Greggs is the UK public’s favourite fast food chain. The stock is also well liked among investors for its resilient growth and margins.

In this initiation post, I profile the track record and growth drivers over thirty years.

Using proprietary peer research, I put Greggs’ performance into context next to the carnage suffered by key competitors. The comparison is flattering, and may drive further growth as retrenching rivals hand market share to Greggs.

As such, the stock is arguably the ‘last UK hospitality stock standing’ in terms of a quality growth name that can be relied on to compound earnings for years to come.

I forecast continued double-digit growth for Greggs. Consensus estimates look beatable, so upgrades may provide a tailwind. Meanwhile the valuation has calmed down to a reasonable level in the high teens, having corrected from the over-exuberance of recent years.

Disclosure: Greggs is a top ten position. I expect to keep it as a long-term holding, subject to valuation.

Understanding the track record

Greggs was founded in 1939 and floated in May 1984. By 1993, revenue reached £110m. It increased to £1,809m by 2023 – a respectable 9.8% CAGR sustained over thirty years.

The store count rose from 492 in 1993 to 2,401 in 2023, a 5.4% CAGR. Within this, the acquisition of Bakers Oven in 1994 added 424 units, expanding Greggs’ footprint into the South East and adding a ‘premium brand’ that endured until 2008, when the remaining 163 Bakers Oven outlets were rebranded as Greggs.

As can be seen in my chart, from 2012 Greggs added stores with franchise partners. Franchise stores reached 500 by 2023, mainly in fuel station forecourts and other travel locations.

Sales per company-managed store rose from £224k in 1993 to £832k in 2023, for a 4.5% CAGR. Over such a long time span we need to adjust for inflation. Expressed in 2023 prices, real growth in sales per store was 2.0% over the 30 years.

To recap, the 9.8% long-term sales CAGR can be decomposed as 5.4% from added stores, 2.5% from inflation and 2.0% from real growth in sales per store.

Growth has not developed evenly. Instead, we can see three distinct phases: a period of strong growth from 1993 to 2004, a wilderness period from 2004 to 2013 in which sales per store fell 10% in real terms, and a new growth phase from 2013 to date. These are illustrated on the chart below.

The early growth phase – IPO to 2004

Historically, Greggs was a traditional bakery chain. It sold loaves of bread, rolls and cakes for consumption at home. From the mid 1980s, it also sold baguettes, sandwiches, savouries and drinks to eat right away.

In the 1990s Greggs was at the vanguard of the rising food-on-the-go trend. In 1997 a new central savoury factory near Newcastle increased capacity hugely for sausage rolls and the like. Up until 2004, rapid growth in sandwiches and savouries more than offset falling bread sales. (Demand for loaves fell steadily over time due to changing lifestyles and increased competition from supermarkets.)

The wilderness years – 2004 to 2013

From 2004 to 2013 Greggs was squeezed from all sides. The food-on-the-go market attracted floods of tough new competitors. Specialists like Pret, Subway and the coffee chains sprang up. In addition, Tesco and Sainsbury opened thousands of new convenience stores geared to the lunchtime sandwich trade. My chart shows Tesco Express leapt from almost nothing to over 1,500 units during Greggs’ wilderness years. No wonder Greggs’ volumes per store fell during this time.

Greggs fell behind the competition. In 2008 Sir Michael Darrington retired after 25 years as Managing Director, having centralised the previously devolved regional structure as his final act.

Ken McMeikan was appointed as CEO in June 2008, with 18 years’ experience at Sainsbury and Tesco. His 2011 annual report is a sorry read. Nearly four years into the role, he seemed confused about Greggs’ purpose. McMeikan wrote:

We believe that there are potentially three types of shop format appropriate for Greggs: ’Food on the go’, ’Local bakery’ and ’Coffee shop’.

Accordingly, he started trialing new ‘Greggs moments’ coffee shop stores with lots of seating.

The national champion growth phase – 2013 to 2023

Happily, the board made a change and appointed Roger Whiteside as CEO in February 2013. He quickly dropped the ‘local bakery’ and ‘coffee shop’ formats, exited completely from selling bread, and focused relentlessly on food-to-go. The 2017 Guardian long read on sandwiches is recommended reading on Whiteside’s background and his turnaround of Greggs.

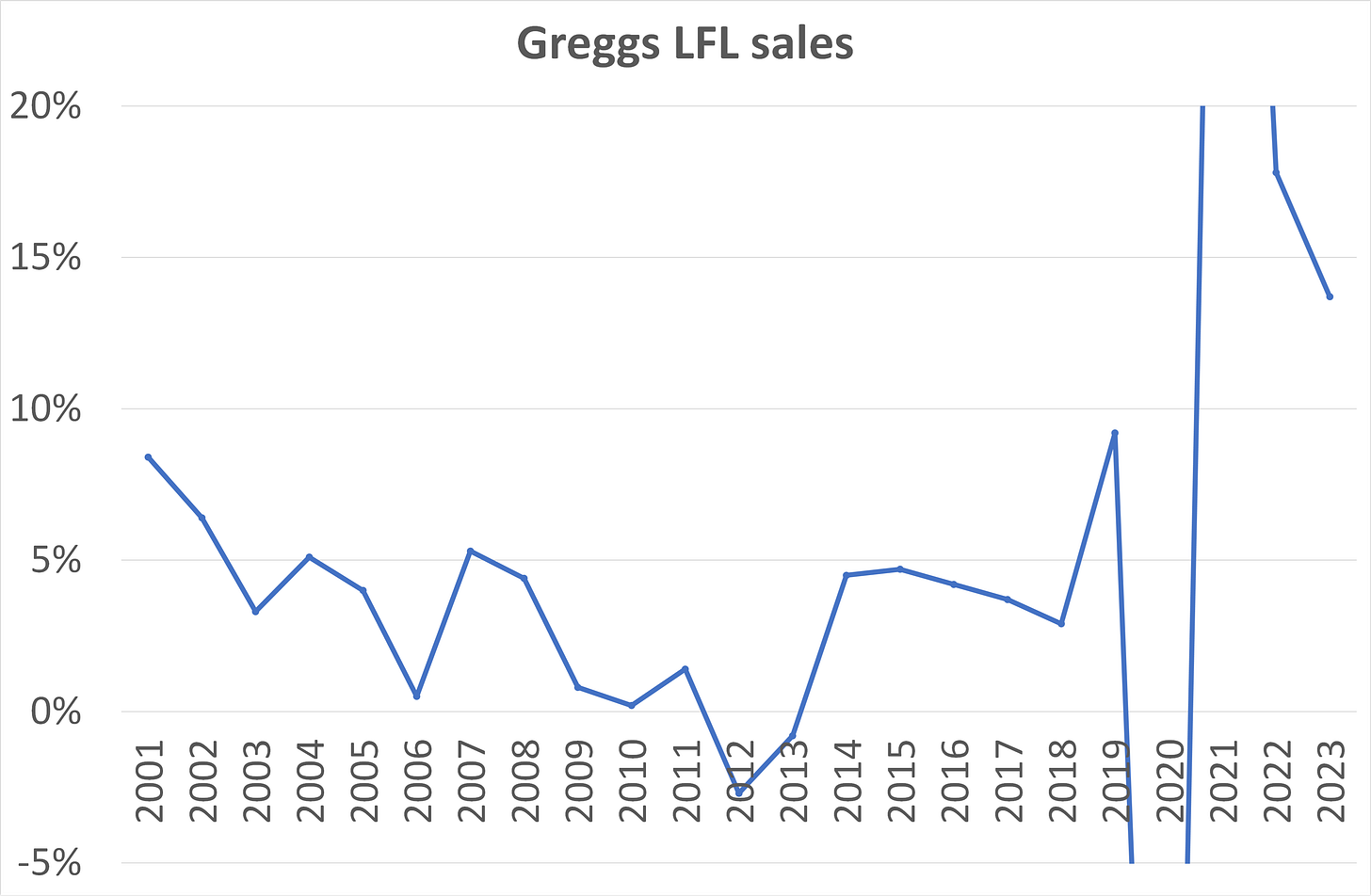

Branding, menu changes and a concerted effort to extend the trading day all played a part in the step change in growth from 2014 that can be seen in the like-for-like sales chart below. A few words on each follow.

Branding. Whiteside oversaw deft marketing, PR and social media use that repositioned the Greggs brand as a national champion with broader appeal than previously. Greggs have displayed a genius for stunts to garner free media coverage that rivals Michael O’Leary of Ryanair. The table below from YouGov shows Greggs currently at #1 and with a clear popularity lead over its fast food rivals.

(Note that Greggs’ actual penetration was only 38% in 2019, defined as the percentage of adults that visited at least once in the year. That and other brand data can be seen in the detailed 2021 capital markets day deck.)

Menu changes. Greggs’ introduction of the vegan sausage roll in January 2019, and their witty response to Piers Morgan’s criticism on Twitter, sealed the deal in establishing Greggs as the nation’s favourite. 2019 was a breakout year for Greggs’ like-for-like sales growth as a result.

Extended trading. Adding breakfast and dinner sales on top of the traditional lunch trade has been a key growth driver for Greggs. They like to talk about additional “day parts”. Virtually all stores now open from 6am or 7am in the morning, selling bacon rolls, porridge and coffee for breakfast. And selected stores are open until 7pm, 9pm or later in the evening, offering pizza slices, potato wedges and a revolving cast of hot food innovations. (This currently includes a trial of chicken burgers in a handful of Newcastle stores.) Post-4pm sales represented 8.3% of managed shop sales in H1’2023, up from 6.5% in the same period a year earlier.

The day part strategy’s potential to increase sales per square foot while keeping non-labour costs relatively fixed is clear. Greggs has also added delivery options via the Just Eat and Uber Eats platforms. Delivery reached over 5% of total sales by mid 2023.

Financials

Greggs enjoys a return on capital employed that is typically 20% or higher, even after leases were brought on balance sheet, as seen in my chart. (2020 was impacted by Covid closures.) ROCE is a pre-tax metric, and the corresponding ROIC sits in the mid teens, comfortably above Greggs’ cost of capital. For new stores, Greggs uses a 22.5% cash ROIC hurdle rate over an eight year investment cycle. For big central investments, the company uses DCF analysis and a hurdle rate is not disclosed.

Greggs’ OP margin has trended up from around 8% to around 10% over the years – see chart below. Note that the quality of earnings has been high, with limited use of exceptional items.

Capital employed in the business is set to increase, as Greggs has embarked on large projects to expand and automate the central factory and distribution infrastructure required to serve their expanding branch network. Capex was a record c.£200m in 2023, and is guided to stay at this level in 2024 and 2025, which will depress ROCE in the short term. Management’s latest remuneration plan requires ROCE to average 21.2% from 2023 to 2025 for full vesting.

Working capital is negative to the tune of £100m, given that suppliers are paid on trade credit terms while managed store sales bring in immediate cash.

Greggs has enjoyed strong free cash conversion over time, with 84% average conversion from net income to free cash flow, reflecting capex running ahead of depreciation.

Capital allocation is summarised in my table below. A 53% reinvestment rate of gross cash flow into capex has been sufficient to fund the decent growth rate. 43% of gross cash flow has been available to pay dividends and to pile up cash on the balance sheet. (Greggs has no financial debt.)

The next growth phase

Roger Whiteside retired in January 2022. Greggs ensured continuity by appointing 12-year Greggs veteran Roisin Currie as the new CEO. She was most recently Retail and Property Director, and was previously People Director. Prior to 2010 Currie worked for 19 years at the supermarket chain Asda, which was a Walmart subsidiary at the time.

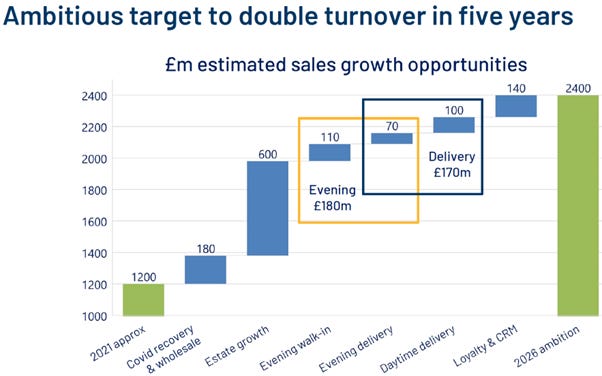

In its October 2021 Capital Markets Day, Greggs set out a new plan to double sales in five years to £2.4bn by 2026E. After allowing for some COVID recovery, this required a 12% CAGR.

The key drivers, shown in the chart below, were to be new store openings and the evening trading and delivery initiatives we reviewed above, as well as the loyalty app driving higher visit frequency and basket size. Back then the coming inflation shock was unknown, so arguably the target should be adjusted upwards to allow for the excess inflation seen since.

Peer group carnage

Greggs has outperformed listed UK domestic leisure sector peers such as Domino’s Pizza UK, Whitbread, JD Wetherspoon, Mitchells & Butler and Marstons. Most pub chains face structural and cyclical challenges, while Domino’s has suffered from competition from delivery aggregators and difficulty in balancing the interests of the key franchisee partners.

Greggs’ closest competitors are privately held or are part of global groups. Most have faced far tougher trading than Greggs. Brief portraits are below.

McDonald’s UK

McDonald’s is undoubtedly Greggs’ best quality competitor. The US parent’s annual report provides no details on the UK subsidiary. But Companies House accounts show that McDonalds has a total of 1,350 restaurants in the UK, 89% of which are owned by franchisees. UK corporate profits have grown fabulously from £232m in 2011 to £657m in 2022. (Franchisees’ profits are in addition to this figure.) My chart shows that Greggs has just about kept pace with McDonalds over this time, with Greggs’ OP today worth c.25% of McDonalds’ UK profits.

Even McDonalds struggled in the UK recently. This article details a “collapse in McDonald’s UK franchisees’ profits: The pre-tax profit margin of 25 of McDonald’s UK’s most sizeable franchisees declined by almost 92% from £103.3m to £8.4m in 2022, as higher labour costs impacted profitability”. On sales of £1.27bn for these franchisees, the margin fell to less than 1%.

Burger King UK

Bridgepoint own the UK master franchise for Burger King, called Royale JVC Ltd. The company has been growing rapidly, but in 2022 it reported a 54% collapse in underlying EBITDA from £33m to £15m, citing cost inflation and weak consumer sentiment.

In November 2021 Sky reported that Bridgepoint tried to IPO Burger King UK. (UK investors dodged a bullet there.) In August 2023, Sky further reported that Bridgepoint was trying to renegotiate the master franchise agreement with RBI, citing unhappiness with its financial returns and a wish to cut the number of restaurants it is obliged to open each year.

Costa UK

Costa is a major competitor to Greggs in both coffee and food, with around 2,700 UK stores as well as 12,700 Costa Express coffee machines. Back in the year to Feb’18, when Costa was owned by Whitbread, the UK business reported £151m of underlying OP on £1.13bn of UK sales – far more valuable than Greggs’ OP of £82m in calendar 2017.

Companies House accounts show that the business has nosedived under Coca-Cola’s ownership. The coffee shop business was loss-making in calendar 2021 and made a tiny £8m OP in 2022. The Express coffee machine business has fared better and made £70m OP in 2022. Combined profits from Costa’s businesses in 2022 were less than half Greggs’. Costa noted that “As a result of the economic environment and inflationary pressures, in the second half of the financial year the company launched a restructuring programme to address the scale of overheads and invest for growth”.

Greencore

Greencore is by far the biggest manufacturer of sandwiches in the UK. It has over 50% market share in packaged sandwiches, which it assembles fresh daily in its factories for sale in supermarkets and catering outlets.

Despite its massive market share in a highly concentrated industry, and its long-term relationships with key supermarket customers, Greencore has struggled to convert sales into profits. My chart shows that Greencore had higher earnings than Greggs from 2012 to 2018, but today the reverse is very much true.

Greencore is now trying to raise prices, and has threatened to terminate unprofitable contracts. This will tend to put pressure on its customers (Greggs’ competitors) to raise their famously low sandwich prices. For example, Tesco’s iconic meal deal (a sandwich, a snack and a drink) was priced at £3.00 for over a decade from 2012, and today still costs only £3.40 with a loyalty card. Any price increase here would help Greggs’ relative value position.

Forecasts

For my preferred long holding period, I need to forecast Greggs’ earnings out to 2026E, as well as considering the sustainability of the trajectory in the years beyond. Growth and profitability can be analysed in turn.

Growth. I start with a review of the 2018-23 period. The revenue CAGR was 11.9% over these five years. Inflation explains 4.2% of that, leaving real terms growth of 7.7%. New managed stores contributed 3.1%, and volume growth per store added 3.8%. The final 0.8% growth came from the increased franchise business. This is summarised in the table below.

Considering the same drivers for the next three years, I estimate that Greggs can drive a further 10.6% revenue CAGR, despite lower inflation ahead. Net new store growth is guided to be an impressive 140 to 160 shops in 2024E, or c.6% growth. The 2026E target implies similar or even higher openings in 2025 and 2026. Lower-value franchise stores make up a good chunk of the new openings, but I expect 90-100 net new managed stores per year in 2024-26.

The other key driver of growth is real same store sales growth, i.e. volume growth per store if Greggs increases prices no faster than inflation over time. I have assumed 3.0% real SSSG for the coming three years, which is slower than the exceptional period from 2018 to 2023, but still pretty punchy. I assume that Greggs’ value positioning, improving brand consideration and the specific evening, delivery and loyalty initiatives drive ongoing market share gains.

Saturation is the obvious potential concern for the longer-term growth outlook. Greggs already has a total of 2,500 stores in the UK, the highest number of any food-on-the-go competitor. What is the ceiling? The company states in its 2022 annual report that “Our ambition is to have significantly more than 3,000 shops across the UK”. They should reach 3,000 shops by the end of 2026.

Greggs argue that they are adding new locations such as inside supermarkets, airports and rail stations, as well as in retail parks, business parks and petrol stations. London is particularly under-penetrated and can take many more stores. Greggs is also still adding stores even in its densest regions such as Newcastle.

In market share terms, Greggs only owns c.6% of the food-to-go market. Their stores are far smaller than rivals on average, with proximity and convenience the priority. The table below gives a comparison for new out-of-town unit sizes.

Greggs should certainly not attempt to expand overseas, in my view, given its uniquely British appeal. They already tried that with a failed Belgian adventure in 2003-08.

Overall, saturation is a valid concern within a five-year time horizon. This does not make Greggs uninvestable, in my view, but it puts a lid on the valuation I am happy to pay for the stock.

Profitability

The P&L from 2019 to 2022 is shown below, along with my forecasts. Note that Greggs has not yet announced 2023E profits, but the company did state in its January trading update that “the Board anticipates reporting a full year outcome for FY23 in line with its previous expectations”. Consensus for FY23 sits at £173m for EBIT and 122p for EPS.

Some comments on the P&L.

· FY20 and FY21 profit margins were distorted by COVID effects.

· FY19 and FY22 were closer to “normal” years for margins. I forecast the PBT margin to return to the normal level by 2025E.

· FY23 saw downward pressure on profit margins due to inflationary cost increases in excess of offsetting price increases. Overall cost inflation was 11% in the first half of 2023, and was expected to ease to 7% in the second half of 2023.

· Greggs’ cost breakdown is shown in the chart below. Food costs are rising more slowly now, and energy costs are falling. Shop occupancy costs are structurally falling due to the company’s strong covenant and UK commercial property market weakness. Wage costs will continue to rise briskly due to the government’s National Minimum Wage hike of 9.8% or more from April 1 2024, depending on age category. Overall, the outlook is for a more stable cost base in 2024.

Valuation

My estimates put the stock on 19.5x current year P/E multiple, falling to 15.6x 2026E: see my table below. My EPS estimate sits 7% above consensus for 2025E. Consensus are likely conservative on new store count and same-store volume growth.

The valuation today is reasonably attractive for a long term holding, in my view. This is refreshing after a period in which the stock was often over-hyped and overvalued. The chart below shows the stock traded at 28x forward P/E in late 2021 when the company unveiled the plan to double sales in five years.

How could I most likely be wrong? To the upside, it is possible that Greggs sees margin expansion from positive operational gearing, especially if cost inflation falls away rapidly and Greggs retains pricing power in the context of a weakened competitor group.

To the downside, any major disappointment in like-for-like growth and / or profitability would indicate botched execution or fading brand strength. Neither I nor the market expect any such profit warning, which means the share price impact would be extremely severe if it comes about.

Greggs is due to report its full results on Tuesday 5 March. I will follow up then.

Can you explain what "proprietary peer research" is please?

Today's a good day to read this write-up again