Cool America? Beijer Ref’s entry into US HVACR wholesale

(BEIJ-B:SS, $7bn market cap, $9m ADVT, 77% free float)

Beijer Ref, listed in Sweden, is a wholesaler of air conditioning and refrigeration equipment and spares in 45 countries. The long-term track record is spectacular. Organic growth, acquisitions and margins have accelerated further since 2018.

In January 2023 Beijer Ref completed a punchy $1.3bn US deal, entering the largest HVACR market for the first time.

Then in November 2023, Beijer Ref held its first ever Capital Markets Day. This speaks to the relative obscurity of this $7bn market cap company, owned mainly by Nordic holders. Management used the event to announce new financial targets that imply a doubling of profits by 2028. I doubt they will manage that.

The write-up is organised as follows.

· I walk through the history of Beijer Ref.

· I outline the business model, the product mix and the key supplier relationships.

· I review the track record and the key deals that built Beijer into what it is today. The focus is on the US acquisition, which is the riskiest part of the story.

· I profile Watsco, the closest listed peer, which however looks very different to Beijer given its 65% dependence on Carrier as a JV partner.

· I present Beijer’s financial profile and share my estimates and valuation.

The stock looks overvalued and risky to me. My conclusion is ‘buy on weakness’, which is dull and not actionable.

Nonetheless, the work done here should serve me well in making future investment decisions about Beijer Ref and Watsco, as well as OEMs and suppliers such as Carrier, Trane, Daikin, LU-VE and Carel Industries.

History

The Beijer Ref we see today is the outcome of thirty years of focused efforts by its effective founders and joint controlling shareholders, Joen Magnusson and Per Bertland.

They must be modest individuals. The company website gives an incomplete version of its history that obscures their key role. First founded in 1866 in Malmö, the company was named G&L Beijer in 1877 when brothers Gottfried and Lorens joined together. For over a century the main activity was commodity trading in cereals, coal and coke and oil. Then we skip forward to 1992, when control of the ancient G&L Beijer was acquired by a listed investment company called Skrinet, with the backing of original Beijer and Hain family members.

The official version omits to mention that this change of control played out as a sensational intra-family feud over a number of years. The saga attracted a lot of attention in the Swedish press, amid conflict between the instigators, John and Jan Hain, and large parts of the family. (Source.)

Upon seizing control in 1993, Jan Hain inherited from Skrinet two talented managers called Joen Magnusson and Per Bertland as CEO and CFO. They realized that large and sweeping changes had to be made, and quickly. All of the legacy commodity trading units were sold. Distribution of refrigeration equipment became a core business, led by Bertland as divisional MD. From the 1990s and onwards they made a series of acquisitions in this area.

In 2002, Jan Hain sold a 31% controlling stake in the firm to Magnusson and Bertland. This management buyout cemented Beijer Ref’s status as an owner-operated company for the next twenty years. Magnusson continued as CEO until 2013. Bertland then picked up the baton and served as CEO from 2013 until 2021. (The new CEO, Christopher Norbye, came from Assa Abloy and Sandvik, good pedigree for Swedish industrials with global success.)

Magnusson and Bertland both continue to serve on the board of directors today. They currently own 23% of the votes and 3.4% of the share capital, thanks to the existence of A shares with ten votes each (as is typical in many Swedish companies). This gives them a strong degree of ongoing control.

The joint controlling shareholder is the private equity firm EQT with 19% of the capital and 21% of the votes, after it bought out Carrier in 2020. More on that below.

Business model

Beijer Ref is a wholesaler of air conditioning and refrigeration equipment and spares. Based in Malmö in Sweden, the group trades in 45 countries. Built by acquisitions over three decades. Beijer Ref relies on a nimble, decentralised model which has served it well to date. A head office of just thirty people supports the many dozens of distinct businesses, which retain their separate brands and diverse product ranges.

Beijer’s direct customers are the fragmented base of HVACR installers and service companies in every local area. End customers are the users of commercial refrigeration (mainly in the food industry, from producers to retailers) and air conditioning (residential and commercial premises of all kinds) who need equipment installed or repaired. Beijer’s value added is to make available a broad range of equipment and parts with the utmost convenience. Beijer’s branch network offers both trade counter collection and delivery service. Knowledgeable staff can provide advice, product training and design help to customers. Extending trade credit is also part of the service.

Beijer represents a number of different manufacturers in each country, such as Toshiba or Mitsubishi air conditoners, Danfoss components, Bitzer and Tecumseh compressors and condensing units, Lu-ve evaporators, Carel controls and so on. It is typically not economically feasible for any of these manufacturers to maintain their own branch network on a standalone basis. This explains from first principles why Beijer Ref and its HVAC wholesaler peers can prosper as middlemen, aggregating demand across many different suppliers.

(NB the above is especially the case across the dozens of small and mid-sized markets in Europe, Africa and Asia-Pacific. It is less true in the vast and homogenous US market, where the biggest manufacturers can choose to operate their own or captive distribution networks with a high degree of control.)

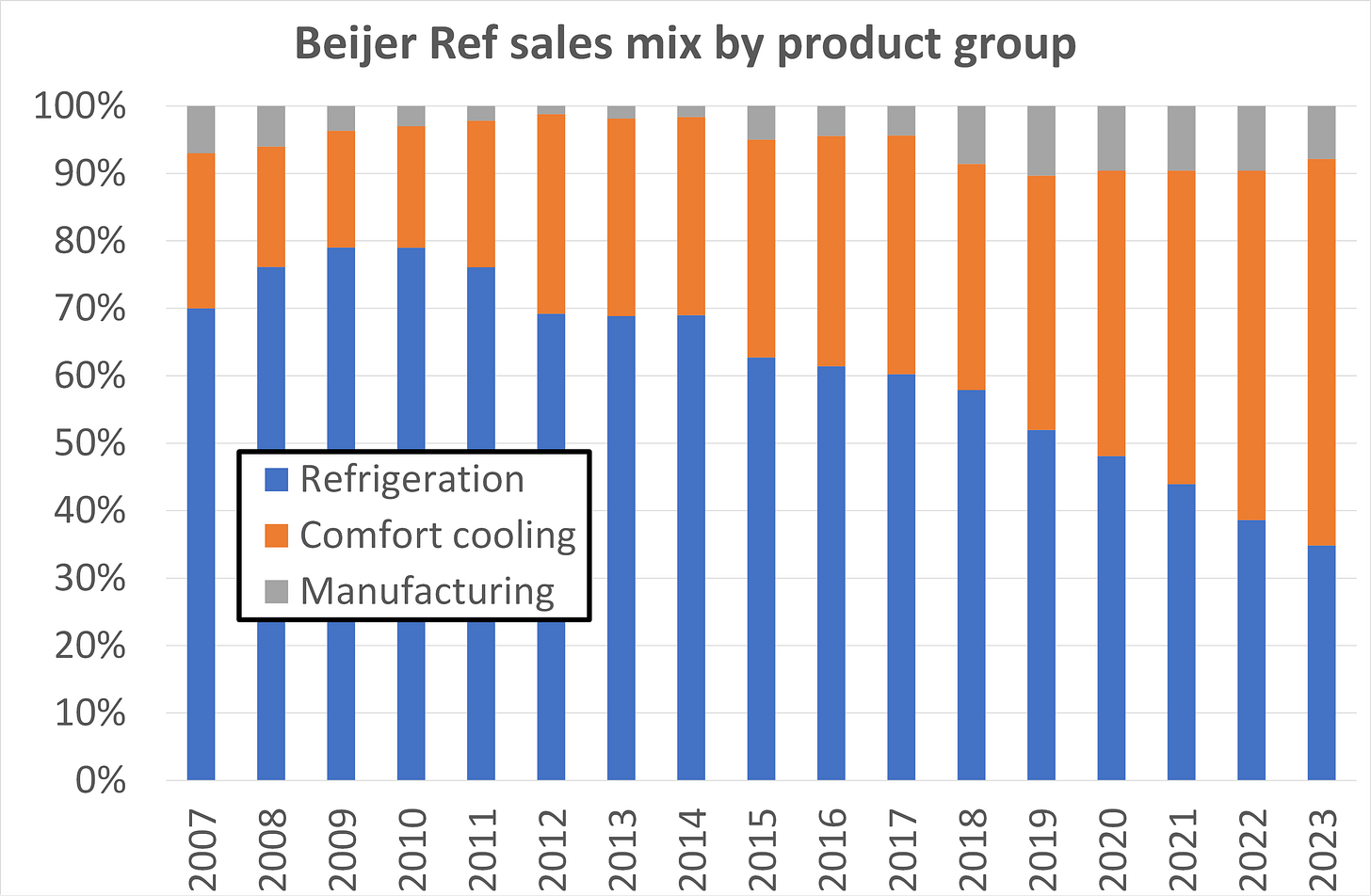

Mix shift from refrigeration to AC

Commercial refrigeration used to account for 80% of Beijer’s business. It is a pretty mature market, focused on spares and components for maintenance and replacement demand.

Since 2011 Beijer has deliberately grown its presence in comfort cooling, a fast-growing market as frequent heat waves drive increased air conditioning penetration. Beijer supplies new equipment and spares for both residential and commercial use. Beijer also supplies heat pumps – as do plumbing and electrical wholesalers, meaning a channel bunfight will kick off as heat pumps start to take serious share from gas boilers in heating.

See the two charts below for the dramatic shift in mix, as air con has grown from 17% in 2009 to 57% in 2023. Beijer achieved this shift via both acquisitions and organic growth in air con.

Supplier dynamics and possible risks

Beijer has a patchwork of “meticulously curated” exclusive and non-exclusive distribution agreements with most major manufacturers across air conditioning and refrigeration. These vary by country. Some are subject to explicit periodic renewal and others are evergreen. Toshiba, Carrier, Mitsubishi, Gree and Rheem are major air conditioning suppliers to Beijer across the group.

As stated above, the manufacturers generally need Beijer as much as the other way round. Beijer has grown faster than most manufacturers, and aims to capture the benefits of its increased global scale by conducting periodic centralised renegotiations with suppliers. Overall I am sanguine about risks from supplier actions.

Nonetheless, further due diligence would be needed to check on the security of the crucial relationship(s) with Carrier-Toshiba, given the facts below which could raise questions when taken together.

· In July 2020 Beijer and Carrier announced an extension of their exclusive distribution agreement on Carrier-branded products until the end of 2023. No subsequent announcement has yet been made about any further extension into 2024. The Carrier brand only ever amounted to 2-3% of Beijer’s total purchases, according to related party transaction footnotes that were provided each year until 2020.

· In December 2020, Carrier sold its controlling stake in Beijer Ref to EQT. (Carrier had made a 10x gain in 12 years and was in debt paydown mode at the time.)

· In July 2022, Carrier acquired Toshiba’s air conditioning business outright. Previously the two companies were joint venture partners, with Toshiba Corp having the majority share. Toshiba is Beijer’s biggest supplier, and a specific risk of “Dependency on Toshiba” was listed in annual reports up to 2019 (but not since). Toshiba’s entire European operation is deeply embedded in Beijer Ref, which acquired the business from Carrier back in 2011.

Manufacturing and own brands

Beijer has recently ramped up its private label strategy, aiming to capture higher margins by selling own brand products through its distribution network. OEM sales amount to 8-10% of the total. This is no different to Ferguson (9% of revenue from private brands) and Reece (not disclosed but estimated higher). Details of the key brands are below.

Unusually compared to wholesaler peers, Beijer has also attempted some vertical integration. It has its own factories making refrigeration equipment in Italy and elsewhere.

· SCM Frigo is Beijer’s Italian manufacturer of commercial refrigeration units which use natural refrigerants such as carbon dioxide or ammonia. These are more expensive than traditional units but favoured by the regulations mandating F-gas phase-out. Beijer first acquired SCM Frigo back in 2011, and has extended the manufacturing footprint and brand reach since then.

· Sinclair of the Czech Republic and Inventor of Greece, both acquired in 2021, sell made-in-China air con units under their own brands. Beijer is rolling out these brands across its various other countries.

· Freddox is a self-developed private label brand for components and accessories, launched in 2020.

Track record and key acquisitions

My chart below shows 26 years of sales and margin history for the refrigeration business. The sales CAGR for the period is 16.8%. Transformative acquisitions were made in 2004, 2009 and 2023.

In 2004 Beijer acquired Danfoss’s wholesale operations, a collection of companies known as Elsmark. This doubled refrigeration sales and extended the footprint from the Nordics and Baltics into the UK, Netherlands and Switzerland. Beijer proclaimed itself the European #1 with c.10% market share as a result.

Elsmark had a low single digit margin at the time of acquisition. Beijer mandated the respective business managers to cut costs and restructure Elsmark’s businesses in each country. (For example, this 2006 interview tells of the changes that newly promoted MD John Billson made in the UK business. Remarkably, Billson remains MD of Beijer Ref’s UK operations to this day.)

Beijer also integrated purchasing across the group to capture scale benefits. The upshot was a record margin of nearly 10% by 2007, helped by buoyant end markets.

Carrier deal

In September 2008 Beijer agreed to buy Carrier’s refrigeration wholesale operations in Europe and South Africa, following several years of talks. The all-share deal completed in January 2009, giving Carrier (then a United Technologies subsidiary) a 41.5% capital stake and a 33.3% voting stake in the combined group. The deal was valued at SEK1.06bn, worth $132m at the time – a reminder of how tiny Beijer Ref still was at the time compared to today’s $7bn market cap.

Carrier was another transformative deal for Beijer. The combined group was twice the size and now truly pan-European, with a dominant c.20% market share and an expanded product portfolio. France, the Netherlands, South Africa, the UK and Switzerland were the top five countries in 2010, contributing 62% of total sales. None of these countries is Nordic! This set Beijer Ref apart from its Scandinavian trading company peers such as Addtech and Indutrade, which to this day continue to depend on familiar Nordic markets.

Australia and New Zealand build-out

In 2015 Beijer Ref entered New Zealand and Australia by buying Patton and Realcold, two New Zealand firms with modest Australian operations. In 2018 they bought Lennox International’s Australian wholesale subsidiary, Heatcraft (since renamed Kirby), for SEK582m, giving them a scale in Australia to rival Reece. An aggressive series of further deals catapaulted Australia to become Beijer’s second-biggest market in 2022, after France.

Entry into US

In December 2022 Beijer announced the purchase of Heritage Distribution for $1.3bn to enter the US. The deal closed in January 2023, funded by a rights issue for the full amount. Helpfully, the rights issue resulted in the publication of a detailed English-language prospectus, which is a key source for what follows.

The TLDR is that:

· Heritage was thrown together in record time by private equity.

· It claims a surprisingly high 13% EBITA margin.

· Its key supplier Rheem is a second-tier player that has lost market share over the long term.

· Performance in the year post acquisition has been somewhat disappointing.

· Top shareholder EQT surprisingly dumped a 7.9% stake in June 2023 at a discount, not a vote of confidence so soon after participating in the rights issue in March.

· Based on all of the above, it’s not yet possible to underwrite Heritage as a sound platform for Beijer’s future US growth.

In detail:

· Heritage Distribution is a brand new vehicle created in 2021 by a middle-market private equity player called Gryphon Investors.

· In August 2021 Gryphon acquired Wittichen Supply in the South East to kickstart the project. Founded in 1914, Wittichen had 25 branches in Alabama, Florida and Georgia. It is a distributor of Rheem air conditioners – discussed further below.

· In December 2021 Gryphon appointed a CEO and CFO for the project. Alex Averitt was previously COO of the smallcap listed building products distributor BlueLinx. He remains in place as Beijer Ref’s head of North America, and presented at the CMD in November.

· In February 2022 Gryphon added Benoist Brothers, a Midwest firm founded in 1928 with 13 branches in Illinois, Missouri, Kentucky, Tennessee and Indiana. Benoist is another dealer in the Rheem family, focused on the sister brand Ruud. Benoist includes NuComfort, a three-branch Chicago operation it acquired at the end of 2019 which still operates separately.

· In April 2022, using the name Heritage Distribution for the first time, Gryphon bought Ed’s Supply Company, founded in 1957 with 19 locations in Georgia, Tennessee, Kentucky and Arkansas.

· In October 2022 Heritage bought Coastal Supply, founded in 1978 with six branches in East Tennessee, to be bolted on to Ed’s Supply.

· In December 2022 Gryphon announced the sale of Heritage to Beijer Ref, who said the multiple paid was 12.4x trailing pro forma EBITDA.

· In February 2023 Beijer Ref published its prospectus in connection with the rights issue. They announced pro forma 2022 net sales and EBITA for Heritage of SEK6,518m and SEK852m respectively. These were translated using a USD/SEK rate of 10.1245, meaning the original USD figures must have been $644m sales and $84m EBITA.

My due diligence for Heritage Distribution and its component businesses has yielded mixed results. At the most basic level, websites for the individual businesses exist (of mixed quality), as do Google Maps listings and reviews for the branch networks.

Neither Heritage nor its component businesses appear in industry ranking lists, including the SupplyHouse Times Premier 150 rankings for 2023 (or earlier years). This is a bit odd. Wittichen, Benoist and Ed’s Supply should all have easily qualified for the top 150 list, but none are listed. Perhaps it is simply a case that none of them participated in the rankings exercise.

As mentioned above, Heritage claims a punchy c.13% EBITA margin. (To be precise, the claim is for 13.1% in 2022 pro forma, and 12.6% in 2023 under Beijer’s ownership.)

· This is higher than the group average margin, and in line with the Nordic region where Beijer has a dominant #1 position.

· It is higher than Watsco has ever reported in 20 years, and also higher than Ferguson.

· Heritage lacks any scale or dominance to explain such a high margin.

· The recent PE origins and lack of visible track record add to suspicions.

· I see a risk of significant downside to the US margin in the near future.

Performance to date under Beijer’s ownership has been patchy. On the recent Q4 call, the CEO said: “the way we saw the business developing was -- the way we saw the year was a stable Q1, a little bit weak in Q2, a stable Q3 and little bit weak in Q4.”

Rheem is the key supplier of air conditioners to Beijer’s US businesses, owned by private Japanese firm Paloma. Market share data is patchy, but at best Rheem is ranked as the #4 player in the US market, lagging well behind Carrier, Trane and Lennox in sales and brand image. Some experts think Rheem will struggle to roll out new products compliant with the latest F-gas regulations in a timely manner, compared to the leaders. Beijer did complain in 2023 conference calls about lack of availability of the right AC product.

Comparison with Watsco

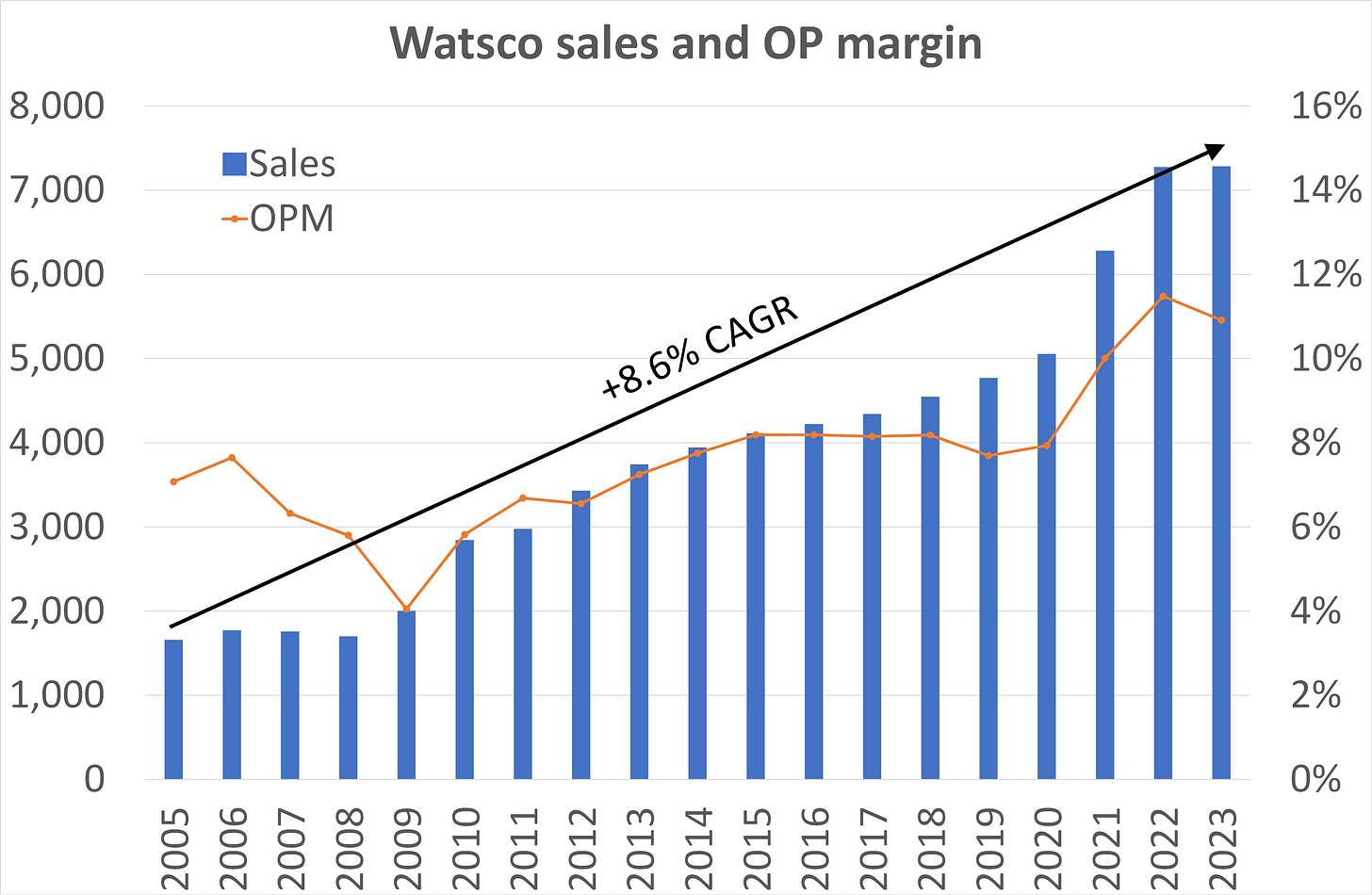

With a $16bn market cap and $7bn sales, Watsco is the clear leader among US HVACR distributors. It has compounded sales at 8.6% over 18 years – see chart below. 96% of sales are in the US and Canada, and Residential accounts for 70% of sales.

Today Watsco is mainly a Carrier dealer. It relied on Carrier for 65% of total purchases in 2023, and 55% of revenue came from several JVs in which Carrier has a 20% minority interest. The partnership began in 2009, when UTC sold 95 company-owned dealerships into a JV with Watsco in exchange for a 10% stake in Watsco. Further JVs were formed in 2011 and 2012, with Carrier contributing more dealerships in exchange for cash and shares.

In February 2017 Carrier sold its Watsco stake for $609m, but the partnership has gone from strength to strength. Most notably, in 2017 Watsco’s Carrier JV acquired 35% of Russell Sigler, the owner of the California Carrier territory. Watsco has the exclusive right to buy the balance of Russell Sigler as and when the family shareholders want to sell.

Watsco is still 53% controlled by founder and CEO Albert Nahmad, thanks to the existence of B shares with ten votes each. (Similar to Sweden!)

Way back in 1995, Watsco was mainly a Rheem dealer, and relied on Rheem for 55% of purchases. They gradually diversified away from Rheem. Prior to the great financial crisis, Rheem was still the top supplier but responsible for only 17% of purchases. Watsco still has the Rheem dealerships today, but Rheem amounts to only 8% of purchases.

Watsco emphasises its strong IT offering as a competitive advantage over its fragmented independent rivals, including e-commerce apps to help its contractor customers win sales from their end customers, the homeowners.

Compared to Watsco, Beijer Ref lacks OEM approval from any supplier other than Rheem. Access to top-tier suppliers may be far more difficult for Beijer to gain in the US than has been the case elsewhere. If Beijer’s available acquisition pool is limited to Rheem dealers, that would be an unattractive limitation.

Financials

Beijer has a decent track record of mid-teens returns on capital employed. This demonstrates the sound judgement shown in the many acquisitions to date. Beijer also deserves praise for clean earnings with minimal exceptionals and adjustments over the entire track record period.

Beijer is a working capital-intensive business, with a 26% WC to sales ratio

This has fallen slightly over time, driven by lower receivables days and higher payables days. The latter includes both trade creditors and other accrued expenses, deferred income and other current liabilities. It would be good to ask the company what these items comprise, in order to judge the sustainability of the rather high balance.

Beijer’s gross margin has been stable over time at 30%, while the operating margin has expanded thanks to leverage over SG&A costs. A bull case for Beijer would argue for margin upside from the private brands push and extracting further benefits from the new scale.

Beijer’s organic growth has accelerated since 2018, helped by some strong years for air conditioning. The falls in 2009 and 2020 show the cyclicality in the business, even if the 2020 fall was more muted than for many other industrials thanks to the high aftermarket share of sales.

Beijer has typically run with 2x net debt to EBITDA or higher, not especially conservative in my book. Their new CMD target calls for net debt not to exceed 3x EBITDA over time. They have used equity to fund the biggest deals.

Recent trading and forecasts

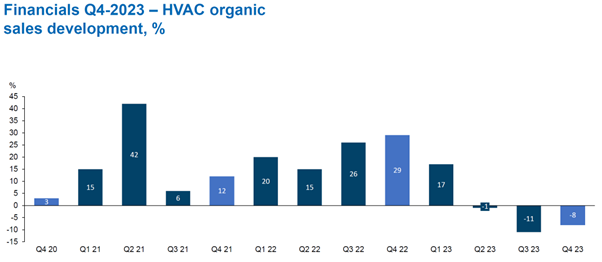

Beijer Ref reported sharp falls of -11% and -8% in air conditioning organic sales in Q3 and Q4 2023. The results were disappointing for consensus: sell-side estimates have been cut by c.10% at the EBIT level and by 13-15% at the EPS level in the last year or so. Unlike Reece last week, Beijer’s management does not seem to have managed to guide its investors conservatively through the current cycle. (With far lower exposure to newbuild construction, Beijer ought to be less cyclically exposed than Reece.)

There is another tough comparison ahead for Q1 2024, as can be seen below. Hence a poor print for Q1 looks guaranteed. From Q2 the comps get far easier, but investors may need to wait until July to confirm whether this leads to a return to good growth.

My estimates show a pessimistic scenario, based on the risk that the US acquisition proves to be less profitable than expected, while organic growth is muted across the business. In this scenario EPS does not regain the 2023 level until 2026. I am 9% and 20% below consensus for 2024E and 2025E respectively. I don’t include anything in my forecast for yet-to-be-announced M&A.

Needless to say, the stock would be much too expensive if my estimates are right. Even on consensus it is expensive, trading at 30x / 27x for this year / next year.

Stock considerations

The stock traded at crazy multiples from 2019 to 2023, caught up in the Swedish quality growth craze – see chart below. Extra points would have been awarded as a thematic ESG stock, helping with the switchover from high global warming potential F-gas refrigerants.

The shareholder register is dominated by the two quasi-co-founders, by EQT (a Swedish PE firm) and by Swedish institutional investors. Baillie Gifford is the highest ranked active foreign investor that I can see, with a 0.93% stake. They shared their thesis in March 2020 and again in August 2023.

The change of CEO in August 2021 was followed by an unfortunate double change of CFO. Ulf Berghult was an external hire who started in March 2022. In May 2023 he was replaced by Joel Davidsson, who had worked alongside the CEO in Assa Abloy.

Senior executives’ share-based remuneration is bizarrely outsourced to EQT. The leadership team participate in an EQT-sponsored bonus programme, seemingly at EQT’s expense. On the one hand it is generous of EQT to subsidise executive bonuses on behalf of minority shareholders. But it means that the true cost of remuneration is currently understated. Whenever EQT exit from their investment (maybe sooner given the surprise partial sell-down) then Beijer shareholders will have to shoulder the burden of remuneration once again.