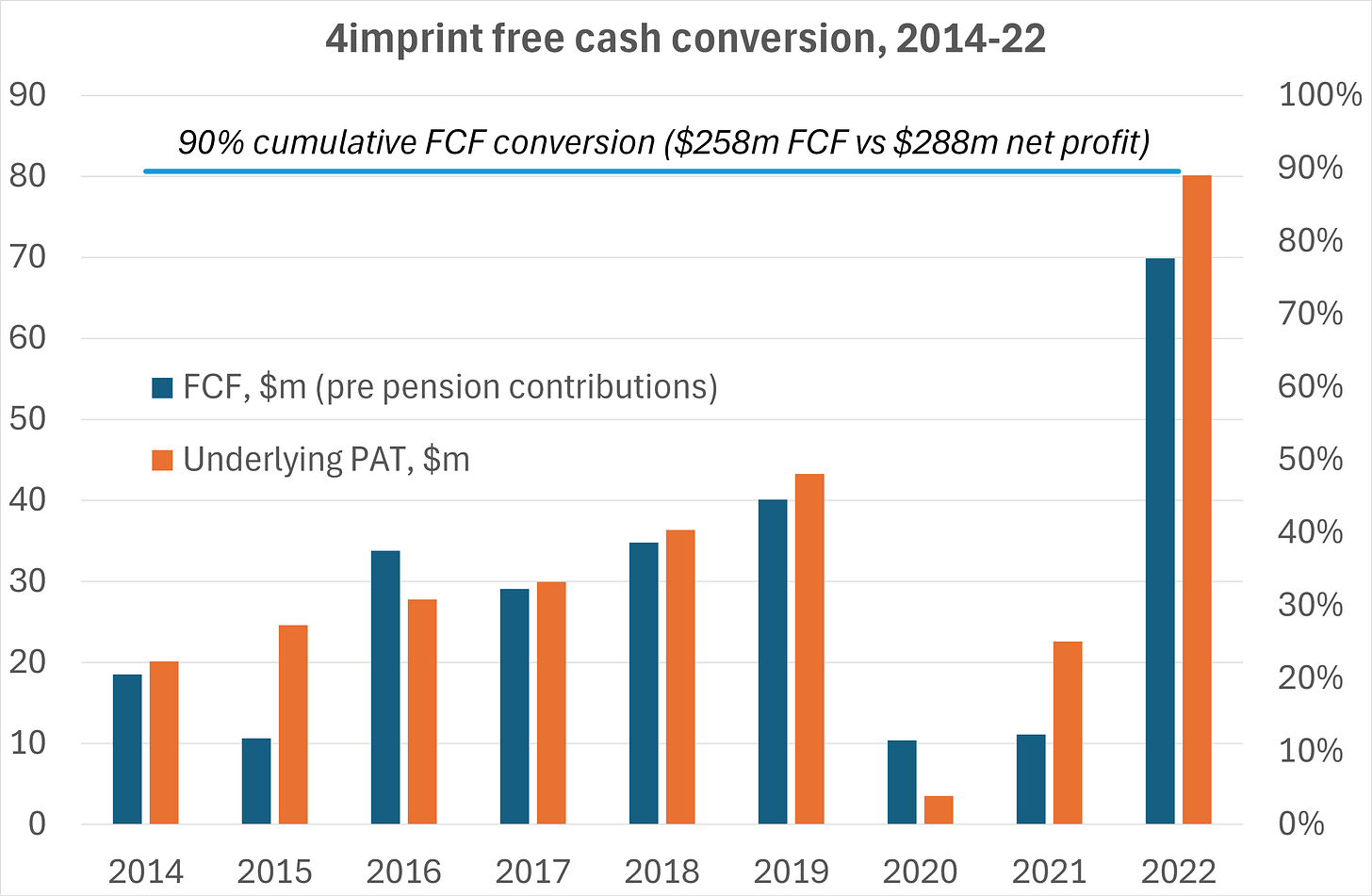

The business has also been highly cash generative. 4imprint relies on its supplier partners to fulfil most orders in a drop-shipping model. With low requirements for working capital and capital expenditure, 4imprint has converted an impressive 90% of net profit to free cash flow over the period from 2014 to 2022 inclusive – see chart below.

The share price has risen broadly in line with the fundamentals over the period. Re-rating has not been a significant driver.

History

The business now called 4imprint was founded as Nelson Marketing by Dick Nelson in 1985. He hit on a catalogue offering promotional products to small and medium businesses, and found immediate success.

4imprint the stock has a different and more colourful history. First listed in 1986 as Bemrose, it was a small printing company with cheque-printing and rail ticket printing businesses among others. A May 1993 write-up in the Independent gives a flavour.

On 30 December 1995, as part of their promotional products strategy, Bemrose bought the Oshkosh distributor Nelson Marketing for £14.4m. Its 1995 net income was $2.255m / £1.452m. In the 1996 annual report, Bemrose wrote:

“Nelson Marketing, in its first year with the Group, has performed very well. Business to Business direct marketing is a developing activity in many countries. We have recently launched Nelson in Canada and the UK. We anticipate that this activity will be a key component of our future growth.”

In early 2000, Dick Nelson changed his business’s name to 4imprint to underscore its four-month-old ecommerce site, 4imprint.com. In March 2000, Bemrose named him group CEO. In August 2000 the group name was changed to 4imprint Group plc. By October 2000 all four legacy printing businesses had been sold for proceeds of £36m, and 4imprint as a group was focused on the promotional marketing business.

Still, the Oshkosh direct marketing entity was only one business alongside other promotional products companies in the UK and Germany that followed different strategies and never produced strong results.

In December 2000, 4imprint spent $13m to acquire Adventures in Advertising Franchise (AIA), a US promotional products distributor franchisor with a network of over 400 franchise owners. This purchase worked out poorly, and after years of big losses it was finally sold in July 2005 for $11m. The activist investor Hanover took control of the board in October 2003, led by Edward Bramson who became chairman. Dick Nelson left the group in December 2003.

Kevin Lyons-Tarr was made CEO of the Oshkosh direct marketing business in 2004, but he did not become group CEO until March 2015. In the intervening decade, the lead executive role was taken by two UK-based executive chairmen, namely Ken Minton (ex Laporte plc) and John Poulter (ex Spectris).

Overall, the period from 2004 to 2012 was characterised by the steady growth of 4imprint in Oshkosh and the flatlining of the other mediocre businesses. The UK-based distributor Brand Addition was sold to H.I.G. in March 2012 for £24m (becoming the core of what is now Pebble Group), and the UK-based manufacturing business SPS was sold in February 2014 for £7m (eventually becoming a part of current 4imprint supplier Polyconcept).

Business model and strategy

4imprint is a distributor of promotional products. They sell an extensive range of apparel, bags, drinkware etc that is custom printed with the logo or name of their customer’s organisation.

The promotional products market in North America is worth around $27bn, served by an estimated 26,000 distributors. 4imprint’s market share is around 5%, making them the single biggest player.

Industry structure for the promotional products industry is two-sided. The many distributors get close to their chosen target customers and seek to win orders, while the many suppliers are responsible for importing, producing and fulfilling orders in a specific category. Vertical integration has not been a viable strategy, and instead the industry has remained two-sided and highly fragmented. This is likely due to the broad product range that must be offered as well as the many different customer types that must be served.

Many distributors retain sales executives to pursue large bluechip accounts, given the attractive characteristics of high and recurring spending year after year. HALO Branded Solutions is a leading company in this category. HALO reached over $1bn in sales in 2022 after its private equity sponsor TPG Growth completed a number of acquisitions. A concern might be that individual sales executives can switch firms or set up independently and bring key accounts with them.

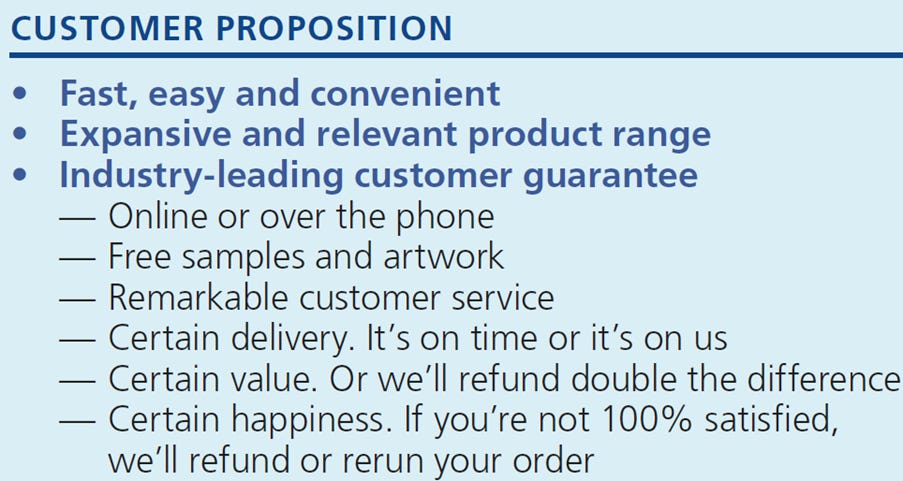

4imprint by contrast offers a single direct marketing channel that is largely self-serve, underpinned by wonderful customer service and credible guarantees (see box below). Customers of any size can order what they need at any time, without contractual commitments. 4imprint’s offer is well suited to small and medium organisations that may be neglected by the traditional distributors.

4imprint’s customer proposition. Source: 2022 annual report

In addition, 4imprint likely does a lot of business with individuals at bluechip customers, with its flexible offer that is free from the bureaucracy associated with a bespoke program. From the 2022 annual report:

We define our customer as the individual placing the order, rather than the business or organisation for which the individual works or with which he/she is associated. Our customer base is widely dispersed geographically, by size of business/ organisation and across commercial, governmental, educational, charitable, religious and other segments.

(Interestingly, 4imprint reports a 24 month customer retention KPI, typically in the low 40% range. This is far lower than the 90%-plus customer retention often reported by peers who focus on bluechip corporate accounts. It is paradoxical that 4imprint’s focus on smaller or more casual customers, with a 40% retention rate, generates superior long-term economics compared to the alternative approach.)

What is remarkable, over a period of more than 20 years, is the strategic and operational continuity of the core business. Lyons-Tarr and his team have pursued a singular vision of a direct marketing business that has reinvested the benefits of scale into further growth initiatives, while avoiding possible distractions such as targeting large corporate programs, vertical integration or acquisitions of any kind.

The one noteworthy evolution of strategy since 2000 was clearly flagged in the 2017 annual report by the new non-executive chairman Paul Moody (ex Britvic). He outlined a new plan to add television and radio advertising alongside the mainstay catalogues, free samples and online keyword ads. He wrote:

Turning to the future development of the Group, the Executive Team and the Board have considered, and subsequently evolved, our strategic framework. We have concluded that now is the right time to accelerate the awareness and strength of the 4imprint brand through a combination of different marketing techniques, including traditional broadcast media and the expansion of our advertising presence in digital media. This brand awareness component will complement our existing marketing engine, with the aim of delivering our new strategic goal of achieving $1bn in Group revenue by 2022.

The contrarian move to start television advertising was an immediate success, as organic growth accelerated from 12% in 2016 and 2017 to 17-18% in 2018 and 2019. The move also proved timely for another reason. When the global pandemic struck in 2020, office employees were forced to work from home. Catalogues and outbound sample boxes lost all relevance as customer acquisition tools, since nobody was going to the office to pick them up. Instead, television advertising reached a broad audience of prospective customers and ensured that 4imprint was top of mind for promotional goods. It is the success of the television advertising effort that drove the surprisingly strong sales rebound in 2022 and 2023, defying the conventional wisdom in 2020 and 2021 that the path to recovery for 4imprint would be slow and arduous.

The commercials emphasise the Feeling of Certainty that 4imprint provides, using the tagline 4imprint – For Certain. Feedback from the Reddit subgroup r/CommercialsIHate suggests that the campaign has achieved a degree of cut-through.

Television advertising transformed not just sales but also profitability, proving far more cost-effective and scaleable than catalogues and free samples. The higher marketing efficiency explains a large part of the new double-digit operating margin level, with positive operating leverage over other fixed and semi-fixed costs explaining the rest.

Unit economics and margin structure

A worked example will help illuminate 4imprint’s margin structure.

-In 2022 the company took $1.14bn in revenue from 1.86m orders, implying an average order value of $613. (A typical example might be 40 embroidered polo shirts for staff uniforms.)

-The gross margin in 2022 was 28.2%. This was below the pre-pandemic average of 33%, due to elevated freight costs, delayed recovery of product cost inflation and product mix effects. (Garments and premium branded items sold more strongly in 2022. These have higher ticket prices but lower percentage gross margins than cheaper products.)

-The typical order of $613 brings in $173 gross profit dollars. 40% was spent on marketing ($69 per order), and 28% on all other SG&A costs ($48 per order), leaving 32% of the gross profit to drop to operating profit ($55 per order). This gave a conversion margin (OP to GP) of 32% in 2022.

The conversion margin is a useful way to think about 4imprint’s profitability. Many investors have struggled with 4imprint’s history of single-digit operating margins, which would typically indicate a lower-quality business. But given the asset-light nature of their platform, a framework of take rate and conversion margin may better represent the economics and the future opportunity.

Capital allocation

As we saw above, 4imprint has an impressive track record of cash generation. The business threw off $258m of cumulative free cash flow from 2014 to 2022.

The business has sustained strong organic growth despite a low reinvestment need. From 2014 to 2022 inclusive, cumulative capital expenditure was just $42.7m on PP&E plus $3.8m on intangibles (software), for an average of just $5.2m per year. Key capex projects pursued over the period were expansions of the Oshkosh distribution centre, as well as purchases of machinery to support modest in-house capabilities for screen-printing, embroidery and direct to garment printing. Further phases of these projects are expected to result in c.$30m of investment in 2024. Overall, I expect capex to stay very low relative to the scale of the business.

The net working capital requirement for the business is also low. Inventory days are just 9 since most inventory is the responsibility of suppliers, while receivables days at 24 are lower than the B2B norm due to a significant proportion of customers paying up front by credit card. Payables days of 35-40 look sensible, reflective of the healthy partnership between 4imprint and its loyal, long-term suppliers.

These factors led to the generation of the $258m of FCF. How did management allocate this capital? See the box below for the capital allocation policy from the 2022 annual report.

Until 2022, a large part of the cash generated had to be paid into the legacy UK defined benefit pension scheme, and was therefore not available for distribution to shareholders. Cash payments to the pension scheme were $74.7m in the 2014-22 period, consuming 29% of the total free cash generated. Happily, this use of cash has come decisively to an end since mid 2023, when the company completed a pension buy-in transaction. The effect is that “balance sheet volatility will cease and future deficit reduction contributions of around $4m per year will no longer be required”.

A cumulative $122m was paid out in normal and special dividends from 2014 to 2022, plus an additional $93m in H1 of 2023. A modest $7.1m was spent on net share purchases during the period, which offset shares issued for remuneration purposes and kept the share count roughly flat during the period.

Based on the track record, we can be confident that future profits will convert to cash and be paid out to shareholders. In my forecast scenarios and valuation work I assume a continuing 90% average conversion of net income to FCF, to allow for modest capex and working capital needs.

Competitive advantage and peer review

I regard 4imprint’s direct marketing model as a successful counterpositioning strategy, as defined in Hamilton Helmer’s 7 Powers framework. Incumbents are committed to maintaining close relationships with their corporate customers despite the costs (think bespoke IT connections, virtual shops, golf trips and Vegas). They are thus unable to respond to 4imprint’s far more efficient model. 4imprint achieved its $1.14bn of revenue in 2022 with 1,310 employees, compared to HALO’s “more than 2,000 employees” required to reach $1.00bn of sales in the same year.

4imprint’s other sources of power within Helmer’s framework are scale economies and branding. 4imprint is the biggest and leanest player in the industry, as well as the best known and most trusted brand.

Is Amazon a significant threat, either actual or potential? Absolutely not. 4imprint’s proposition is for remarkable customer service, backed by a credible money-back guarantee (see box above). This is a world away from what an increasingly enshittified Amazon can offer. John Kingham’s great write-up has further detail on why Amazon is not even close to being a threat to 4imprint.

The trade organisation websites are a great resource on 4imprint’s market position and competitive advantage against its peers. ASI (Advertising Specialty Institute) and PPAI (Promotional Products Association International) both provide rankings and coverage of all significant players within the industry on both the distributor and supplier side. This ensures that any new competitive threat would be flagged well in advance. For the time being, all signals from these two sources are flashing green: see for example PPAI’s glowing write-up from last summer.

Listed comps include CMPR, PEBB.L, SGC and SWAG. A few lines on each below. In summary, I see no cause for concern for 4imprint from these firms. On the contrary, their indifferent financial performance contrasts with 4imprint’s exceptional track record. This gives backing to the thesis that 4imprint has a sustainable competitive advantage over its peers.

CMPR is Cimpress, the $2.1bn mkt cap owner of Vistaprint. Vista revenue of $1.6bn in FY23 was not materially ahead of $1.5bn in FY18, suggesting headwinds to growth. Vista’s business mix includes the printing of marketing materials, signage, business cards, stationery, photo and consumer merchandise, as well as a relatively smaller but growing promotional products offering that directly overlaps with 4imprint’s business. CMPR has a burden from its 3.5x leverage ratio and high interest costs. Without concluding on the possible attractions of CMPR as a turnaround opportunity, I see limited readacross or threat to 4imprint.

PEBB.L is Pebble Group, the £104m mkt cap London-listed owner of the Brand Addition distributor business divested by 4imprint in 2012. Pebble also purchased Facilisgroup in 2018, a technology platform and buying network supporting around 200 small promo distributors across the US and Canada, and connecting them to 100 preferred suppliers. Facilisgroup processed $1.4bn of sales in 2022, but this delivered just $20m of net revenue / gross profit for Pebble, implying a disappointing 1.5% take rate that belies Pebble’s claims of a SaaS-based platform. Meanwhile, Brand Addition revenue is going backwards, suggesting the business is no more attractive now than when 4imprint jettisoned it a decade ago.

SGC is Superior Group of Companies, a $229m mkt cap owner of promo distributor BAMKO, as well as healthcare apparel and contact center segments. BAMKO reported $389m of promo sales and 8% adjusted EBITDA margin in 2022. It appears to specialise in supplying branded uniforms. The financial track record of SGC is indifferent.

SWAG is Stran & Co, a tiny independent distributor with a $30m mkt cap and $59m annual revenue in 2022. SWAG claims a bluechip client base, offers program managers and customer-specific technology, and is pursuing an M&A agenda with an earnout structure based on sharing a percentage of gross profit for 3-4 years post acquisition. This raises questions about whether the principals will remain with Stran & Co and continue to achieve good results in the years after the earnout period.

The biggest unlisted competitor is HALO Branded Solutions, the private equity backed firm mentioned above. HALO achieved just over $1bn revenue in 2022, but suffered a fall in 2023, in sharp contrast to 4imprint’s 17% growth.

A number of other private equity firms have active investments in promotional products, on both the supplier side and the distributor side. ASI’s excellent review shows nothing to trouble 4imprint investors at this time.

Forecast scenarios

As we have seen, 4imprint has sustained a mid-teens organic growth rate for over 20 years, with an acceleration since the television commercial strategy was introduced. Operating profit and conversion margins in the most recent two years have been markedly higher than before, despite slightly lower gross profit margins.

Most recently, on 19 January 4imprint released strong headline results for 2023, with 16% organic sales growth and a PBT result that implies a >10% operating margin. Full details will follow on 13th March.

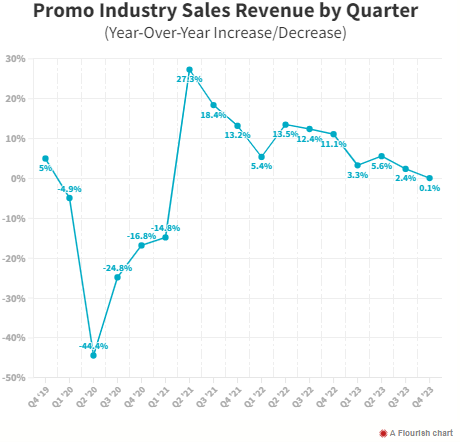

4imprint’s 2023 results were extremely impressive, especially in the context of tough 2022 comps and a US promo industry that is virtually in recession (see chart)

4imprint will likely announce a new long-term strategy and targets alongside their full 2023 results on 13th March. (Source: CEO interview). Their previous plans were framed over five-year periods.

Looking ahead to 2028, the most likely scenario that the company will guide for is a new revenue target of $2bn, in my view – likely accompanied by guidance for the operating margin to remain stable at the current c.10% level as they allow for investments needed to drive the growth. This would imply a 9% revenue CAGR from 2023 to 2028. This Conservative scenario puts the stock on 17x P/E multiple for the current year, falling to 11.9x for 2028, and with a free cash flow yield building from 5.4% to 7.6%, all to be paid out as dividends. This scenario implies profits for 2024, 2025 and 2026 slightly above the latest published sell-side estimates, and is likely to be roughly what the buyside have in mind.

What other scenarios to consider? At face value, a sustained mid-teens organic growth rate and further upward progress in the conversion margin cannot be ruled out – after all, this is the trajectory we have seen to date, based on its unique competitive advantages, headroom to keep taking market share and ongoing operational gearing. My Blue Sky scenario shows that a 15% sales CAGR and an increase in margins to 40% conversion / 13% OPM result in 150% growth in EPS from 2023 to 2028. The stock would be trading at 7.2x P/E and 12.5% free cash flow and dividend yield. If anything like this scenario plays out then the stock would have 150-200% upside over the same period.

A downside scenario could include a US recession, though the business has bounced back quite quickly from these in the past. Worse would be if the company suddenly goes ex-growth, struggling to take any further share and seeing margins slip backwards. In the Ex Growth scenario, pancake-flat earnings would trigger 30-40% downside until the stock found support from its dividend yield.

Why would the company suddenly stop growing? A major execution disaster or some kind of unforeseen reputational damage to the brand might do it. But absent such a black swan event, it seems outlandish to predict a sudden end to the 4imprint growth story, given its still-intact competitive advantages.

My personal handicapping of the three scenarios would be Conservative with 60% probability, Blue Sky with 30% probability and Ex Growth with 10% probability

Equity considerations

The above has focused on the business fundamentals. Some additional considerations apply to 4imprint as a stock.

· The London listing of a US business is an anomaly that likely fuels reduced understanding, lower liquidity and a lower rating for the shares. While this creates an attractive valuation opportunity, we should not expect management to move the listing to the US any time soon, since it is a core holding for a number of loyal UK fund managers whose mandates may not permit ownership of a US stock.

· ‘Purveyor of tat’ or ‘plastic crap with brand name on it’ is an offputting business description to many investors. Differentiation sounds impossible when selling commoditised products. Until recently the single-digit operating margins seemed to bear this out. Even a positive write-up such as Jamie Powell’s commendable FT Alphaville long pitch from September 2020 was titled 4imprint: branded tat on sale.

· Liquidity is rather low relative to market cap, with six month average daily value traded (ADVT) of $2.7m preventing many institutional investors from getting involved. This is a problem that will solve itself over time if the company keeps growing earnings.

· 4imprint has a reputation with investors for being highly cyclical. While it is fair to point out that sales and profits fell sharply in the Great Recession and during the pandemic, this does not make the stock uninvestable in my view. Indeed the company used both these periods to its advantage to accelerate market share gains, as the fortress balance sheet and long-term approach allowed the company to hold onto its people and continue to promote its brand. 2023 was a tough environment for many US B2B suppliers, in the context of tech companies cutting spending and SMEs lacking in confidence. Yet 4imprint came through with far stronger results than peers.