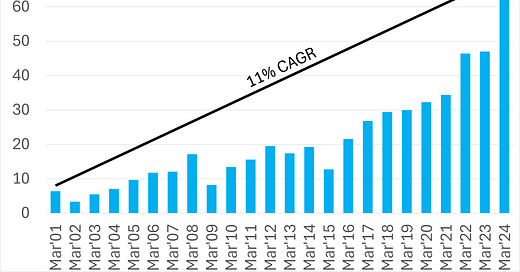

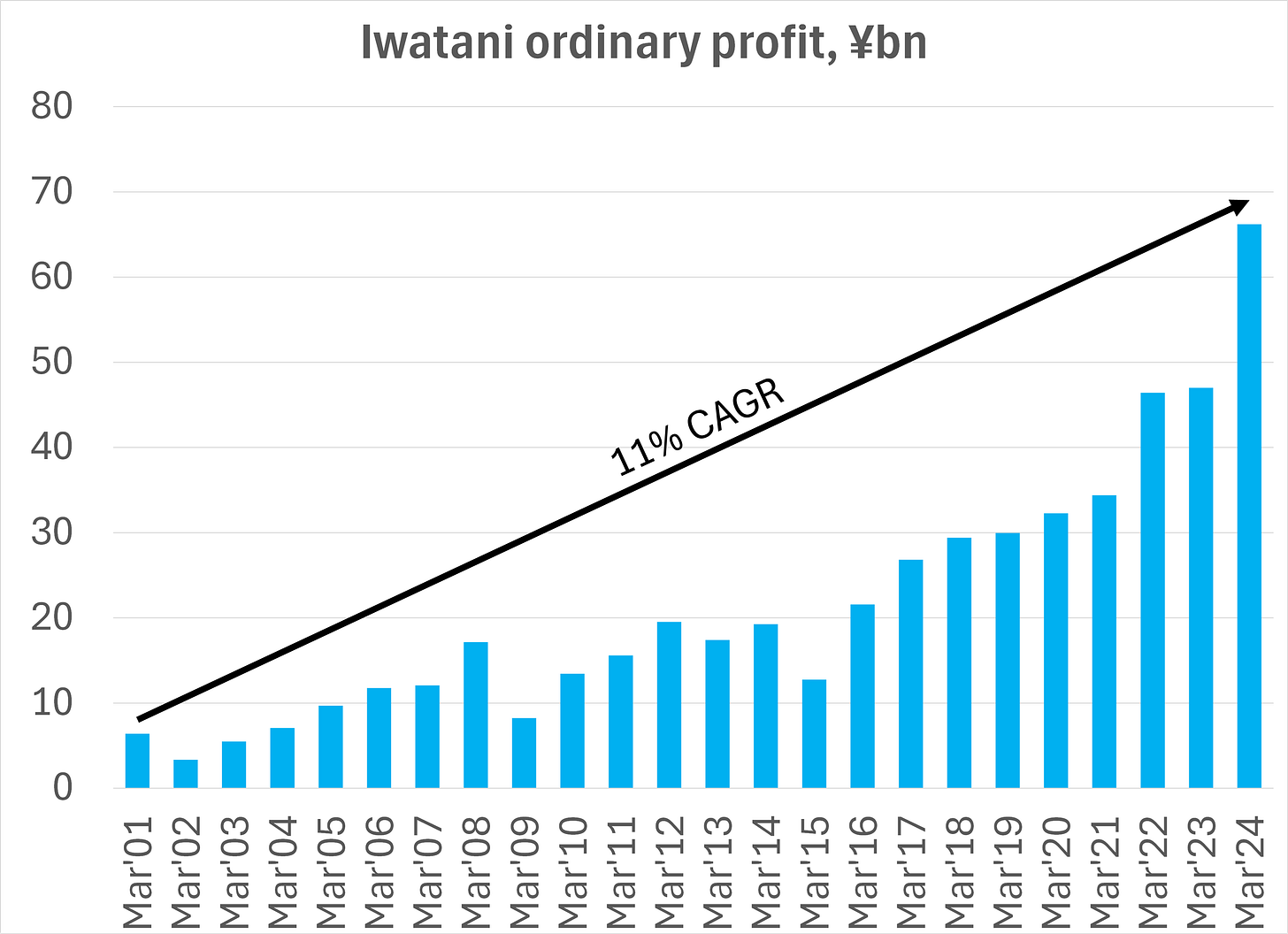

Iwatani is a Japanese trading company, specialised in gases, that has compounded profits by an excellent 11% CAGR over 23 years (see my chart below). Yet it is given no credit for this, and trades at a low 9.8x current P/E multiple.

In my process, I pay close attention when a business with an objectively superior track record is ignored by the market at large.

The profit split by segment is even more interesting. Iwatani has three main business areas (industrial gases, energy and materials) that have all prospered over time. This makes it particularly unlikely that the impressive sustained profit growth is attributable to luck. Rather, I suspect a surprising and successful entrepreneurial culture is at work.

To the extent that international investors have any familiarity with Iwatani at all, they likely view it as a stodgy bottled gas distributor that pays a low dividend while splurging on uncertain hydrogen investments.

What is far less appreciated is Iwatani’s strong position in industrial gases, a famously attractive industry that is led globally by Linde and Air Liquide.

In this post I’ll describe each of the businesses. A key emphasis must be the especially rapid profit growth in the last three years. The market is reflexively fading this. If instead Iwatani can keep on building from here then the stock would have a lot of upside.

For the coming year Iwatani is forecasting another rise in profits. And their clever deal to buy a 20% stake in highly profitable refiner Cosmo Energy on the cheap could contribute to ongoing profit growth, given Cosmo itself is forecast to grow earnings at a double-digit rate.

I lack any high-conviction insight into Iwatani’s near-term earnings, but I do expect continued progress on my preferred three to five year holding period.

I have therefore started a position in Iwatani at around the current price.

Feedback is welcome as always. What have I missed or misunderstood? Am I top-ticking Iwatani despite its derating?

Industrial gases

Industrial gases is the supply of air separation gases (including nitrogen, oxygen, argon) and speciality gases (including carbon dioxide, hydrogen, helium) to all kinds of industrial users such as steel and chemical makers, food and beverage firms and semiconductor companies.

The industrial gas market is concentrated. Linde and Air Liquide are the global giants. The next tier includes Air Products, Nippon Sanso and Messer, who have broadly spread international operations. (When Linde and Praxair merged in 2018, they were forced to sell major operations to win regulatory approval. Nippon Sanso bought the European disposal group and Messer bought the Americas disposals in 2019 with CVC, giving both a boost in global scale. Iwatani in turn bought four unwanted California hydrogen filling stations from Messer.)

Finally, Iwatani and Air Water in Japan / Asia, and Gulf Cryo in the Middle East, are notable regional firms.

My table, below, shows the most recent annual sales and adjusted EBITDA for seven firms.

The three Japanese firms have by far the lowest margins of the group. In fact, much of the margin variation in the table can be explained by Japan weightings. Air Liquide has a significant and long-standing presence in Japan, which likely weighs on its group margin. Linde, Air Products and Messer benefit from virtually no Japan presence. And Nippon Sanso has a low margin in Japan, balanced by higher margins overseas.

It has been a long-standing fact of life that industrial gases in Japan are far less profitable compared to the rich margins typical in North America and Europe. The former director of M&A at Praxair commented recently on Tegus as follows:

If you look at the Japanese gas model, I'm not saying it's bad, [but] gas businesses in Japan don't make any money. I worked in M&A for Praxair, several times, the Board would task us to let's go buy a business in Japan, and every time we came back, the margins were terrible. I can never really understand it.

It's not highly competitive or fragmented. It's just a lack of discipline in the industry. I don't know what the story is, but their margins in Japan were very low.

My chart below shows Iwatani’s industrial gas segment sales and margins over time. There is clear and impressive improvement from a very low starting point. My thesis is that Iwatani can continue to grow its industrial gas margin towards the higher levels enjoyed by other players.

The segment is split 58% industrial gases and 42% related machinery and equipment. The split of gases is as shown below left: Iwatani under-indexes to air separation gases at 30% of total, and over-indexes to helium and hydrogen, which are its key specialty gases with top market share in Japan. Next I give further details on each of these two.

Helium is in tight supply globally. It is a by-product of certain natural gas production, and is essential to semiconductor manufacturing and to MRI in healthcare. Iwatani imports helium from both the US (where ExxonMobil is the key supplier) and Qatar under stable, long-term contracts. In 2010 Iwatani gained a major coup when Qatar awarded it rights to a 20% share of helium from the Qatar II project in Ras Laffan Industrial City, running from 2013 to 2032. Linde and Air Liquide were the only other awardees for this globally significant helium resource.

The price of helium is volatile, and has risen over time. There have been four major shortages since 2006, with associated spikes in spot prices and in the mid-term 2-3 year contracts that are typically signed with large users. The most recent shortage was prompted by Russia’s invasion of Ukraine and the resulting sanctions by western nations against Gazprom, which was just in the process of ramping up a major new helium project called Amur. The spike seen in 2022-23, when the spot price peaked at around $1,500 per MCF, has now unwound as Gazprom restarted production and re-routed its helium to China and India. Current spot prices are back down to around $500 per MCF, and mid-term contracts would be struck at around the same level.

Iwatani and the other industrial gas players are partially insulated from the price swings, because their supply arrangements with ExxonMobil and Qatar tend to pass on price moves on a back-to-back basis. Nonetheless, Iwatani probably made some windfall profits from helium in the recent spike.

Air Products (APD) is the major with the biggest relative exposure to helium. Investors were fretting about APD’s Chinese helium results in the February quarterly results call. By May the situation had stabilised significantly.

Iwatani supplies hydrogen both in liquid and compressed form. It is the sole supplier of liquefied hydrogen in Japan, after it invested in three liquid hydrogen production bases across Japan. The chart below shows Iwatani’s strong growth in volume of liquid hydrogen delivered, taking its overall market share of hydrogen from 35% to 70%.

Iwatani’s current hydrogen is fossil-fuel derived, but it is investing to develop green hydrogen sources. Iwatani has also invested in hydrogen filling stations to support Japanese automakers’ experiments with fuel cell cars. It is fair to say that Iwatani is all-in on a bright hydrogen future which may or may not come true. However, in my view the existing industrial business is attractive enough to own, even without a miraculous realisation of green hydrogen as the abundant clean energy of the future.

27% of segment sales are overseas. Iwatani sells helium throughout Asia, and some of the machinery and equipment sales go overseas. In addition, in January 2023 Iwatani acquired Aspen Air, a US air separation gas firm in Montana. Iwatani paid $40m or Y5.2bn. Aspen itself is tiny, but the entry into the US market was a notable move which could result in additional acquisitions in future.

Energy

Iwatani’s Energy segment features a unique vertically integrated LPG import, wholesale and retail business with a dominant #1 position. Despite operating in a fragmented and overall gradually shrinking market, Iwatani has sustained steady growth in customer numbers and profit per customer. I expect this to continue.

The context for this market is shown in the chart below. Only half of Japanese households have access to city gas. For the other half of households, a minority rely on electricity alone. However, most choose to buy bottled gas (LPG aka propane) from a retailer who trucks it to their house in cylinders. Gas is preferred to electricity for heating the home and cooking.

Out of the 24m households buying LP gas, 1.1m are served directly by Iwatani (whose brand is MaruiGas). Another 2.2m are served by partner retailers that Iwatani supplies on a wholesale basis. So Iwatani has c.14% market share (3.3m / 23.7m).

The #2 LP retailer is Nippon Gas with 997k households. #3 is Tokai with 778k. The top three combined have c.21% market share. The rest of the market is in the hands of around 16,000 tiny distributors. (There are no barriers to entry in retailing LP gas – one man with a truck can have a go.)

In this setup, Iwatani has been able to gain market share steadily and improve its profitability significantly over time. My chart below shows that despite a flat revenue trend, Iwatani has tripled segment profits from 2005 to 2024 via steady margin increases.

(Reported Energy segment profit fluctuates from year to year due to the three month time lag from import to sale, plus the impact of Iwatani’s first-in, first-out accounting. This is purely an accounting fluctuation which does not impact the underlying results over time.)

Both Iwatani and Nippon Gas (Nicigas) have improved their market share and profitability in lockstep, while #3 player Tokai has been less effective. See chart below.

Aside from LPG wholesale and retail, other parts of the Energy segment include industrial LPG supply, some LNG and kerosene supply, a portable gas cooking stove and canisters business (2m units of cartridge gas stoves and heaters, plus 100m cassette gas canisters per year), and various gas supply equipment and devices.

Materials

The materials segment is diversified across several business areas, and exemplifies Iwatani’s heritage as a Shosha or trading company.

The graphic below gives the split within the segment.

The biggest single contributor is mineral sands, the raw material for titanium. This is imported from Iwatani Australia, previously known as Doral, which is 100% owned.

Iwatani don’t disclose specific figures for mineral sands. But since Iluka spun off Deterra Royalties, we can back out the revenue. This is because Deterra owns a 2% royalty on Iwatani Australia’s two key assets.

In the years to June 2022 and 2023, Deterra’s royalty from Doral tripled from A$0.35m to A$1m, implying A$50m of revenue for Iwatani Australia. This was thanks to successful ramp up of Doral’s new Yalyalup mine, pictured below. Prior royalty was A$0.4m in calendar 2018, A$0.6m in calendar 2019, and A$0.8m in the year to June 2021. Clearly Doral revenue is volatile from year to year, based on both the mine plan and pricing, but the upward trend is impressive.

The growth of the Australian mineral sands business is likely a key driver of the strong overall Materials segment growth in sales and profit shown in my chart below.

Cosmo Oil

Iwatani demonstrated its eye for a bargain when it seized the opportunity to acquire a 20% stake in $4.4bn oil refiner Cosmo Oil in December last year. Cosmo had come under sustained pressure from the Murakami family of activist investors. Instead of ramping up their fight further, they sold their stake of just under 20% for Y105bn to Iwatani, which acted as an uninvited white knight. While Iwatani and Cosmo had partnered on specific projects before, Cosmo had given no indication to Iwatani that they wanted them to become the single largest shareholder.

In March 2024, Iwatani increased its stake from 19.93% to 20.22%, which had the important effect in accounting terms of making Cosmo an equity method affiliate that would contribute significantly to Iwatani profits. As an equity method affiliate, fluctuations in Cosmo’s share price don’t impact Iwatani’s P&L. However, the current price of Y7,953 happens to be 31% above the price Iwatani paid, suggesting they got a good deal.

In April 2024, the two firms formalised the marriage by signing a capital and business alliance agreement to work together on production of green hydrogen and other areas of overlap.

Iwatani funded the Cosmo stake purchase by debt. Cosmo was very cheap, and has improved its payout ratio to 60%. The purchase should therefore be highly accretive to Iwatani, certainly in earnings terms and probably also in cash, as dividends received from Cosmo will more than cover the interest cost of the debt.

In March 2024, Iwatani announced the sale of its fancy central Tokyo headquarters building. Handover is scheduled for May 2025, and an Y11bn extraordinary profit will be booked in the FY26 year. Total proceeds should be quite a bit higher, since my understanding is that Iwatani only bought the building in the 1990s.

Financials

The excellent profit growth across all three main segments is shown in the table below, together with my estimates by segment for the next three years.

Iwatani does invest heavily across its businesses for long-term growth. This is often a negative in Japanese midcaps, if a company is making value-destroying investments over time rather than paying cash to shareholders.

In Iwatani’s case, however, I view their track record of sustained double-digit profit growth as giving them permission to reinvest. The firm is particularly renowned for their hydrogen-related investments. They receive backing from the Japanese government for this theme, including subsidies.

My chart below shows cash from operations and capex over the last 12 years.

ROE has been consistently double-digit for a decade, reaching 14% in Mar’24. ROIC of 6.7% is not especially impressive but is likely 2pp above the WACC.

Iwatani’s balance sheet is strong enough. Net debt and leverage were reduced impressively over time, both by free cash flow and by a Y30bn zero-coupon convertible bond that was issued in October 2015, an unwelcome surprise to shareholders at that time due to the 14% dilution. The CB has since been converted, and the company has more recently foresworn issuing any further equity.

Recent capex and M&A, especially the Cosmo stake purchase, have increased debt somewhat, but not to an uncomfortable level. Iwatani plans to sell down cross-shareholdings, as well as dispose of its head office building, to reduce debt.

Iwatani has 11,351 employees, with nearly half in the energy business. It is undoubtedly a large and complex group, with 163 subsidiaries plus 76 affiliates.

Iwatani is mainly a domestic story. By geography, as of Mar’23, 87% of sales were in Japan, 8% East Asia, 3% Southeast Asia and 2% RoW. Industrial Gas & Machinery accounted for the majority of the overseas revenue, as described above.

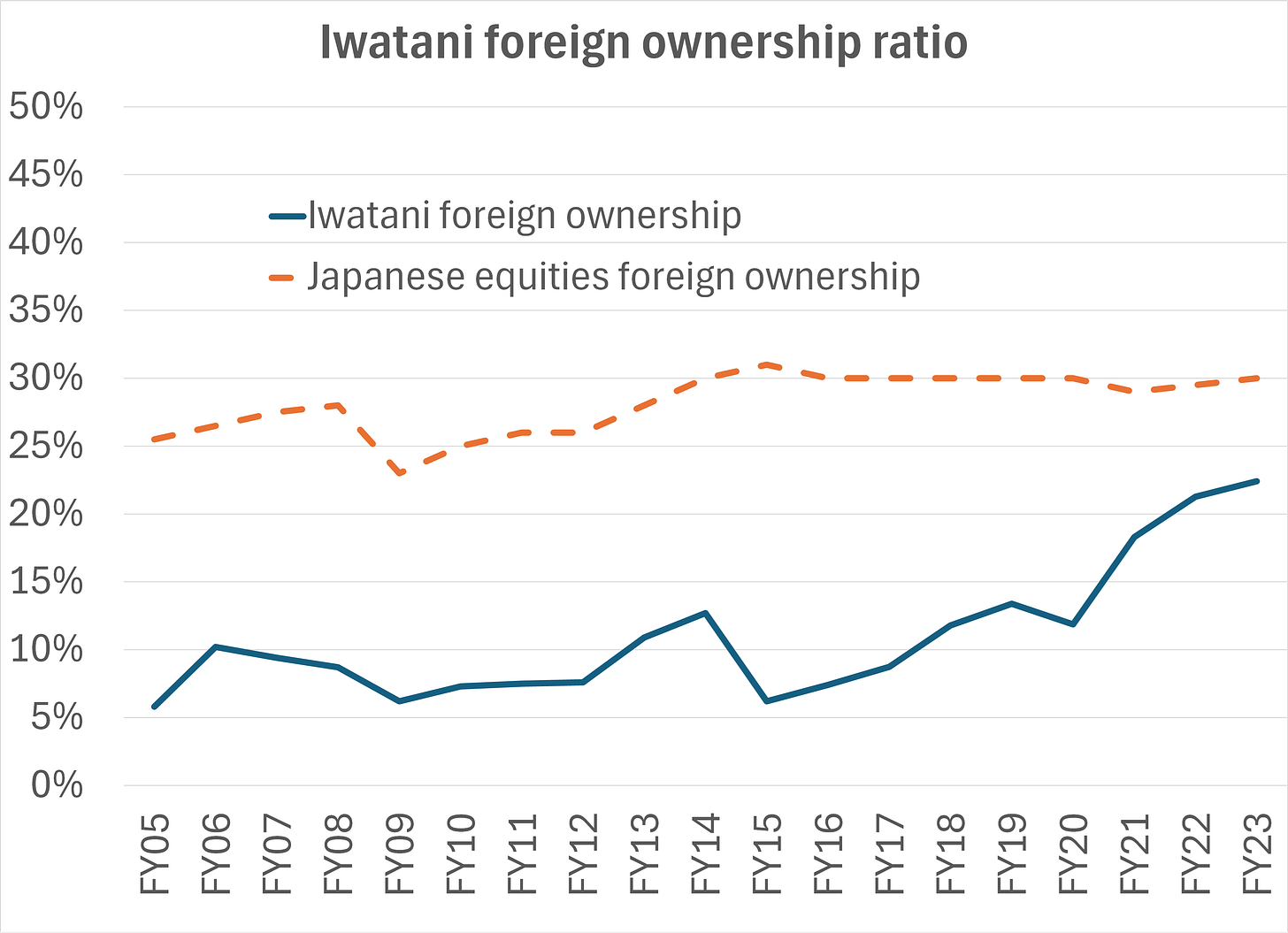

Iwatani’s foreign ownership ratio has gone from extremely low, in the single digits, to a higher level in the 20s that remains below the market average.

Estimates and valuation

I share my estimates below. Beneath the operating line, the Cosmo Energy contribution can be seen in the ‘net non-operating result’ line.

The stock is cheap. In fact it has de-rated right to the bottom of its range: see my chart below.

Historically Iwatani stock has spiked up at times of immense retail investor enthusiasm for the hydrogen theme. The last significant outbreak was in 2021, when hydrogen stocks were in fashion worldwide.

I am attracted to the low expectations that are implied by the derated share price and the lack of earnings growth forecast by consensus.

The chart below shows Iwatani’s 10 year return in context of the industrial gases peer group. Linde (LIN) is best in class, while Nippon Sanso (4091) successfully transitioned from Japanese to global and re-rated accordingly.

Iwatani performed respectably, in line with Air Liquide and Air Products, but dragged entirely by its strong earnings growth, and despite a significant de-rating.

Air Water (4088) is simply a mediocre conglomerate, with lots of non-gas businesses that are far poorer than Iwatani’s.

Thanks Alex, great idea indeed!

Any comment on any of your two Japanese ideas (Iwatani, Daiwabo) after the recent price drop?

Excelente Alex, hace unos días que estoy investigando a Iwatani y creo que puede ser una gran oportunidad, voy hacer una entrada para ir valorando la compañía más a fondo. Creo que la voy a comprar en el Tradegate, aquí el tiker seria IWA, que opinas de esta bolsa ?