Kobe Bussan runs Gyomu Super, a chain of hard discount supermarkets that can be described as the Aldi of Japan.

I regard Kobe Bussan as one of the longer-dated and lower-risk compounders available worldwide. The front-year multiple is not low at 35x P/E, but the stock is a solid bet to double earnings every six years or so for decades to come.

The timing looks favourable to start a position, because inflationary pressures have weighed on the margin for the last two years. I am more bullish than consensus on the potential for margins to resume their long-term upward trajectory, driven by structural factors of scale economies and rising mix of exclusive private label items at high gross margins.

In this write-up I cover the following.

· Hard discounter philosophy

· Gyomu Super business model

· Competitor review

· History and track record

· Financial profile

· Forecasts and valuation

· Risks

· Annex 1: the franchise system

· Annex 2: in-house production of private label items

Disclosure: I own both Kobe Bussan and its top franchise partner G-7. As always, I welcome any feedback, especially on bear points I may have missed.

Hard discounters

The hard discount model in food retail is exemplified by Aldi and Lidl, two privately held German firms that have expanded over fifty years across Europe, Australia and the US. The key characteristics are the following.

· Hard discounters offer a limited assortment of food products at the lowest possible prices. Everyday low pricing (EDLP) is favoured over a high-low promotional pricing model.

· Exclusive private label products typically account for 70-80% of total sales. In each category, the aim is to match the leading brand on quality, while undercutting it dramatically on price.

· Stores are set up to minimise costs, with a small footprint to save on rent, and a highly efficient operating model to save on labour costs.

· Advertising spend is low, but hard discounters earn positive PR and word-of-mouth as journalists and citizens love to discuss the amazingly low prices. (Aldi credited such press coverage in the 2008 financial crisis for turbocharging its UK sales and market share.)

· Hard discounters appeal not only to low-income customers (who need to save money) but also to middle-income and wealthy shoppers (who know it is smart to save money). As Jan-Benedict Steenkamp wrote in a great 2009 HBR magazine article on hard discounters,

In Germany, for example, hard discounters own 43% of the market in the lowest income quartile and 34% in the highest. These wealthy consumers patronize hard-discount stores not because they have to but because they want to. Germans characterize this as “Ich bin doch nicht blöd” (“I am not stupid”).

Full-service supermarket operators have found it difficult to resist the appeal of the hard discounters, who have gained market share steadily over decades in each country they have entered.

Gyomu Super business model

Gyomu Super fully meets the above definition of a hard discounter, in my view. Further, I argue in the competitor section that Gyomu Super is the only hard discounter in Japan operating at any scale. These facts underpin the investment case for Kobe Bussan, since the rewards available to a successful and dominant hard discounter are huge.

All customers are welcome. The Gyomu Super name means ‘business supermarket’ to suggest wholesale prices. However, general customers have been welcomed since the start, and make up 80-90% of sales today.

Store size is small. According to the pitch to potential franchisees, Gyomu Super typical store sizes are small at 150-220 tsubo total, and 120-170 tsubo sales floor area. Translating to square feet, at midpoint we have 6,600 sq ft total size and 5,200 sq ft sales floor area – seriously small stores even compared to Aldi and Lidl, which often trade from 10k-12k sq ft stores.

Product range is limited. An excellent newspaper profile quotes 2,500 core SKUs in a Gyomu Super store, compared to 30,000 in nearby full-service supermarkets.

Costs are kept low in-store by stacking stock on the shop floor in cardboard cartons rather than unpacking items onto shelves. The freezers are uniquely designed to hold a lot of stock with minimal labour requirements. Store appearance is hectic and shabby, but the low prices and high product quality more than compensate.

Private label is a key advantage – and is far higher than the street understands. By Kobe Bussan’s definition, c.35% of total sales are private label products, including 11% produced in its own factories, and 24% directly imported from overseas (e.g. chocolate from Belgium, tinned tomatoes and pasta from Italy, etc). The long-term trend as defined by Kobe Bussan is in the chart below. (The recent levelling-off is explained by national brand price hikes, passed on by Kobe Bussan, which meant that sales of both categories rose equally fast.)

At first glance, the 35% private label ratio is puzzlingly low, compared to the 70-80% at Aldi and Lidl. However, the true ratio of private label products is far higher. The 35% refers only to the most differentiated products that are exclusive to Kobe Bussan. The other 65% of products, purchased from domestic suppliers, includes an even split of famous brand and “OEM” products – with the latter meeting the normal definition of private label used by other supermarkets. Therefore on a comparative basis, the true private label ratio would be 65-70% of total sales. (My source for the above is Arashi Nishizawa’s 2021 initiation report for BofA Global Research. Other sellside research fails to mention this.)

Gyomu gains hugely from free publicity as television and newspapers frequently marvel at the low prices and surprising exclusive products. Youtubers specialise in highlighting the best buys. Foreigners recommend newcomers to shop at Gyomu in the Japan Life subreddit. Gyomu has particularly done well when the consumption tax was hiked and when recession hit, prompting consumers to find new ways to save money.

Gyomu Super diverges from Aldi and Lidl’s model in two key respects.

1) A franchise system allows for rapid and capital-efficient store growth by partnering with around 100 franchisee store operators.

2) Kobe Bussan owns food processing factories in Japan and in China, enabling it to develop and sell unique and exclusive products at the lowest possible cost. This vertical integration is counter-intuitive but contributes significantly to Gyomu’s differentiation and appeal, and also to profits.

I provide further detail on both these strategies in two annexes.

How big can Gyomu Super get?

Gyomu Super today has a low market share of just 3.5% among supermarkets, or 1.2% of all food retail when allowing for food sold in convenience stores, drugstores and general merchandise retailers as well. (Source: Kobe Bussan’s Y447bn of sales to franchisees equates to c.Y525bn of retail sales after franchisees’ markup. The market sizes are in this USDA report sourced from METI.) By comparison, Aldi and Lidl have reached market shares of 10% to 20% in many other markets such as Germany, Australia and the UK.

Saturation is a potential concern for Kobe Bussan investors. Today there are 1,050 stores. The company has announced a target of “over 1,500 stores” – see slide below from their mid-term plan. This allows for a decade of growth at my estimated c.4% rollout rate.

I would argue there is continued scope for expansion to 2,000 stores, based on the far higher market shares achieved by Aldi and Lidl in Germany, the UK and many other markets they have entered. That would provide visibility to 2040 and beyond.

In regional terms, Gyomu Super has a nationwide presence across Japan, but with a far higher concentration of stores in its home region of Kansai, where it continues to trade successfully. Both Kanto and Kyushu have lower numbers of Gyomu Super stores per person, and ample room to open new stores.

Competitive landscape

Food retail in Japan is highly fragmented, with hundreds of national, regional and local operators. Many claim to be discounters of various types. Most have failed to achieve any great scale or success. I profile several of the notable rivals briefly below.

Costco is a relevant competitor. The ultra-low prices, differentiated private label products and strong execution capabilities are similar to Gyomu Super. The obvious differences are the huge store sizes and annual membership fee. Costco has 33 warehouses in Japan, up from 26 in 2018, and the company has announced a target of 60 stores by 2030. In urban areas, Costco is likely to make limited impact given tiny housing size, low car usage and limited land availability. Costco’s revenue in Japan is estimated at Y500-600bn, giving it the same scale as Gyomu Super.

JM Holdings (3539 JP) is a $481m mkt cap supermarket operator with 54 stores in the Niku no Hanamasa cash-and-carry format. These stores look and feel pretty similar to Gyomu Super, with imported and private brand items and impressively low prices. However, the small number of stores and the focus on the 23 wards of central Tokyo means a low overlap. Store growth has been minimal in the Hanamasa format – instead they are expanding in other formats that emphasise fresh meat (JM stands for Japan Meat). JM has a decent financial profile and might be an interesting small cap investment idea in its own right, but it does not look like a relevant threat to Gyomu Super.

OK is a chain of 144 larger-format discount supermarkets located in and around Tokyo. The stock is not listed, but the financial information on their website suggests decent growth and profitability. Revenue in FY23 was Y552bn, the same scale as Gyomu. Not a hard discounter.

Daikokuten Bussan (2791 JP) is a $917m mkt cap discount supermarket operator with 206 stores under the LAMU and DIO names. The financial profile has shown brisk topline growth but limited profitability.

Direx is a regional discount food retailer owned by Sundrug (9989 JP), a $3.8bn drugstore and pharmacy operator. Direx has 364 stores. Historically based in Kyushu and west Japan, Sundrug has announced an ambitious plan to roll out Direx nationwide, with a target of 1,500 stores. Direx carries 25k SKUs so is not a limited assortment hard discounter. It is profitable and fast-growing, so worth watching closely.

A-PRICE is a 94-store discounter chain owned by Toho (8142 JP), a $202m mkt cap wholesaler with a weak track record. A-PRICE makes up just 18% of Toho sales, and appears to focus on restaurant customers. It has failed to catch the general public’s imagination in the way Gyomu Super has managed. Growth has been non-existent.

Big-A is a 341 store self-proclaimed hard discount chain that was directly acquired by retail giant Aeon in February 2019 from their affiliate Daiei. The logo is amusingly similar to Aldi’s. Limited information is available on Big-A, but it appears to be positioned as a convenience store with 24-hour operations. It is not significant enough to merit any mention in Aeon’s financial reporting. Aeon’s overall ‘Discount Store’ segment has 584 stores in Japan, and has reported poor results with low profitability, led by Aeon Big, a soft discounter with 122 large-format stores.

History and track record

Kobe Bussan’s founder was Shoji Numata (born in 1954). He served as president until 2012, since when his son Hirokazu Numata (born in 1980) has led the business. The Numata family’s charitable foundation is the controlling shareholder with a 32% stake.

For a deep-dive into the history of Kobe Bussan and the origin story of Gyomu Super, I recommend this 2018 interview note, in which father and son both tell their story. They cite Uniqlo and Muji as key inspirations for their vertical integration of manufacturing and exclusive product sourcing with retailing. McDonalds is cited as the key inspiration for the capital-efficient franchise model, allowing rapid unit growth to achieve all-important scale.

The brief chronology is as follows.

· In 1981 Numata-san opened his first supermarket, and also launched a trading business exporting foods to the US and Europe.

· In 1992 he opened his own food factory in China, producing wasabi and pickled plums at low cost, to be sold in his Japanese supermarket and for export to the west.

· With retailing, imports and manufacturing, all the elements were in place for the unique Gyomu Super business model.

· In 2000 Numata-san franchised the first Gyomu Super store.

· In 2006 the store count reached 400 stores, and Kobe Bussan held its initial public offering.

New stores have been added steadily ever since, reaching 1,048 in 2023. That gives a 6.1% store count CAGR over the last 18 years: see chart below.

Same store sales growth has been strong in the context of deflationary Japan. Kobe Bussan’s average Gyomu sales per store has grown by 3.2% per year across the whole 18 year period, massively superior to rivals. See chart below.

Thanks to Gyomu Super’s outstanding same store sales growth and new store openings, Kobe Bussan has compounded at 10.5% sales growth and 16.6% OP growth over the 18 years from 2005 to 2023, as shown below.

Financial profile

In summary, Kobe Bussan enjoys a profitable and efficient business model, with low working capital and capex needs. This drives good free cash conversion and wonderful returns on capital employed. Capital allocation could be better.

Profitability has been improving with scale. The operating profit margin has reached around 7% at group level, as in my chart below. The company targets a 10% OPM in future.

Without wanting to get too far into the weeds, I note that the tiny non-Gyomu activities have had a distorting effect on the historic group profit margins. This was especially the case from FY13 to FY20, when Kobe Bussan consolidated ‘Cook Innoventure’ and its separately listed restaurant subsidiary under the name Yakiniku Sakai and ticker 2694 JP. Kobe Bussan only ever had a minority stake in YS, and it walked away from the business from April 2020.

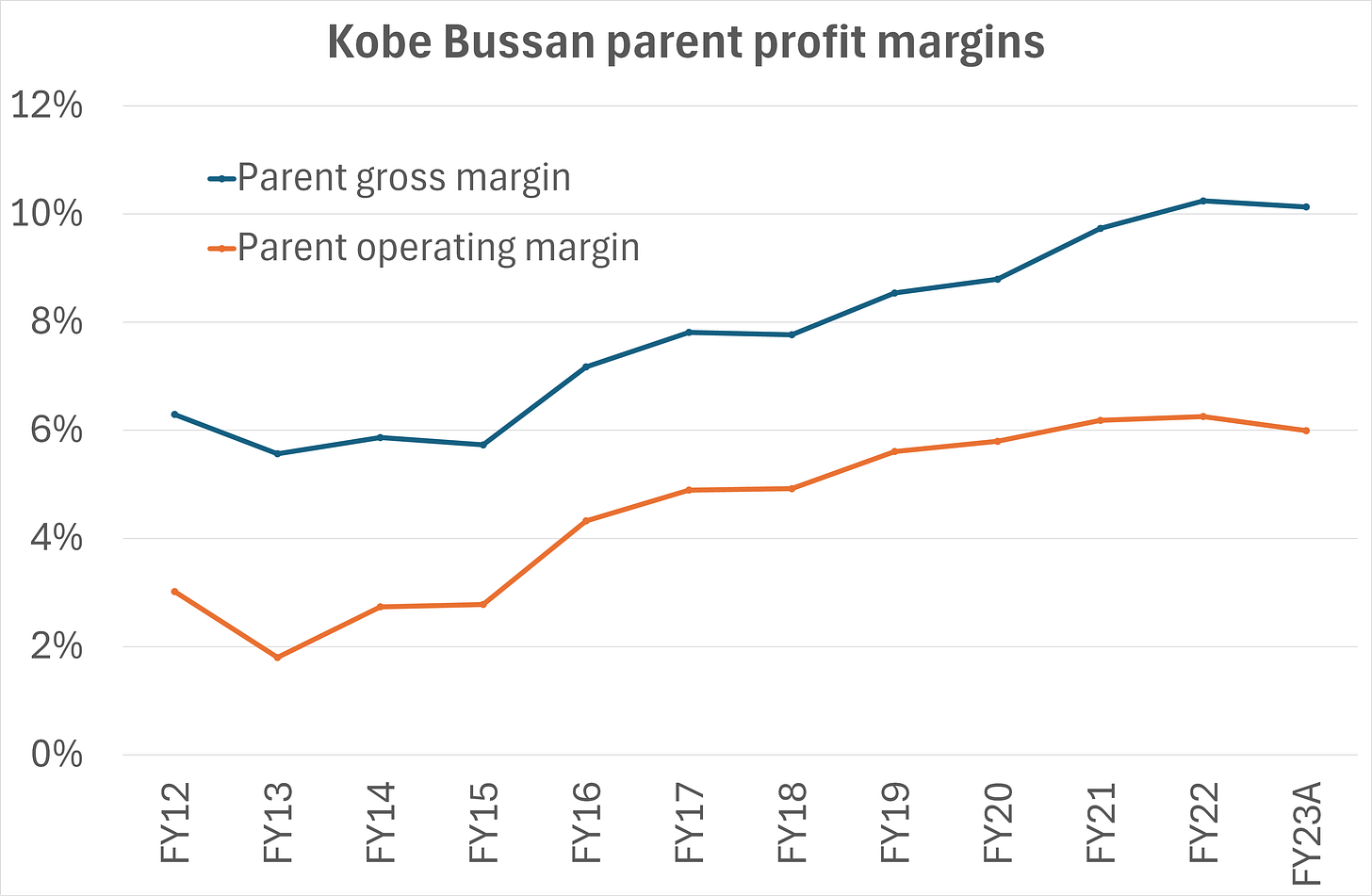

A cleaner picture of the key Gyomu Super economics is seen in the parent financials. My chart below shows that Kobe Bussan’s parent gross profit margin and operating profit margin have both expanded steadily from FY12 to FY23, by around 35bp per year.

Private brands and scale are the key driver of this impressive margin expansion. Specifically, Kobe Bussan’s gross profit margin is 10.1% at parent level, which reflects the Gyomu Super business alone. The company has briefed sellside analysts and investors that the c.65% of national brand / OEM products are sold to franchisees at just 1-2% gross profit margin, to allow them to be retailed at highly competitive prices. Meanwhile, the 11% of in-house manufactured items are sold at a c.15% gross margin, while directly imported items earn a c.20-25% gross margin. (And the small franchise royalty fees have a 100% gross margin.) Therefore, higher private label mix and increased scale economies both drive the group margin higher over time.

In the short term, the group operating profit margin peaked in the FY21 year at 7.5%, and fell back to 6.6% in FY23. Not coincidentally, the stock has marked time over this period since its September 2021 peak. Yen weakness and Kobe Bussan’s caution in passing on inflationary cost increases in full have both dragged on margins in the last couple of years. I expect these factors to reverse, and for Kobe Bussan to be able to continue to increase its operating profit margin towards the 10% target level in the coming years. Consensus expects only a modest margin rebound to 7.2% by FY25, so there is potential for positive surprise.

The net working capital to sales ratio is low at 3%, which means that rapid growth in the Gyomu business does not put a strain on cash flow.

Kobe Bussan’s strong growth is self-funded, with positive free cash flow in nine of the last ten years even after capex and M&A. It clearly helps that store-related capex falls on the franchisee partners under the franchise system. See chart below.

Return on capital employed is extremely high at around 50% — see my chart below. (Note this calculation deducts the net cash pile from the denominator. Returns would look less impressive, but still satisfactory, if penalising Kobe Bussan for the cash.)

There is certainly room for improvement in capital allocation. Kobe Bussan has invested Y39bn of capex into its less attractive restaurant and renewable energy businesses over the last ten years. These businesses account for just 3% of sales. They are profitable but yield a low return on invested capital.

Even worse are the faddish failed ventures. Don’t ask about the Oita hot springs tourism park, the New York restaurant and hotel venture or the California expansion of Gyomu Super. None worked out well. However! It is arguably the sign of a good management team that they attempted new ventures and also knew when to cut their losses, without harming the strong core business.

My chart below shows that less than half of total capex has been allocated to the Gyomu Super segment over the last ten years. Officially, Kobe Bussan intend to invest more than Y10bn per year in capex and M&A for food plants to support private brand manufacturing, but in reality the pace of investment is likely to be slower.

In addition, like many Japanese businesses, Kobe Bussan is allowing excess cash to pile up on the balance sheet without a clear plan to pay this out to shareholders – see chart below. The 24% dividend payout ratio is too low.

Overall, while stricter capital allocation discipline would be ideal, the key fact has been the huge success of the core Gyomu Super business. Its profitable growth has driven a tremendous stock performance in the last decade. I expect this to continue.

Forecasts and valuation

I forecast Kobe Bussan and its franchisee partners to grow the store count by c.4% per year, and to sustain excellent same-store sales growth of c.5% per year, which drives my 9% top-line growth forecast.

As discussed above, profit margins have grown steadily over the longer term, but have compressed in the last two years. I forecast a return to margin progress as the yen and inflationary cost shocks fade. The first quarter result for the three months to January 2024 was encouraging, with a recovery to 7.1% OPM. On a trailing 12 month basis the OPM bottomed in April 2023.

My estimates are shown below. I forecast a 15% EPS CAGR from FY23-28E. This puts the stock on an attractively low valuation of 21x P/E or 12x EV/EBIT towards the end of the forecast period.

Historically, Kobe Bussan traded at a low P/E multiple back in 2018, when the market cap was below $2bn and the stock had not been “discovered” by global growth investors. Then from 2020 to date the stock has been well and truly discovered, and has traded at a high front-year multiple of 30-50x P/E. (See representative discussions in investor letters by Artisan, BLI and Wilson.)

Today’s multiple of 35x current-year P/E is in the middle of the recent range. See my chart below.

In conclusion, I find the risk-reward attractive, given the predictable and counter-cyclical growth profile. As mentioned above, I own both Kobe Bussan and the top franchise partner G-7, which enjoys broadly similar exposure to the Gyomu Super long-term growth story at a far lower valuation.

Risks

How could I most likely be wrong?

A halt in new store openings by franchisees would be a problem. From Kobe Bussan’s excellent monthly disclosures, we can see that only a net four new stores have been opened in the first four months of the current fiscal year, behind pace compared to the 35 store target. In fact net store additions show a declining trend: 71 in FY21, 57 in FY22, 41 in FY23 and a target of 35 in FY24 which looks in jeopardy.

Store franchisees took a hit to their profit margins due to recent operating cost inflation (utilities and wages), as well as due to Kobe Bussan’s dedication to keeping prices low. Build costs have also risen in Japan.

Nonetheless, based on the plans of the listed franchisees G-7 and Ocean System (see more detail in Annex 1), and the favourable long-term experience of the franchisees, I expect continued franchisee appetite to open new stores at a satisfactory rate. Any re-acceleration in monthly new store openings from the current sluggish rate would serve as a positive catalyst.

Saturation or increased competition are other possible risks that the street might fear. I am bullish on these points, given Gyomu Super’s enduring competitive advantage, still-low market share, and the positive examples of sustained hard discounter success from Aldi and Lidl in various countries.

A food safety scandal and/or a corporate governance scandal are black swan events that can always strike in Japan. Back in February 2016 Kobe Bussan already suffered a scandal when an investigation was launched into suspected insider trading by executives. There were no negative findings or ramifications, but the stock took a nasty hit at the time.

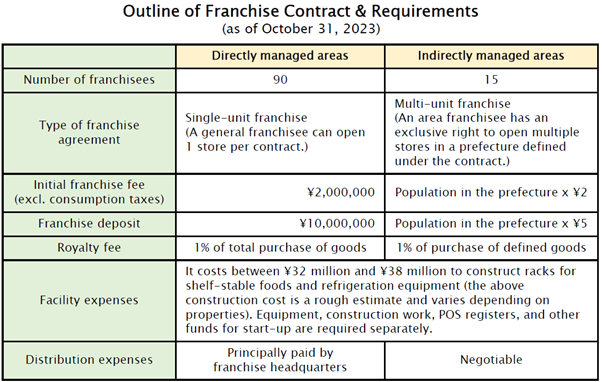

Annex 1. Franchise concept in detail.

Kobe Bussan operates only four stores directly. Virtually all the stores are operated by corporate franchise partners. Kobe Bussan supplies the range of merchandise to the franchisee at a wholesale price, including the various frozen and ambient ranges, across private label and selected national brands.

The table below spells out the various fees payable within the franchise contract, such as a Y2m initial franchise fee and 1% royalty levied on all goods purchased. These specified fees are deliberately kept de minimis. Instead, Kobe Bussan earns its profit via a wholesale margin on the goods sold to franchisees.

Specifically, Kobe Bussan’s gross profit margin is 10.1% at parent level, which reflects the Gyomu Super business alone. The company has made it known that the c.65% of national brand / OEM products are sold to franchisees at just 1-2% gross profit margin, to be sold at highly competitive prices. Meanwhile, the 11% of in-house manufactured items are sold at a c.15% gross margin, while directly imported items earn a c.20-25% gross margin.

The franchisee retails the goods at an agreed markup, calculated to provide a c.17% gross profit margin. This must cover all store operating costs (including rent, labour and utilities). Franchisees can earn an operating profit margin of 2-5% from their Gyomu stores, depending on their scale and efficiency. See the table below from Kobe Bussan’s presentation, providing a simulated franchisee P&L.

The franchise system adds a complication to the Kobe Bussan investment case. The advantages are that it can focus on its strengths of purchasing and own product development, while outsourcing the hard work of efficient store operations to retail partners. It also means that store growth is not constrained by Kobe Bussan’s own balance sheet.

The franchise relationship needs to be a win-win for both partners to ensure long-term sustainability. This is certainly the attitude that Kobe Bussan takes: they deliberately designed the franchise agreement to be attractive and flexible for partners, with the low royalty rate and freedom to sell other items in the stores, such as fresh meat and produce, sourced from third parties.

Fortunately, we don’t have to take Kobe Bussan’s word for it that this is the case. We have over twenty years of evidence from the two biggest franchisee partners, both listed smallcaps in Japan who have prospered mightily from their relationships with Kobe Bussan.

G-7 (7508 JP) is a $423m market cap retailer that operates 189 Gyomu Super stores, making it the single biggest franchisee. Gyomu-related business accounts for 65% of total sales at G-7. (The other main business is operation of Autobacs 7 franchise auto service stores, nicely profitable in its own right but without much growth.)

G-7’s head office is just a 30 minute drive from Kobe Bussan’s head office in the outskirts of Kobe City. The two firms have been partners for over twenty years, with G-7 having been the biggest Gyomu Super franchisee ever since 2002.

G-7 has enjoyed outstanding long-term sales and profit growth from its Gyomu Super business, and also earns an above-average return on capital employed compared to other Japanese retailers. Recently, G-7 has achieved a 4.3% segment profit margin on its Gyomu Super business, higher than the 2.1% benchmark level suggested by Kobe Bussan’s simulation. See my chart below for the long-term track record of profitable growth.

Ocean System (3096 JP) is a $70m microcap retailer that operates 111 Gyomu Super stores, making it the second-biggest franchise partner. It derives 51% of group sales from Gyomu Super, earning a 2.6% segment profit margin, similar to Kobe Bussan’s simulation. Gyomu is green in the sales mix chart below – its growth is obvious compared to Ocean System’s other businesses which are stagnant, as is typical for Japanese smallcaps.

Annex 2. Manufacturing footprint and private label product examples.

Kobe Bussan owns 25 food processing factories in Japan, including their own poultry farm and bakery. Ten of these were existing factories that Kobe Bussan acquired between 2008 and 2015 from distressed food producers. Kobe Bussan was able to repurpose the equipment to make innovative and popular products in high volume and at low cost. A famous example is converting a dairy line to produce chilled puddings in milk cartons. (The caramel pudding is shown in the picture below.)

Part of the commitment to low cost is low waste. For this reason, Kobe Bussan emphasises frozen and long-lived ambient products in its range. As mentioned above, franchisees are welcome to stock fresh meat, fruit and vegetables in the stores to provide their customers with a complete offer, but Kobe Bussan does not get involved in supplying those items due to the high risk of wastage and discounting.

Very informative article, learned a lot about the company and the industry as a whole.

One question I had is that you mentioned their market share is 3.5%, and 1.2% if we include food retail from convenience stores/similar. Taking market share is easy when there are no restrictions on scale. i.e. Make an online product that is superior to the rest and switching costs are low. The thing that limits market share expansion in grocery stores is opening new stores. You don't want to open up side by side to a competitor.

Are there any metrics like population/grocery store or population/(grocerystore and convenience store) that tell us which cities have more store expansion potential. Because if all the cities are completely saturated with enough grocery stores, how will Kobe Bussan continue to grab market share?

Other questions:

-do they have any loyalty program with points

-do they have an app where ppl can see deals

-Do the food delivery apps offer grocery pickup at Kobe Bussan locations?

Thanks for the great research. I hold Kobe Busssan shares and I randomly walked into a Trial (141A.T) Mega Center yesterday at Utsunomiya and was supprised to see many of the products are quite competitive in price and quality.

I wonder if anyone reading this article have any insights on Trial.