Jack Henry & Associates – a core holding

(JKHY, $12.1bn market cap, $72m ADVT, 100% free float)

Jack Henry & Associates (JHA) is the smallest of the Big Three core system providers to US banks and credit unions.

It has an attractive profile of high returns (ROIC 20%) and steady growth (EPS >10%) at a valuation that is now palatable (28x P/E) after a de-rating.

Key peers Fiserv and FIS have neglected core banking as they chased after the more exciting merchant acquiring businesses. Upstart fintech rivals lacked the credibility to address JHA’s conservative customer base, and are now in retreat as funding dries up and they need to pivot to profitability.

By contrast, JHA’s dogged focus on its core business has delivered superior organic growth and steady margins, even as it invests heavily in customer service and product renewal.

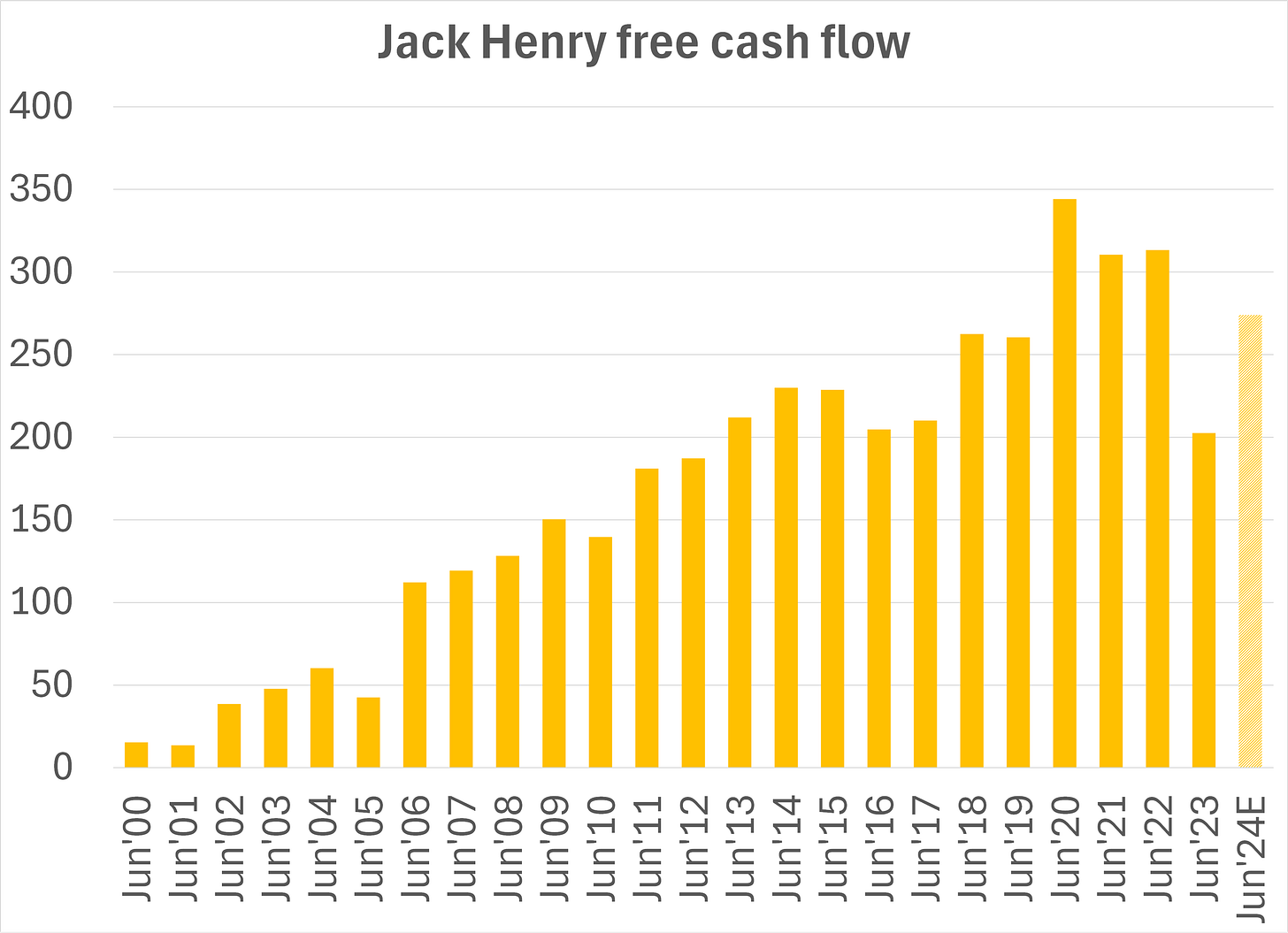

The stock has underperformed for five years as the high investment has weighed on free cash flow, amid fears that a new generation of competitors could threaten JHA’s position.

In this write-up I review JHA’s business model and competitive positioning. I argue that JHA remains highly competitive, and I see street estimates as achievable with potential upside. I intend to start a position in JHA at the current level, which I would hope to build on any weakness.

Market context

America has over 9,000 financial institutions, both banks and credit unions. This is different to the situation in Canada, where six banks account for 95% of banking assets, or indeed Sweden, the UK or Australia, all of which have rather concentrated banking markets.

Each of the many US banks and credit unions needs a core system, meaning the back-end IT system that processes transactions and updates financial accounts and records.

While the banks and credit unions are fragmented, the IT providers are concentrated. The Big Three providers are Fiserv ($88bn market cap), FIS ($42bn) and Jack Henry ($12bn). They have over 70% share by number of banks between them: see chart below.

All three main providers offer core systems with comparable functionality, as well as a long list of optional in-house and third-party modules covering digital banking, payments, anti-fraud and anti-money-laundering, commercial loans, credit cards etc. FIS and Fiserv address institutions of all sizes, while JHA focuses on smaller customers.

The current standard is to offer a hosted solution, aka private cloud. Typical contract length is seven years, or sometimes up to ten. Pricing in a hosted solution includes no upfront licence payment. There is simply a monthly fee which is generally related to the total number of accounts held at the bank. An annual price escalation clause will be included in the contract. After seven years, the bank can switch provider or seek to negotiate a renewal with a customary retention discount.

Switching cores is a notoriously painful and disruptive process that banks would prefer to avoid. Hence retention rates can be excellent at the 98-99% level. A key exception is M&A: when two banks merge and integrate then by definition one core contract is lost.

There has been a lot of M&A among US financial institutions. My chart below shows that in 1991 there were 28,100 banks and credit unions. This has fallen to 9,300 today, for an average decline of 3.4% per year. The last year or two have been quieter.

Losing a core customer to M&A is bittersweet. The exiting institution must pay off its remaining contract value in full. This is recognised by the core provider as “deconversion fee revenue” at a very high gross margin. Therefore in a given year, a high level of M&A activity leads to windfall profits.

Meanwhile, the total number of accounts in the US keeps growing, which means the overall market size has grown alongside it, despite the shrinking pool of potential customers.

Jack Henry background

JHA was founded in 1976 in Missouri by Jack Henry with a business partner called Jerry Hall. It listed in 2000 with $240m sales, 2,850 customers and 1,600 employees.

My chart below shows JHA has compounded sales at 10% for 25 years, for an impressive 10x since the pre-IPO level. Employee numbers are now >7,000 and they have c.7,500 total clients, of which c.1,700 are core customers.

JHA has remained laser-focused on providing core and complementary systems to its chosen clientele of small to medium banks and credit unions. This is in contrast to Fiserv and FIS, who both diversified into the separate merchant acquiring market in a big way, as I’ll discuss in the section below on competition.

Specifically, JHA targets institutions with under $50bn of total assets. This deliberately excludes the biggest 40-50 banks, who have complex requirements, vast internal tech departments and low pricing. At the low end, JHA also avoids targeting institutions with assets below $250m, since they have basic requirements that are better served by some specialised low-cost providers.

The upshot is that JHA claims high market shares of 23% for banks and 46% for credit unions in its chosen sweet spots: see the slide below.

JHA has a distinctive corporate culture that is devoted to highly engaged employees delivering excellent client service.

Feedback from Third Bridge and Tegus transcripts suggests that JHA is indeed regarded as offering superior service than Fiserv and FIS. Examples include

· communication and a willingness to answer the phone and visit clients;

· rapid trouble-shooting of any problems that arise;

· following through on commitments such as additional features to schedule;

· ensuring smooth integration of customers’ chosen third-party modules.

These may sound basic, but they serve as differentiators which help to explain JHA’s above-average organic growth and gradual market share gains over time.

Competitors

My key task in this post is to survey JHA’s actual and potential competitors. Nobody else is taking JHA’s path, which I find encouraging.

Fiserv

Fiserv’s January 2019 merger with First Data was a bold move that has paid off handsomely. First Data is a globally scaled payments and merchant acquiring business that has struck gold with its Clover cloud-based point-of-sale solution, among other fast-growing hit products.

First Data’s CEO Frank Bisignano has become CEO of the combined group, despite having been the underdog at the time of merger.

All this means that Fiserv’s core banking software business has taken a back seat in terms of focus. Its role within the group is to generate as much cash as possible to pay down debt and fund payments growth.

Fiserv’s banking software is reported in a segment that was called Financial until 2019. After a change in segment definitions post merger, it is now reported in the Fintech segment. My chart below shows a sales CAGR of just 1.6% over the last 17 years, way below JHA’s growth rate.

The segment profit margin has grown impressively throughout this period and has reached 37%. That is not an apples-to-apples figure compared to JHA, given central costs. Nonetheless, Fiserv is clearly taking a different approach of running the banking software business for profits and free cash flow rather than growth.

It is interesting to note that Fiserv continues to provide JHA with card processing services under a successful white label agreement that was signed with First Data in 2017. This is just one example of a ‘frenemies’ or ‘co-opetition’ dynamic between the various banking systems peers, who provide each other with various modules or services while also competing for new customers in RFPs.

FIS

FIS panicked and copied Fiserv by buying Worldpay later in 2019 for $43bn. This was a complete disaster, as the FT documents well. Worldpay turned out to be a mess of dysfunctional acquisitions which fell apart during Covid when it lacked the agility to help its clients.

Even worse, Worldpay wanted to grow by helping merchants issue credit cards, thus competing against FIS’s core customers on the banking software side.

FIS mirrored Fiserv in promoting a former Worldpay executive to run the combined group. Stephanie Ferris became FIS CEO in December 2022. Awkwardly, her first duty was to unwind the deal by jettisoning Worldpay, which has now been deconsolidated via a sale of 55% to a PE firm.

FIS’s core banking business has been dull during this period. My chart below shows a CAGR of 3.3% over the six years that the Banking Solutions segment has been reported.

The $6.7bn segment total revenue includes Payments and Wealth & Retirement solutions that are not directly comparable to JHA’s offerings. The most comparable part is 40% of the segment total and has been growing at just 2% per annum, as per the slide below from FIS’s 2024 investor day.

A segment adjusted EBITDA margin of as high as 44% is not especially meaningful, given the large adjusting items that result in FIS having a lower GAAP operating margin than JHA.

Post Worldpay deconsolidation, FIS may now return its focus to core banking software and try to improve its performance there.

CSI

CSI is JHA’s smallest core competitor. The #4 player in US core banking software, and with a special focus on the tiniest community banks, CSI was listed until 2022 when Centerbridge and Bridgeport private equity acquired it for $1.6bn. Then in Jan’24 TA Associates co-invested in order to accelerate CSI’s growth.

As my chart below shows, CSI was a better-than-average 5.9% grower and a market share gainer in the decade prior to acquisition. Its profit margin was in the same 20-25% range as JHA.

CSI remains small, but in the long run it could grow to be a competitive threat to JHA if its new owners invest to take it into the higher tiers by customer size.

Digital banking competitors: Q2, Alkami, NCR Voyix

These three listed companies do not offer full banking cores, but all three are competitors to JHA in the online banking module category.

Q2 ($3.5bn market cap) and Alkami ($2.7bn) both position themselves as fancy newbuild fintech companies that invested heavily in shiny new product offerings. (Q2 was actually founded way back in 2004 which makes it ancient in fintech terms.)

Their well-timed IPOs now look busted, and both are forced to pivot to profitability.

NCR Voyix ($1.8bn) is the resulting stock after the spin of the NCR Atleos ATM business. Alongside retail self-checkouts and restaurant POS software, NCR has the Digital Insight business that it acquired in 2014 for $1.65bn from Thoma Bravo / Intuit.

JHA competes in the online banking category with its Banno app. In an example of its patient and long-term approach, JHA acquired Banno back in 2014 when it recognised that its previous NetTeller solution was outdated. JHA then spent many years investing in and developing the Banno product, before fully launching it in about 2018 to their core clients. They have now penetrated 800 of their 1,700 core clients, with 11m Banno users.

A next step for JHA is to offer Banno more widely to non core customers. They plan to do so by the end of this year. Another expansion is Banno Business, extending the product from retail to business customers.

Clean sheet core offerings: Mambu, Thought Machine, 10x, Temenos

These potentially scary competitors are often discussed, but have so far made virtually no impact in JHA’s market of small-to-midsized US institutions.

What unites these companies is modern core technologies, and reference customers internationally or with US megabanks. E.g. Thought Machine works closely with JPMorgan. Mambu has a number of international clients. 10x focuses on UK and Australia. Temenos announced a couple of recent US wins, after its failed $500m acquisition of Kony in 2019.

JHA, Fiserv and FIS are responding to these threats by overhauling their own core systems to bring them into the public cloud age. The next-generation product is to be a modular and open design that is far more customer-friendly in terms of frequent updates and upgrades. It is supposed to be easier than ever to configure best-of-breed vendors for specific modules alongside the proprietary core. The slide below illustrates the concept.

Behind the scenes, the benefits to JHA will include an end to hosting their own private data centres, and the ability to leave behind outdated coding languages, with the hiring and talent headaches they entail.

The chart below shows JHA’s jump in total R&D spending in recent years, to reach an amazing 15% of sales. This reflects the total cost of the technology modernization program, which is expected to last ten years from 2021 when it was first announced. That comes on top of heavy business-as-usual investment into priority products such as the Banno digital solutions, financial crimes technology and JHA’s bank payments capabilities.

Jack Henry estimates and valuation

JHA has admirably clean financials, with no dubious adjustments to GAAP. Cash generation is strong, even after the high reinvestment into capitalised R&D: see chart below.

I take a positive view of JHA’s prospects for continued upper single digit revenue growth, and potential for higher margin expansion than the current cautious guide. JHA’s high level of spending on product development and customer service should continue to drive the top line, and also provide levers to manage margin if needed.

My estimates, below, are modestly ahead of consensus by 7% for the June 2026E year. The resulting valuation of 24.7x is attractive, in my view, given the defensive qualities of Jack Henry.

The stock got overbid in 2021, in common with many technology stocks. My chart below shows the re-rating and de-rating journey that JHA has been on over the last decade.

Relative performance vs the benchmark has mainly followed the changes in multiple seen above. Estimates have also disappointed slightly of late, with a single-digit downgrade to consensus last August.

Annex – management and culture

I discussed above the positive aspects of JHA’s distinctive culture. Leadership has been characterised by continuity, with long tenures and mainly internal promotions over time.

Michael Henry, the son of the eponymous founder, was CEO from 1994 until 2004, after joining his father in the business in 1979.

Jack Prim was CEO from 2004 to 2016, after joining a predecessor of the firm in 1985 and JHA proper in 1995 by acquisition.

David Foss was CEO from 2016 to 2024, after joining the firm in 1999.

New CEO-designate Greg Adelson joined the firm in 2011. Strategic continuity is promised.

Management are incentivised on organic revenue growth and EBIT margins.

There is an argument to be made that the culture is a bit too cult-like. Perhaps costs could use some closer scrutiny.

For example, it is a matter of pride that there has never been a headcount reduction at JHA. Instead, every few years they hold a voluntary early retirement program. The most recent iteration saw 160 eligible employees choose to depart at a $17.5m cost, or an average cost of $109k per head.

Thanks for the write-up!

I worked in digital banking at a Hong Kong bank (using Temenos). Anything the bank wanted to do had to adapt to the core banking software. Asking for a change in the core banking system was impossible. The bank could fire 50% of the staff and everything would be fine, but they won't be able to replace the core banking software.

A lot of bargaining power as a core banking system vendor.

Thank you for a nice deep dive!