Griffon, Sanwa and late onset pricing power in the US overhead garage door market

(Griffon is GFF, $3.3bn market cap, $25m ADVT. Sanwa is 5929.T, $4.1bn market cap, $13m ADVT)

Price-fixing is illegal in the US. Executives face jail time if they are convicted of colluding to keep prices high.

Fortunately, investors face no such sanctions for buying shares in companies with impressive pricing power and unnaturally high margins. Instead, the key risk is loss of capital if the apparent pricing power proves to be temporary.

Today’s post explores a case of surprisingly big price increases and record-high margins. After working through it, I have chosen not to invest in the stocks in question. Nonetheless, I hope the example may be of interest for anyone who needs to analyse abnormally high margins in similar cases.

As always, feedback is very welcome. Which past examples of overnight step changes in margins proved enduring?

Introducing Griffon and Sanwa

Griffon and Sanwa own two of the biggest US garage door makers, Clopay and Overhead Door (OHD). Segment margins at both companies doubled in 2022 to record levels, and have stayed sky-high ever since.

I look at why profitability jumped so dramatically, and whether margins are likely to stay high.

If the step change is sustainable, then the stocks would be cheap from here, even after having made big moves already.

Conversely, Griffon and Sanwa will prove to be nasty value traps if economic gravity kicks in.

The US garage door market

The US market for overhead doors is worth c.$6-7bn, split between residential and commercial. Residential is mainly repair and remodel rather than newbuild. Commercial end uses include 40% warehouse and 30% retail.

Industry structure features a few manufacturers and many local installers / dealers, as well as some involvement by wholesalers and home centers. (Griffon’s Clopay is exclusive garage door supplier to Home Depot, which accounted for 9% of sales in 2023. Sanwa’s Wayne Dalton brand is exclusive supplier to Lowe’s.)

Homeowner end customers make a garage door purchase only occasionally, and may not know what the “right” price should be. They rely for advice on their local installer or dealer (who they used to find in the Yellow Pages, and now via Google or social media). Meanwhile, newbuild and commercial purchases may be mediated by an architect or other specialist adviser.

Most purchases will be motivated by necessity (old door is broken). Garage door replacement is also an attractive and affordable remodeling project to boost curb appeal.

Basic pan doors are engineered steel panels with spring-and-rail mechanisms for opening. Value-added options include sandwich designs with upgraded insulation, wood veneer finishes and automatic electric openers. (Openers are mainly supplied by Blackstone’s Chamberlain Group, which it bought at a $5bn valuation in Sep’21. Sanwa has a rival opener called Genie.)

Half a dozen large door players have meaningful shares, alongside many mid and small players. All doors for the US market are made in the US or Canada, as the products are bulky and cannot be economically shipped over long distances.

Brief profiles of major manufacturers are provided in the annex.

Griffon’s lucky activist

Griffon is a $3bn US conglomerate that owns the leading overhead garage door business, Clopay. This forms the “HBP” or Home & Building Products segment. Griffon also owns long-handled tools businesses and home organization products that form the “CPP” or Consumer & Professional Products segment.

Starting in 2021, Travis Cocke and his Voss Capital led an activist campaign against Griffon, citing its comically poor corporate governance (two son-in-law CEOs in a row!), egregious management compensation and conglomerate discount.

By any measure, the Voss investment in Griffon was a great success. Voss won c.150% relative outperformance against the S&P500 since they went public in November 2021.

However, Voss made the right call for the wrong reasons. They campaigned for a sale of HBP and a turnaround plan to lift the low margins at CPP.

Instead, the single main driver of Griffon’s subsequent huge performance was an outlandish doubling of HBP’s already-respectable profit margin.

Margin history for Griffon’s Clopay and Sanwa’s OHD

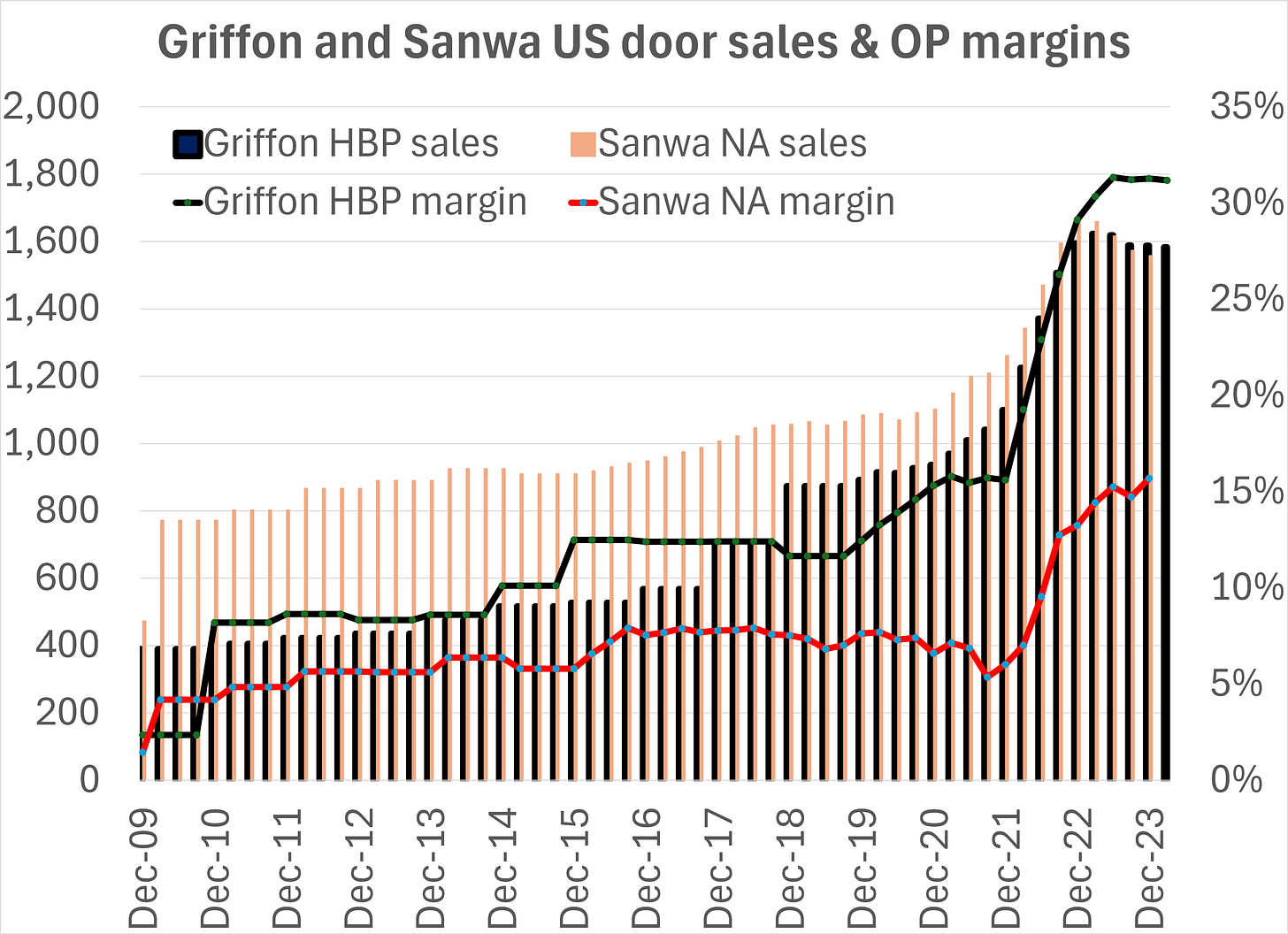

The two-firm margin chart shown above is the central exhibit and puzzle. Here is a busier version of the chart, also including revenue for both firms.

Margins for both Griffon and Sanwa’s US garage door segments were fairly low until 2022, when they doubled almost overnight.

Griffon’s Clopay business has long been more profitable than Sanwa’s OHD. While both firms doubled their margins since 2022, the gap between them has widened in absolute terms. Sanwa investors might hope the gap narrows in their favour, but this would be over-optimistic.

Clopay has also grown much faster than OHD – it appears to be by far the stronger business.

What happened in 2022? This was a period of post-COVID demand recovery, bottlenecks, long lead times and inflation. However, the extent and persistence of the margin jumps are hard to explain.

In the March 2022 quarter alone, HBP adjusted EBITDA increased 161% year-over-year. The segment margin jumped 12pp year over year or 10pp sequentially.

This was utterly unexpected at the time, and drove the stock up sharply. However, an even bigger move up in the stock came at the end of 2023, when for the first time investors dared to wonder if the new higher margin might be permanent. See relative return chart below, showing Griffon’s outperformance against the Mag-7-fueled S&P500.

The first analyst to ask a question on the April 2022 call couldn’t hide his astonishment.

“Congratulations on outstanding results… I'm still trying to wrap my head around all this. It's fantastic. But maybe we can start with HBP. And could you dig in a little on the primary strength in commercial and the outlook there and kind of the drivers? And -- I mean this is such a huge increase. What changed? And how sustainable is this outlook?” [Griffon Q2 2022 Earnings Call, April 28 2022]

Management failed to explain the margin change properly, other than to say that the quarter reflected price cost benefit after multiple quarters of price cost lag.

The table below challenges this analysis. It shows that price-mix was already positive in FY20 and FY21, sufficiently so to support margin increases in both years. However, the 47% price-mix lift in FY22 is a truly astonishing number. And to follow this up with another +8% in FY23 is equally impressive.

Today, after Q2 of FY24, volumes have fallen for two years straight, and revenue has fallen for the last four quarters. Yet the margin has remained as high as ever.

Explanation: late onset pricing power?

The most obvious explanation is that general inflation, which picked up in late 2021, provided the trigger or smokescreen for the garage door companies to put through radical price increases, far above what was needed to recover input cost inflation. Somehow, with their captive distribution networks, the companies turned out to have the pricing power to make these increases stick.

This still leaves a puzzle of why they couldn’t or didn’t hike prices significantly prior to 2022, even without inflation? The pricing power ought to be logically separate to inflation. Perhaps nobody thought to try.

All the garage door manufacturers are members of DASMA, the Door & Access System Manufacturers’ Association. The CEOs presumably know each other well, serving on committees together and meeting at functions. Nobody can import product from overseas due to the freight and other challenges. These factors could all contribute to a high degree of pricing discipline in the industry.

I consider it highly unlikely that formal price-fixing is taking place in the garage door industry. Instead, the conditions seem to be currently in place for all the major firms to enjoy higher-than-normal prices and margins together, despite no collusion.

Price-fixing is illegal in the US, though prosecutions are rare. The chart below shows the small number of major convictions under the Sherman Act each year, especially in the last three years. Individual executives can face jail time if convicted of price-fixing, but this is also rare.

A contributing factor to current high margins may be the long capital cycle. Garage door margins had underperformed other construction sub-segments in the great housing bubble market of 2005-07, due to over-capacity at that time. The 13 years from 2008 to 2021 saw consolidation and plant closures. It is likely that industry overcapacity had finally been removed by the time the post-COVID demand surge hit.

Valuation: stocks would be cheap if high margins are permanent

Both stocks currently trade at similar P/E multiples of 13-15x – see chart below. They have re-rated from even lower single-digit multiples when the margins first rocketed. The future margin path is the key controversy for both stocks.

I have not struck my own forecasts for either stock, as I am not tempted to get involved in the situation. It will be interesting to watch what happens next with the margins. I think it likely they fall gradually from here back towards prior normal levels.

Eliminating hypotheses – nothing similar overseas

Sanwa’s US margin doubled from 2022, but its similar businesses in Europe and Japan saw no comparable increase in profitability. Whatever happened was a US-only thing. See charts below.

In so many cases, and across different industries, the US is often more profitable than other regions. This could be because of the sheer efficiency of such a huge, prosperous single market compared to operating across many small countries in Europe. Social and cultural factors such as low unionisation, different management norms and different consumer behaviour might also be factors.

Eliminating hypotheses – not the same in construction steel products

The third largest US garage door maker, C.H.I., was acquired by Nucor from KKR in 2022. KKR had taken C.H.I.’s EBITDA margin up to a high 30% level before Griffon and Sanwa followed.

Since acquisition, Nucor has reported C.H.I. within its much larger Steel Products segment. This segment mainly comprises much heavier and more commoditised products for non-residential construction, such as joists, girders and beams.

My chart below shows that Nucor’s Steel Products margin spiked in 2022 as sharply as Griffon and Sanwa’s – but unlike them it has already given back c.10pp of the spike. This looks more like the behaviour we would expect from commodity supply-and-demand markets, with rapid, mechanistic swings in margins.

Eliminating hypotheses – not the same in adjacent door-related products

Assa Abloy and Allegion are two companies that sell locks and door hardware: somewhat adjacent markets to garage doors. I compared the regional margins for Assa and Allegion in America vs the rest of the world.

Both firms enjoy far higher profits in America than in RoW, similar to Sanwa as discussed above. This has been the case for over a decade.

But in neither case was there any special spike in 2022. Quite the opposite – these firms saw slightly lower margins in the recent inflationary period compared to the prior years. See charts below.

Eliminating hypotheses – not quite the same for Advanced Drainage Systems (WMS)

Advanced Drainage Systems makes pipes, septic tanks, and water management products for rural homeowners in particular.

ADS’s margin profile is high and rising, but in a different shape, without a step change at a single moment in time.

Annex: main overhead door manufacturers

Virtually all US garage door makers are members of the trade association DASMA.

Clopay, owned by Griffon, has $1.6bn sales split evenly between residential and commercial. In commercial they sell rolling steel doors under the Cornell-Cookson brands.

Overhead Door Corp (OHD), owned by Sanwa, has $1.6bn sales which splits evenly between residential and commercial. OHD acquired Wayne-Dalton in 2009 and has maintained its separate brand, product range and dealer network separate. Unlike Clopay, OHD also owns Genie overhead door operators, plus Horton Automatics pedestrian sliding and revolving doors.

C.H.I. Overhead Doors was acquired by Nucor from KKR in June 2022, with about $700m revenue and a high 30% EBITDA margin. KKR was the third successive private equity owner, and had put in place an aggressive employee incentive scheme that had lifted margins sharply.

Amarr was acquired by Assa Abloy back in 2013. At the time 2014 sales were expected to be $330m. Assa Abloy has not reported a standalone number for Amarr since then that I am aware of. If it has grown with the market it may now have c.$500m sales.

Garaga is a Canadian family-owned garage door maker that has expanded into the US by two acquisitions, reaching over 1,200 employees and likely several hundred million dollars in sales.

Hörmann Group is a German family-owned company with >€1bn in total sales. It has entered North America in the last 15 years via both acquisitions and greenfield investments. My guess for North America sales would be $100m to $200m.

Haas Door of Ohio is a family-owned garage door maker that is said to have c.$100m of sales.

Martin Door is a Utah based garage door maker that was acquired by PGT Innovations for $185m in mid 2022, based off $60m of expected sales and an EBITDA margin of over 30%.