Goldwin is a Japanese apparel company, and the outright owner of The North Face brand in Japan and Korea. TNF delivers 78% of total revenue, while a dozen other brands account for the balance.

In a striking example of divergent evolution, Goldwin and its Korean partner have taken The North Face to heights never achieved by VF Corp, which owns the brand in the rest of the world.

For the next leg of growth, Goldwin aims to build up its namesake Goldwin brand in China and around the world.

The stock surged from 2017 to 2019, as earnings trebled and the multiple doubled. Since then, the company has been delivering on further growth, while the rating has roundtripped back to an 18x current P/E multiple. This tees up an interesting potential entry point for the stock.

While tempted, I decide on balance to stay on the side lines for now. I will follow the company with interest.

Feedback is welcome as always.

Background to Goldwin owning The North Face in Japan and Korea

I provide a full timeline in my annex. Briefly, Goldwin was TNF’s distributor in Japan since 1978. Then in 1993, the US parent company filed for Chapter 11 bankruptcy and went into drastic restructuring. Goldwin seized its chance, and purchased the perpetual Japanese and Korean rights to The North Face trademarks. There is no royalty payable, and no right of termination.

From that point forward, The North Face has had two separate owners – Goldwin for all sales in Japan and Korea, and the US company (later acquired by VF Corp) for the rest of the world. The relationship is on an equal footing – neither controls or restricts the other. The two parties meet once a year to agree on matters of mutual interest, such as logos, design guidelines, etc.

Under careful and patient management, Goldwin has developed TNF in Japan on three tracks.

· First and foremost it is a technical performance brand, with clothes and equipment for camping, hiking, Alpine climbing and skiing. Performance makes up 33% of group sales.

· Second, it is also a lifestyle brand, with products that draw on the performance heritage for everyday life. Lifestyle is 58% of sales.

· Third, it has also entered the realm of Fashion (9% of group sales). In 2003, Goldwin’s designer Eiichiro Homma launched the ‘nanamica’ label as well as The North Face Purple Label. This high-end diffusion brand has achieved global legendary status. It is all the more elusive given it cannot be sold outside of Japan and Korea without VF Corp’s express permission.

Underpinning all of the above, Goldwin maintains two sincere and attractive commitments: to protect the environment and preserve nature as far as possible within their business, and to develop new technologies for cutting-edge materials and products. The two are related, for example in Goldwin’s development of Spiber fermentation-derived silk.

Financial performance of The North Face in Japan

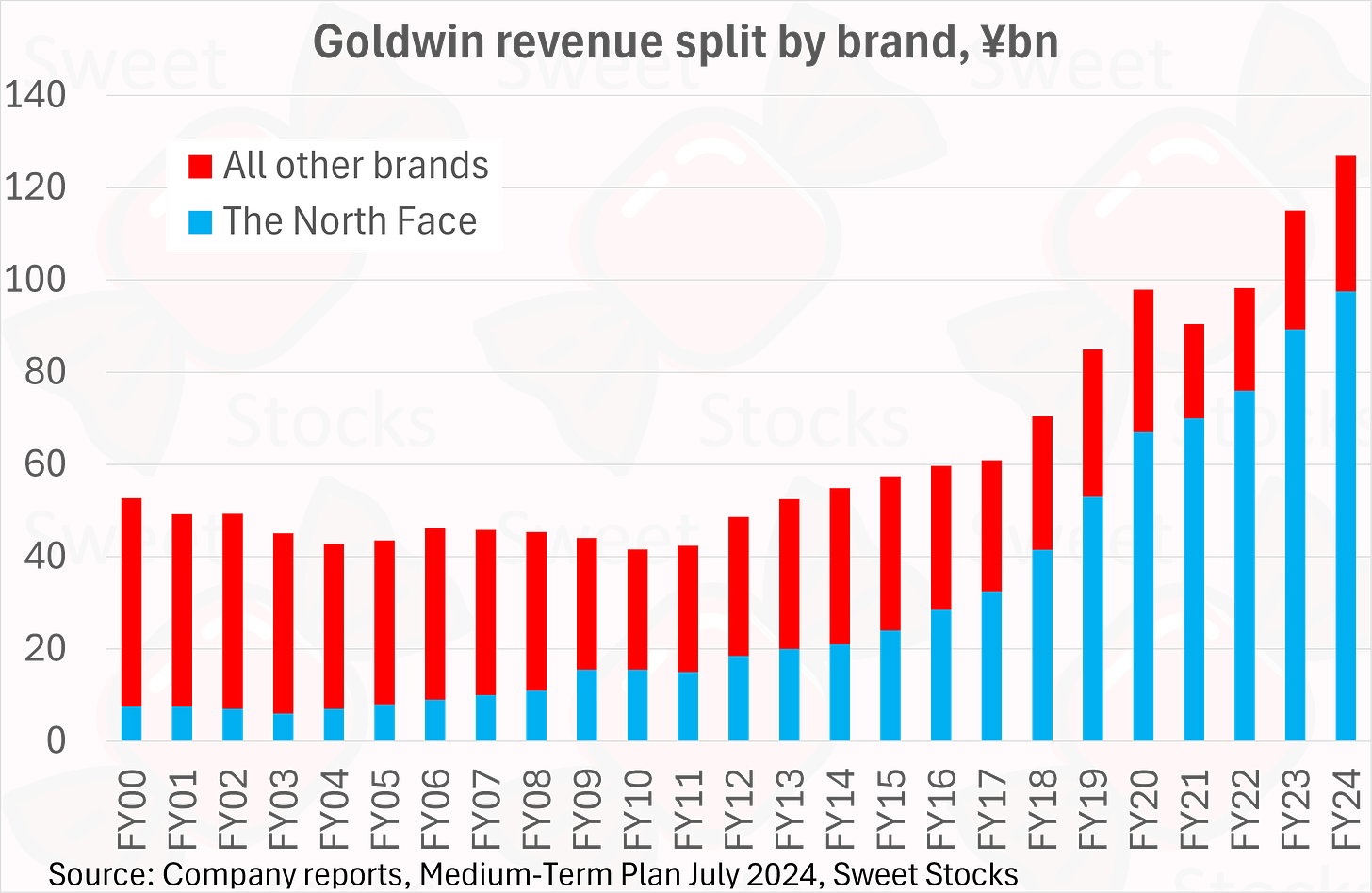

My chart below shows Goldwin’s revenue, split between TNF Japan and other brands. Back in 2000, TNF Japan was just 14% of group sales. It has grown at an 11% CAGR to reach 77% of total sales in the most recent year.

Meanwhile, sales of other brands have shrunk. This relates in part to the loss of Champion, a previous mainstay that Goldwin sold under licence until termination in March 2016.

The mix shift from licensed brands to TNF as a fully owned brand has been positive for margins. My chart below shows that after losing money in 2007-08 due to impairments, Goldwin has steadily increased its operating margin, with a particular jump from March 2018 and on, to reach 19% in Mar’24.

Gross margin expansion has been the key driver of the higher operating margin. My chart below shows the gross margin has risen from 30% to 53% over the period, while the ratio of SG&A expenses to sales has also risen across the period, from 28% to a peak of 40%. More recently, operating leverage has shone through, and SG&A has fallen back down to 34%.

How did Goldwin come up trumps?

Goldwin argues that it has spent over twenty years laying the groundwork for the success that has shone through in the last few years. It has transformed its business model in several ways.

The current chairman, Akio Nishida, is the son of the founder. He took over from his father in 2000, at a time of crisis for the company. It had too many brands, a lack of differentiation, and a problem of excess inventory and high returns from the retailer customers.

He switched from a pure wholesaling model to a direct sales led model. The transition was lengthy and faced resistance, but has paid dividends. Directly managed stores (43%) and own ecommerce (13%) now account for 56% of total sales, up from just 7% in 2000, as shown in the chart below.

Goldwin came up with the idea of making each TNF store different. Four different themed Tokyo stores are shown below, each specialising in a different product range and user type.

Nishida-san also devoted huge efforts to eliminating excess inventory and waste. Goldwin calls this its “in-store digestion-based product supply business model”. While something might have been lost in translation, the underlying point is to gain direct understanding of customer needs at their own stores, ensuring more accurate store demand forecasts. With rigorous production management, and by flexibly moving inventory between stores, the result is an extremely low sales loss rate (defined as the ratio of returns plus discounts to total sales). See chart below.

Nishida-san remains in place as chairman, but he handed on the management baton to President Takao Watanabe in 2020. Watanabe-san has worked at Goldwin since 1982, and ran The North Face from 2005.

Two other executives stand out in Goldwin’s strong team. Eiichiro Homma was already mentioned above as the founder and inspiration of nanamica and TNF Purple Label. Hikari Mori was promoted in April to COO. He previously ran The North Face after Watanabe-san, and also took a couple of years away from Goldwin to run Black Diamond Equipment’s Japan business in 2012-14. (Owner Clarus is listed with ticker CLAR, but has seen better days.)

The North Face in Korea – managed via joint venture with Youngone

So far we have only looked at Goldwin’s success with The North Face in Japan. It also owns the brand in Korea, where it has been equally successful, if not more so.

Ever since 1993, Goldwin has licensed out the Korean rights to its local partner, the textile firm Youngone. The North Face in Korea is run as a joint venture called Youngone Outdoor Corp (YOC), which is owned 59% by Youngone Holdings and 41% by Goldwin.

Youngone Holdings (009970.KR), as well as its operating subsidiary Youngone Corp (111770.KR), are both listed on the Korean stock exchange, according to the typical chaebol structure used to maintain family control and organise inheritance. Youngone’s mainstay operating business is as a supplier. It manufactures garments for brands including Patagonia, Adidas and Lululemon from its factories in Bangladesh and other low-cost locations, which directly employ over 70,000 workers.

Despite a lack of other experience in marketing and brand-building, YOC has been astonishingly successful in developing TNF in Korea. Methods have included the appointment of popular brand ambassadors, and the launch of The North Face White Label, an exclusive-to-Korea fashion-forward diffusion range that echoes Purple Label in Japan.

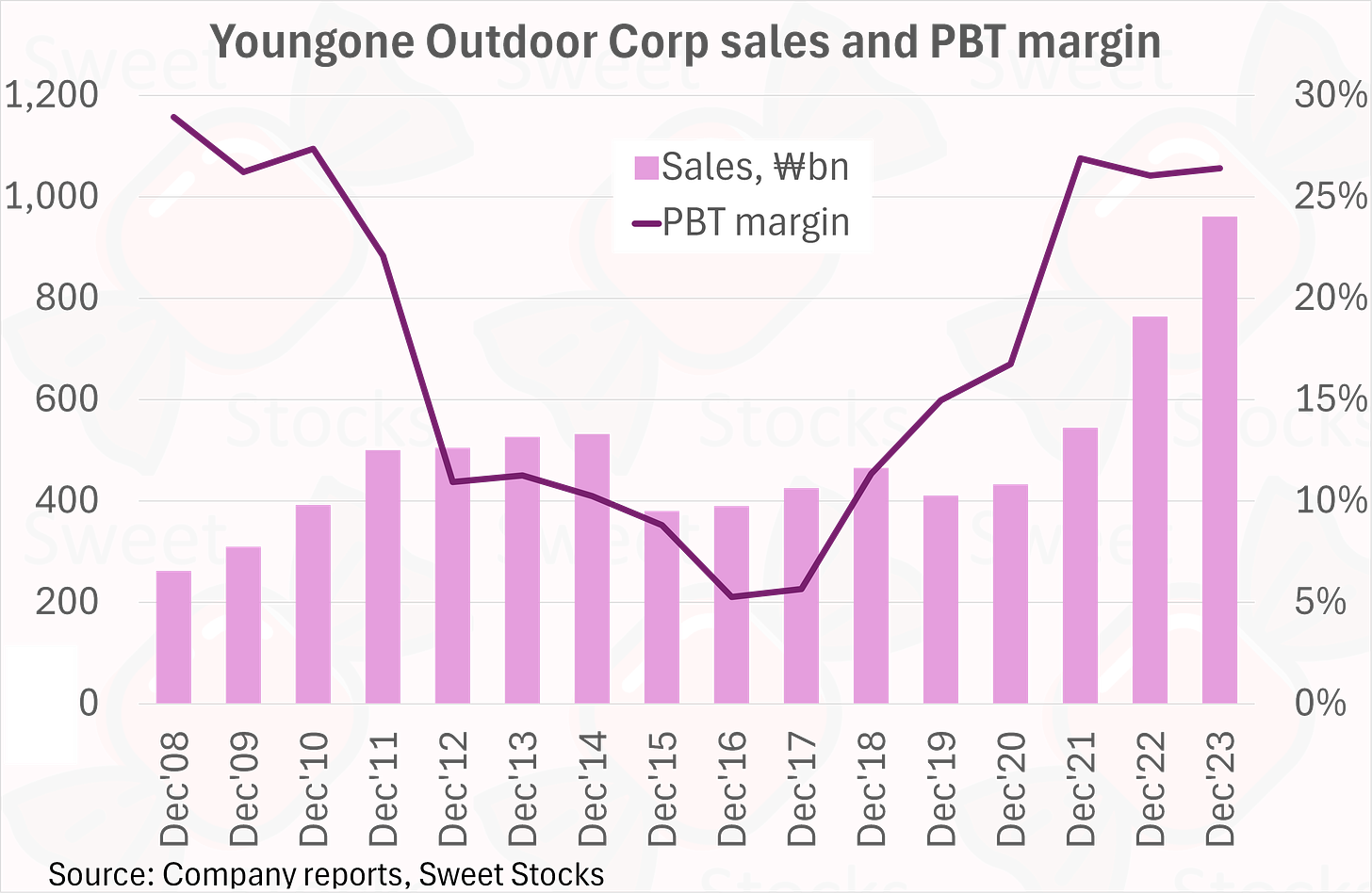

My chart below shows YOC net sales reached nearly a trillion won in calendar 2023, making TNF by far the leading outdoor brand in Korea. The pre-tax profit margin is high at 26%, stemming from a gross margin of 74%.

This translates into a substantial equity method profit for Goldwin, which reached Y8.5bn in FY24, or over a third of total net profit. See my chart below. (It shows the Korean JV already had great success since 2006. From then to 2015 or so, it kept Goldwin afloat, until the fruits of the restructured domestic business came through.)

The total contribution received by Goldwin from YOC is even greater. The licence deal includes a royalty payable by YOC to Goldwin, which averages 3.7% of sales. This resulted in a Y3.8bn royalty for the year to Mar’24, which equated to 16% of Goldwin’s operating profit.

In both Japan and Korea, The North Face sales benefit significantly from inbound visitor sales.

For Japan, in FY24 the inbound sales ratio was around 19% at directly managed stores, and likely similar or higher at wholesale partner stores. By country, visitors from China, Taiwan, Korea and the US are the most important. They disproportionately buy the fashion items (that elusive Purple Label…) and the average spend per customer is a healthy Y60,000.

For Korea, the flagship Myeong-dong store in Seoul has a 70% inbound sales ratio, with Japanese and Chinese as the top nationalities.

Comparison with VF’s TNF business

VF’s revenue from The North Face was $3.7bn in FY24. This was split 46% Americas, 36% Europe, and 18% Asia-Pacific. The margin for the Outdoor segment, at just 11% in FY24, is far lower than Goldwin’s 19% margin and YOC’s 26%.

Goldwin’s The North Face revenue in Japan was $671m in FY24, using the average exchange rate for the year. Korean TNF revenue was $713m. Together, Goldwin achieved $1.4bn of TNF revenue from Japan and Korea alone.

My table below shows that when factoring in population sizes to calculate brand revenue per head, Goldwin and YOC have achieved far higher penetration rates than VF Corp in their respective territories. The excess demand from inbound visitors may explain part of the difference, but superior product design and brand positioning are also likely factors.

Goldwin brand global strategy

By definition, Goldwin is not allowed to sell The North Face outside of Japan or Korea, just as VF Corp is not allowed to sell the brand inside Japan or Korea. This is clearly limiting for Goldwin’s global ambitions.

Its answer is to try to expand overseas with its wholly owned namesake brand. Goldwin is a premium outdoor brand with a heritage in skiing. In the last few years, Goldwin has rebranded and expanded its range, as illustrated below.

From 2018 to 2020, flagship stores in Tokyo, San Francisco, Munich and Beijing were opened to establish the brand’s global credentials.

Current sales stand at just Y3.2bn, mainly in Japan. The bold target is for Y50bn of global sales by Mar’33.

In April 2024, Goldwin established a new 65:35 JV in China. It plans to open a dozen more stores in the coming two years, starting with Chengdu and Shanghai. The ambition is to reach Y30bn sales in China by Mar’33, with Y3.9bn in Mar’27 offered as an early checkpoint. The margin target is 20%.

Japan and Korea are the other key targets for the Goldwin brand, with aspirations for Y10bn and Y6bn sales respectively.

Europe and North America are expected to be tiny by comparison, with flagship stores in key cities (London and New York coming soon) mainly an investment in the global brand profile, rather than a push for meaningful sales or profits.

It is natural to be cautious on the Goldwin brand’s odds of achieving meaningful success. But it does stand a chance. It has already gained a certain credibility in fashion circles.

An appreciative recent tweet by Derek Guy, the renowned menswear commentator, cannot hurt. See below.

Goldwin’s other brands

Goldwin owns outright the Japanese rights to Helly Hansen (sailing and outdoors wear), Canterbury (rugby wear) and ellesse (ski and sportswear). These are nice brands, but they are unlikely to move the needle in terms of scale. And of course, Goldwin does not have the right to sell these brands outside of Japan.

In addition, Goldwin has the rights to sell Speedo, Woolrich and Allbirds in Japan under licence. This is an even less attractive arrangement, given the lack of control and possibility of future termination.

20% of Goldwin’s sales come from the above brands and some other minor ones, with no precise breakdown given.

Competitive landscape – selected premium peers

Arc’teryx is the hottest new outdoors brand, in Japan as in other countries. It is part of the recently listed Amer Sports (AS, $7.1bn market cap). The price point is high. Arc’teryx Japan is likely well below $50m sales at present. (Asia Pacific ex Greater China was $350m for Amer Sports in 2023, spread across Japan, Korea, Australia and Malaysia. Arc’teryx was far less than a third of this total.)

Amer Sports is controlled by Anta Sports, which is by far the strongest competitor in China in its own right, with several powerful brands in the outdoor and sports categories.

Descente is a premium Japanese rival to Goldwin and TNF. It is currently being taken private by Itochu at a $2.3bn market cap, in a very rare instance of a Japanese hostile takeover. Revenue of Y127bn in FY24 included Y52bn in Japan and Y59bn in Korea, making Descente smaller than TNF but not by a huge amount. Descente’s OP margin of 7% is weak. Equity method profit in China is substantial, thanks to a JV led by Anta Sports.

Snow Peak is another relevant peer. This premium camping equipment and clothing brand was listed until its $333m MBO with Bain earlier this year. Revenue was Y26bn in calendar 2023, down from a peak of Y31bn in 2022 as the Covid camping boom unwound.

In Korea, the #2 outdoor brand is Discovery, a bizarre licensed usage of the Discovery Channel brand for outdoor clothing. This is operated by F&F, stock code 383220.KS, which had its IPO in May 2021 off its equally surprising success with the MLB brand, licensed from the US professional baseball league. F&F is a $1.7bn market cap which has fallen by 70% from its post-IPO high, and now trades at a trailing P/E multiple of 5.7x. (NB I know nothing of its prospects or corporate governance. There might be an opportunity, but caution is advised.)

Returns on capital and cash flow

Goldwin generates an excellent ROIC. This was 27% in FY24 by my calculation: see my chart below. I include the Korean JV income in NOPAT. Other calculations are available, but by any measure Goldwin is adding value, with a superior ROIC compared to most Japanese companies.

Goldwin is proud of keeping its inventory well under control. My chart below shows 100 days of inventory when comparing it to cost of goods sold. The company prefers to compare inventory to sales, where the trend is even more impressive, flattered by the rising gross margin.

Estimates and valuation

In principle, Goldwin looks well equipped to keep growing sales and profits at an attractive rate of 10% or so. The success or failure of the Goldwin namesake brand would drive a better or worse result in the longer term.

A stronger yen should be a tailwind to margins, given that everything is manufactured in USD-linked currencies and sold in yen.

Seasonality is a factor reducing visibility somewhat. The third quarter, from October to December, typically accounts for 37% of annual sales and 65% of operating profit (average of last five years).

The company forecast a sharp 24% fall in operating profit for the current financial year, due to temporary costs related to the Employee Share Ownership Scheme and a relocation of headquarters building. It is also investing in the Goldwin brand rollout, which will initially incur SG&A ahead of sales and profits. In fact the company’s OP forecast for Mar’25E is an apocalyptic Y18.1bn, which consensus and I think is far too low.

Taking all the above into account, I forecast a 7% EPS CAGR over the next three years, with a backloaded profile. My estimates are shown below. As can be seen, I have no high-conviction view different to consensus in this case.

The valuation, at around 18x March 2025E P/E, is reasonably attractive. Goldwin also has a super strong balance sheet, with 19% of market cap held in net cash and securities. The total payout ratio (dividends plus buybacks) has been lifted to 40%, which implies around 2% yield at present.

I am tempted to take a position in Goldwin, but I remain on the sidelines for now. Fashion is always a difficult category, and the balance of risk and reward does not seem quite compelling enough. I will monitor Goldwin’s progress with interest.

Annex – history of The North Face

A timeline will be helpful to set out the unusual circumstances in which TNF came to be divided between two owners of equal status.

1950 – Goldwin’s precursor is founded in Toyama Prefecture, far away from Japan’s main cities.

1963 – now a sportswear manufacturer, the company name is changed to Goldwin Inc.

1964-66 – The North Face is founded in San Francisco by Doug Tompkins and Susie Russell as a retailer of outdoor and climbing gear.

1968 – Hap Klopp acquires The North Face and turns it into a product design company.

1978 – Goldwin becomes the exclusive distributor for The North Face in Japan.

1988 – in financial difficulty, The North Face is sold to manufacturer Odyssey International, controlled by the American Bill Simon, for just $11m.

1993 – Odyssey files for Chapter 11 bankruptcy. The North Face is put into restructuring prior to court auction. At this time, Goldwin negotiates to purchase The North Face trademark rights for Japan and Korea on a perpetual basis. There is no royalty payable and no right of termination. From this point forward, The North Face has two separate owners – one for Japan and Korea, and one for the rest of the world. (For primary documentation of this fact, see North Face Inc Form 10-K for 1998 and search for Goldwin.)

1994 – in May, the auction for the restructured US business of TNF is contested by Deckers, but ultimately won by an MBO bid for $62m.

1996 – North Face Inc is listed on NASDAQ.

2000 – an accounting fraud drives The North Face to the edge of bankruptcy. VF Corp buys it for just $25m.

I didn't even know this stock existed, and I'm a fan of JP streetwear/athleisure fashion, thanks for yet another great write up.

I've known of Nanamica through streetwear YouTubers in Japan. The purple label does have its own unique hype. The customer adores the minimalistic, quality, Japanese styling, and exclusivity of the brand. If you spot someone wearing a purple label, there is an automatic assumption that this person does his research and is into streetwear/athleisure fashion. It gives you "street cred" basically.

Given, purple label has limited growth outside of JP, Goldwin should copy the Nanamica framework and have a Japanese designer create an exclusive JP styling inspired Goldwin brand that has a Japanese title and call it maybe "black label" or "blue label".

The frustrating thing for this to work out is ensuring demand is always way above supply. This is to ensure the exclusivity or the perceived exclusivity remains. This is the business model Supreme uses. Completely underserve demand with extremely limited supply. This results in a higher priced resale market. This high price gets ppl attracted for the right reasons (fashion) and the wrong reasons (greed). Now you have everyone talking about the brand, and so you raise price and volume a little bit. Then you do collabs and limited drops and ur off to the races. Analogous to the story of the golden goose.

Have you seen in Goldwin's history where they have rushed expansion too fast?

The demand ramp up can be painful for shareholders who are impatient. Do you think Goldwin has what it takes to create an exclusive brand outside of Japan that has the same hype? I'll be looking at YouTube to see what the impression of Goldwin is amongst consumers.

Hi Alex. A great write up, especially on valuation. I did my own write up comparing Mizuno and Asics. I did not include Goldwin thinking their TNF reliance does not make it a good comp. Maybe I should have looked GW at its own right. Thank you.