Rational make combi steamer ovens for use in professional kitchens. And that’s just about it.

They have taken their philosophy of specialisation to an absurd – and profitable – extreme.

They invented the combi-steamer in 1976. Since then, they’ve shipped 1.2m units worldwide, all made in their Bavarian factory.

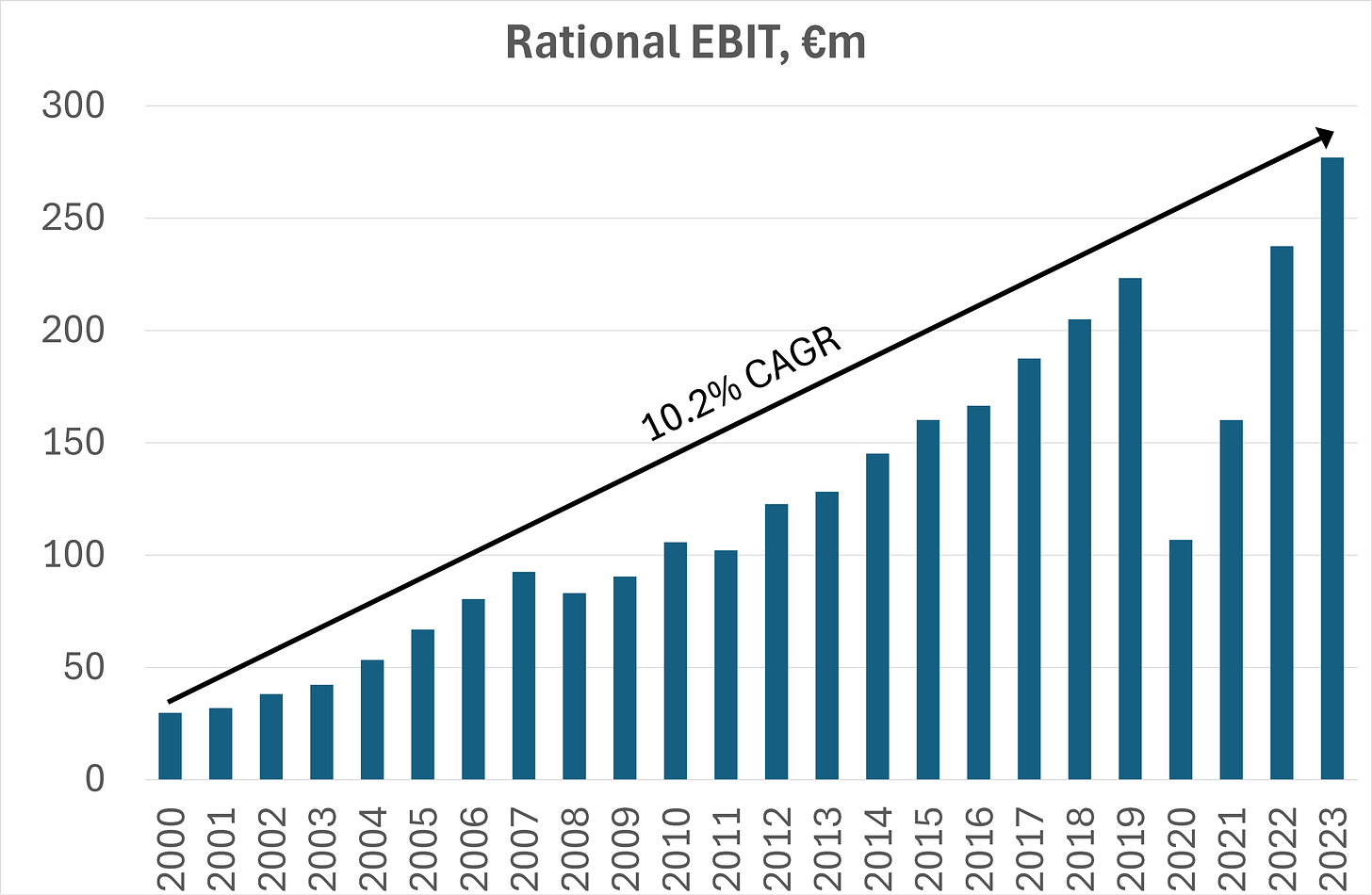

It’s a penetration story that has been playing out over decades. Rational has delivered a purely organic profit CAGR of 10% over the 24 years since IPO.

Today Rational is a $10bn stock. It trades at a rich 38x forward P/E, reflecting the impeccable track record and pureplay status.

Is it a good name to buy and hold from here? The answer depends on what growth rate they can sustain for the next five years. Continued 9-10% growth or better would likely give a very nice IRR. But any hint of saturation and slowdown would be punished harshly.

In this post I cover the following.

· I review the regional, product and market factors that explain the stellar growth performance to date.

· I highlight Rational’s key competitive advantages, instilled by the late founder Siegfried Meister.

· I drill deep into the competitor analysis to see if anyone is coming for Rational’s crown.

Ultimately I stay on the fence. They will probably be fine, but the valuation leaves little room for error. With an ambitious Italian competitor, and some uncertainty about management and execution in the post-founder phase, this is a stock I don’t feel compelled to own right now. I will monitor it for a more attractive entry point.

Feedback is welcome in either direction. What would be the red flags that could actively make this a short candidate?

Background

Siegfried Meister founded Rational in 1973, initially making convection ovens. The location was Landsberg am Lech, a small town in Bavaria.

In 1976 he invented the combi steamer, an oven that uses both convection and steam to heat.

“His mother's duck dish […] was so delicious mainly because it was repeatedly basted with the gravy. That’s exactly what he wanted to implement in a cooking system. The result was the invention of the combi-steamer in 1976, which combined hot air and steam, essential for humidity, which could boil, fry, steam and grill.”

The new device had clear benefits for professional chefs and owners. It could save time, labour, energy and kitchen space, while also producing tastier food with greater consistency.

The chart below shows the enormous sales and profit success that followed.

Why did Rational win?

While Rational claims to have invented the combi steamer in 1976, the truth is that a number of rival makers sprang up near simultaneously. It was an idea whose time had come.

However, only Rational went on to become a >€1bn revenue behemoth, while the others lagged behind and eventually stalled out at below €100m of sales.

Mr Meister was evidently a brilliant and hard-driving entrepreneur. His ideas and methods made the difference.

His death in July 2017 at age 78 was a great loss to Rational. As supervisory board chairman and majority owner he was still hands-on, and called the shots to the last.

Whether the current five-strong management board will be as successful without him remains to be seen. Meister’s majority shareholding has been dispersed among several inheritors, two of whom have already sold down. His widow Ms Gabriella Meister and his daughter Ms Franziska Wuerbser retain a 31.5% stake in a pooling agreement. Shareholders may be nervous about the outsized role that these individuals must play in management oversight — or about the vacuum if they exercise none.

Winning method one – live cooking demonstrations as part of the hard sell

Rational recruited chefs as salespeople, and spread the gospel about the new appliance by conducting live cooking demonstrations in front of potential customers.

Mr Meister worked his salespeople hard. According to a former Rational executive who spoke to Third Bridge in December 2023, each sales rep had to do six customer visits per day, four times a week. (Leads were supplied by Rational’s CRM system, including telemarketing and leads from trade fairs and exhibitions.) The fifth day was reserved for a three-hour live cooking demonstration, which should have at least five qualified potential customers in attendance. Fortnightly follow-ups were also required. All this was strictly controlled.

Naturally this process is tough on the salespeople, and led to fairly high turnover, but Rational’s results over the years speak for themselves. Other firms are said to be less pushy and less consistent in how they drive their salespeople, leading to weaker results.

They gradually established master subsidiaries in key overseas markets, while relying on a network of trusted dealer partners to handle sales and service.

Winning method two – scale economies shared (R&D progress, manufacturing efficiency and flat prices)

Meanwhile, back at headquarters, the R&D and production teams worked relentlessly to improve the machine’s functionality and to manufacture it more efficiently.

Mr Meister’s philosophy was all about customer benefit. Every seven years or so, Rational would launch a new combi steamer generation with major upgrades. They added smart cooking programmes, a self-cleaning mechanism, automated descaling, more precise controls. Yet they kept the price virtually unchanged over the years and decades.

The IPO prospectus in early 2000 spelt this out with admirable clarity. Prices were held pretty steady until the inflation of 2021-22 forced a big jump.

“RATIONAL’s price structures are customer-focused and oriented to the overall competitive environment. RATIONAL expects selling prices to remain relatively constant until 2002. It intends to cushion cost increases by appropriate rationalization measures. This limits the market’s attractiveness for new competitors, while also decreasing its attractiveness for existing competitors. RATIONAL’s sales figures are considerably higher than its competitors’, which enables the Company to produce its products much more cost-effectively and therefore more profitably.” [Source: IPO prospectus, 2000]

Thanks to these methods, Rational was able to stay ahead of its competitors. While dozens of other firms launched combi steamers, Rational retained a c.50% share of the ever-growing market.

The track record

Rational floated in March 2000. It achieved €153m in revenue in that year, which has since grown seven-fold at a CAGR of 9.1%. See chart below.

Rational was already highly profitable at the time of IPO, with a 20% EBIT margin in 2000. The margin has stayed high throughout, giving a 10.2% CAGR to EBIT.

As mentioned above, this impressive growth has been entirely organic throughout the period. The only acquisition of note in Rational’s history was back in 1994 when they acquired Frima, their French sales partner at the time.

Frima had its own R&D operation, and in 2005 Frima launched the VarioCooking Center, which is a fancy, automated tilting / bratt pan. The Vario features lightning-speed cooking, but in revenue terms it has been a slow burn. Vario accounted for 5% of total sales in 2011 when it was first disclosed, and its share stands at 10% today.

My chart below shows that the Vario range is not (yet) a relevant sales driver, compared to the core combi steamers and associated revenue from spares, accessories and service.

An additional newly launched model in Q1 2024 is called iHexagon. This adds microwave power to the hot air and steam, for customers who require high cooking speed. This is likely to be an even smaller niche product than the Vario, in my view. I factor in nothing for its success.

Customer mix

There’s a wide range of customer types for Rational’s commercial cooking appliances, which can be used anywhere that hot food is prepared out of the home. This includes

· individual restaurants

· fast food chains

· hotels and banqueting centres

· supermarkets, bakeries and butchers

· workplace canteens

· institutional caterers in schools, hospitals, nursing homes, prisons etc

Most units are sold individually or as part of small projects. About 20% of appliances are sold in bulk contracts of hundreds or thousands of units. Rational has the resources to pursue these contracts, which may require months of testing, customisation and proof of concept. Two case studies are below.

· Yum! Brands: ever since 2002, KFC restaurants in China and other Asian countries have used Rational combi steamers to cook vegetable and side dishes, and also to bake the famous KFC egg tarts.

· IHG: c.3,000 units were delivered to Holiday Inn Express hotels in 2018-19. Rational combi steamers are used to cook the new breakfast concept, featuring freshly made scrambled eggs, bacon and cinnamon swirls.

Cyclicality

The customer diversification provides a degree of stability. And Rational is selling a product that is tied to the constant human need to eat. Therefore, despite the capital nature of the purchase, Rational’s sales are clearly less cyclical than for other capital goods in any normal economic downturn. Sales fell just 8% in 2009 during the financial crisis, and profit actually rose the same year as the company took decisive cost-cutting action.

COVID was a unique situation in which many forms of out-of-home catering were shut down simultaneously. Rational saw a -22% sales fall in 2020, with a full recovery by 2022.

Overall, I give Rational credit for being far more recession-proof than most capital goods names.

Competition

This is the crux of the case. As noted, Rational is far from the only maker of combi steamers. Despite its extensive patent portfolio to protect specific features, the overall concept was not patentable, and there have been dozens of rivals ever since the start.

Rational has outgrown both the commercial kitchen market in general and also its combi steamer competitors specifically over the decades. As above, this is thanks to the hard-driving sales methods and its pricing philosophy to hold prices as low as possible in order to leave no space for the competition. Rational has a strong brand image in the category, and its products are seen as superior to the competitors in terms of cooking performance, reliability and features.

My chart below shows a comparison of organic growth rates for Rational compared to identifiable competitor segments in commercial kitchen equipment. The cumulative difference is immense. These competitors generally include full ranges of cooking, cooling and dishwashing equipment with dozens of different platforms, in contrast to Rational’s unique hyper-specialisation.

Individual profiles of the most significant competitors are below.

Unox is a privately owned Italian group that appears to be the most dynamic and successful combi steamer maker next to Rational. Revenue grew rapidly from €125m in 2018 to €280m in 2022. Profit is strong at €68m in 2022, for a 24% margin. Unox’s positioning has been to sell good-enough appliances in high volumes at a discount to Rational. More recently they have been working to improve the appearance, features and performance of their machines.

Unox is investing heavily: it opened a flashy new UK sales centre in 2022, and it says it is investing €46m in Unox City, a new factory and R&D centre by its headquarters in Padua. A North Carolina assembly facility is also supposed to be under construction, though this appears to have been delayed.

Unox was founded by Enrico Franzolin in 1990. The current CEO Nicola Michelon, aged 42, married Franzolin’s daughter Chiara, who is also a senior executive in Unox. Michelon is praised by the former Rational executive on Third Bridge for his drive and determination to catch Rational.

Privately held Ali Group now owns two struggling Bavarian combi steamer makers. It will be interesting to see whether it combines them in future.

Convotherm was founded in Bavaria in 1976 in Eglfing, just 45 minutes by car from Rational’s headquarters. In 1998 it was sold to UK firm Enodis, then the world’s largest foodservice equipment maker. In 2008 Enodis was acquired by Manitowoc, the cranes company. In 2016 the foodservice business was spun off and renamed Welbilt. In 2021 Middleby and Welbilt agreed to merge. But Ali Group of Italy launched an all-cash counter-bid for Welbilt at a $4.8bn enterprise value. Ali prevailed and delisted Welbilt in 2022.

Convotherm does not publish financials, but it is far smaller than Rational, and the gap has been getting wider. It delivered its 20,000th appliance in 1990, 14 years after founding. Rational delivered its 50,000th combi-steamer in 1991. Then Convotherm mentions that by 2011 it reached annual sales of 10,000 combi ovens. Rational was shipping around 50,000 per year at this time. Finally, trade website gv-praxis estimates Convotherm had 2019 sales of €76m (of which 88% exported), ranking it in 14th place among German manufacturers of commercial kitchen technology, and making it ten times smaller than Rational.

Eloma is the third Bavarian combi steamer maker after Rational and Convotherm. It is located in Maisach, a 35 minute drive from Rational. Founded in 1975 to make chicken grillers, Eloma started making combi steamers from 1977. In 2006 Eloma was sold to Aga, and in 2007 Aga’s commercial business was acquired by Ali Group of Italy. Revenue was €31m in 2007 with 200 staff. By 2017 the staff number was down to 130 and Eloma was shipping just 6,000 appliances per year, according to Aliworld Deutschland promotional magazine, suggesting stagnation or decline.

MKN of Wolfenbüttel near Hanover is family-owned, and more successful than the two Ali brands. The firm dates back to 1946, but only launched combi steamers in 2003. By 2016 they had expanded to 500 employees worldwide, and today they are reported to have 600 employees and just over €100m of sales. Interestingly, they have had greater success than Rational with the FlexiChef, their answer to the Vario tilting bratt pan range.

ITW owns several brands offering combi steamers as a side option next to other main items: Vulcan of Baltimore, Elro near Zurich, Hobart in Offenburg and Bonnet in Paris. I have seen no sales figures for their combi steamers, but they seem to be tiny players. In December 2020 ITW made an interesting appointment of the former Rational North America CEO, Markus Glueck, to lead their global cooking brands.

Hounö of Denmark is owned by Middleby. Hounö is supposed to have a high end postioning but seems to be struggling. Accounts at the Danish company register show sales of just DKK51m in 2022, lower than 2016, and losses for four years to 2022. It is unclear if these figures are representative of Hounö’s global performance. It did show signs of life with a new model launch in 2023, but generally life sounds tough for them.

Retigo of Czech Republic has been making steam combi ovens since 1994. Revenue is apparently just under €20m, according to credit rating websites, making it a tiny player.

In Japan Rational sells directly and via its OEM partner, Fujimak ($5965.T). However, Japan has dwindled in importance for Rational, falling from 6% of group sales to 3% in the last 20 years. Aside from the weak yen and the stagnant overall market, it seems that Rational and Fujimak have lost share to Maruzen ($5982.T) and Hoshizaki ($6465.T) as competitors with better distribution, including into the key convenience store market.

Growth forecasts by region

North America has been the strongest growth region for Rational by far. My chart below shows that since NA was separated from Americas in 2015, sales have tripled, with the euro roughly flat vs the USD over this period.

Penetration is far lower in the US than in Europe. Rational is getting traction both with large chains but also with individual restaurants. The labour-saving and energy-saving aspects of the combi-steamer are now resonating more than before.

There is a tailwind from the long-term trend towards eating out of the home, as reflected in the chart below showing the relative shift of spending from grocery stores to restaurants and bars.

Rational currently uses independent sales reps in much of the US, with its own employed salespeople only in the big cities of the east and west coasts. While the current arrangements seem to be working fine, further upside is possible as and when Rational gains the critical mass to add more of its own sales staff.

From 2018 Rational has also reported regional segment profitability. This should be taken with a pinch of salt, given the potential for arbitrary transfer pricing and allocation of central costs. Still, it is interesting that in 2023 the North America segment reported a 26% margin, higher than the 25% group average. In previous years America’s margin was typically reported as being a few points lower than the group average.

Management have said that the mix is particularly rich in the US, because customers tend to order larger-sized units which have a higher gross margin.

Bringing things right up to date, North America remained a bright spot in Q1 2024, with 13% growth despite a tough comp.

I forecast North America to keep growing at 20% pa for the next five years. This should serve to offset the sluggish German and European outlooks.

My chart below shows that the run-rate for the combined Europe area is high single-digit at best, with a 6.5% CAGR delivered from 2015 to 2023.

In Q1 2024 the combined Europe sales fell 6% yoy, dragged down by Germany which fell 17%. Management has argued this merely reflects a tough comp in a single quarter, as the abnormal post-COVID order backlog was still being delivered a year earlier.

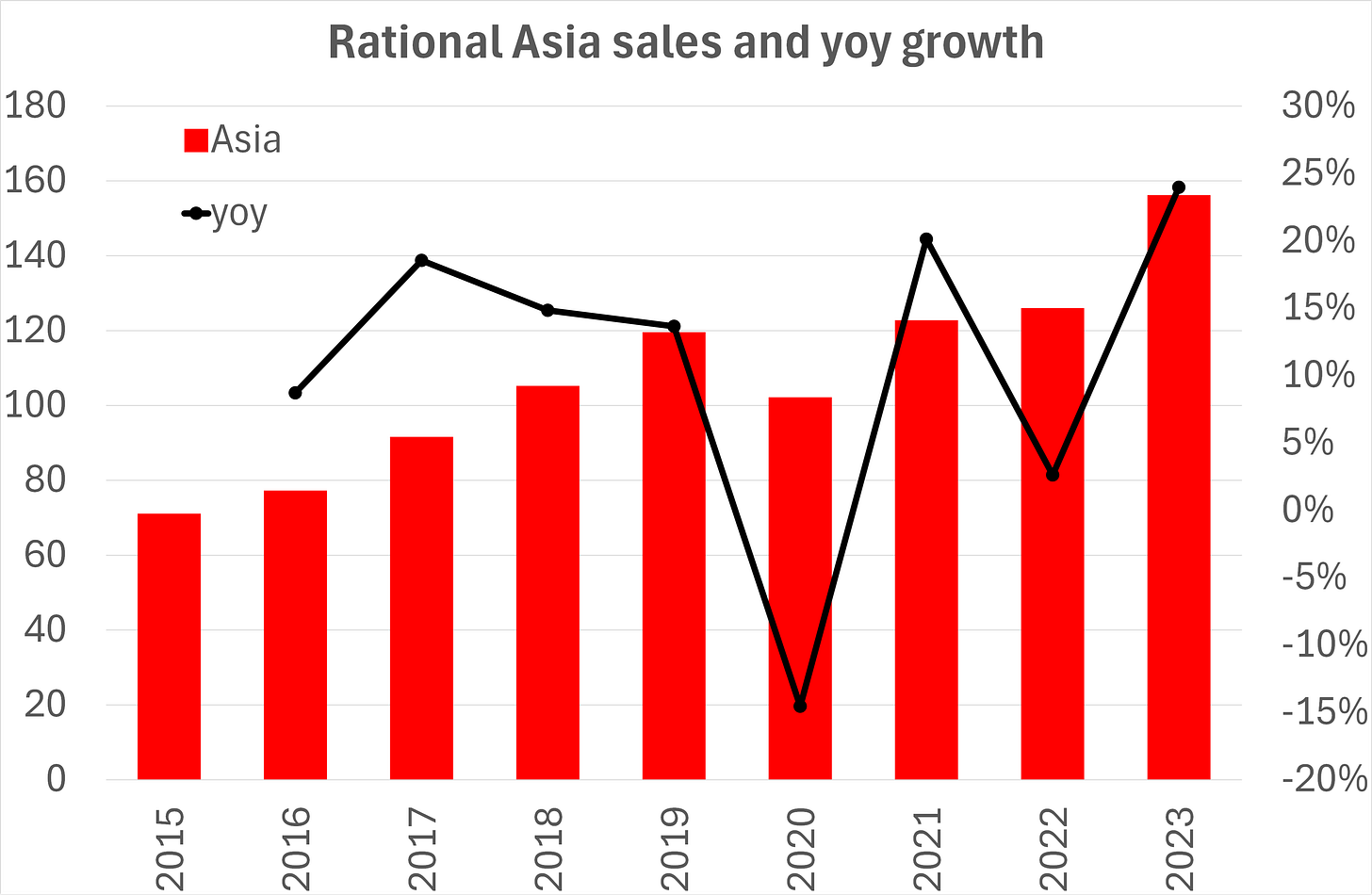

Asia has performed strongly, with a 10% CAGR from 2015 to 2023 despite Japan’s maturity. Rational has seen good sales in China both from KFC and from other smaller chains. So much so that Rational has started construction of a factory in Suzho. They aim to start production in Q4 2025 of a combi-steamer aimed specifically at price-conscious customers in the Chinese market.

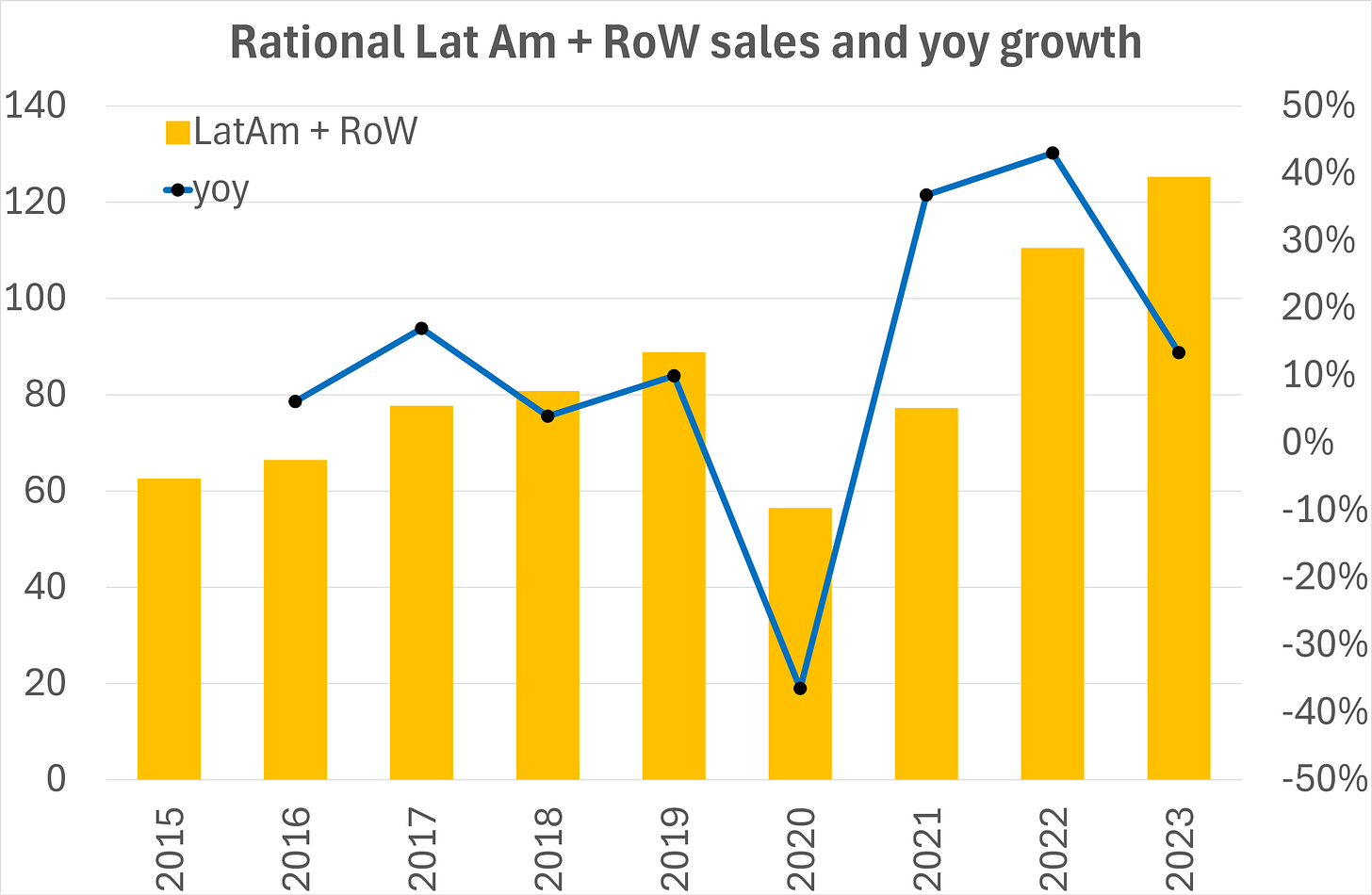

The rest of the world combines Latin America with Australia and the Middle East / Africa. Growth has been decent on average, with a 9% CAGR from 2015 to 2023.

I strike regional forecasts as below. The net result is a 10.5% CAGR from 2023A to 2027E, driven by North America and Asia – attractive if achievable.

Estimates and valuation

My estimates and valuation are shown below. These numbers come out modestly higher than consensus, and result in a reasonably attractive valuation within 2-3 years.

The margin may improve this year thanks to fading cost inflation boosting the gross profit margin. While management are guiding to additional opex, I see some benefit to the EBIT margin as likely. I then hold the margin roughly flat for the rest of the forecast period.

Rational is inherently a ludicrously profitable business. The 25% operating margin is achieved despite spending generously on areas such as R&D, custom software development and lavish trade fair stands. One imagines that a private equity-style management could find another 5-10pp of margin quite easily, at least in the short term.

Note that sell-side analysts, and perhaps the buyside, have been obsessed with the exact cadence of orders vs deliveries vs backlog, as post-Covid demand recovery and chip supply bottlenecks caused some volatility. In my view these effects have largely washed through by now, so the focus can return to the underlying growth rates in each part of the business.

My hesitancy is around Rational’s execution ability in the post-Meister phase. The management board currently has five members, as the outgoing CFO gradually hands over his duties to a new CFO-designate before he retires.

Even at the normal size of four members, the German-style collaborative management board can lead to frictions. Deadlock could result if members take different views on basic questions like whether to diversify the product range. Responsibility for core executive functions like maintaining sales discipline and ensuring R&D effectiveness might be diluted.

I choose to stay out of the stock for the time being.

If you enjoy research like this, hit the like & restack buttons, and subscribe if you haven’t done so yet. Also, please share a link to this post on social media or with others who might be interested. It will help the newsletter to grow, which is a good incentive to publish more.

Great write-up! I also covered Rational AG and shared my thoughts earlier this year in February. It’s an amazing business, but I’m staying on the sidelines for now.