SITC – the Ryanair of container shipping stocks

(1308.HK, $5.3bn market cap, $16m ADVT, 48% float)

SITC is a quality growth shipping company, specialised in the intra-Asia trade. Like the famous Irish low-cost airline, its niche positioning generates defendable competitive advantages that enable it to sustain profitable growth over the long term in an otherwise unattractive and cyclical industry.

SITC was nicely profitable every year during the tough 2010s, when overcapacity dogged the industry and forced peers into losses. Then when freight rates spiked due to COVID, the boom generated multi-billion dollar windfall profits and dividends, and also whipsawed the stock.

That cycle has now played out, and from here the strong fundamentals can return to the fore. At 10x current P/E on fairly sensible estimates, the stock is volatile and hard to call in the short term, but looks a good bet on a three to five year view. Upside should come from earnings growth, which has historically compounded at an average rate in the mid to high teens. Any re-rating would be a bonus but is not counted on.

Disclosure: having been out of SITC during the COVID spike, I’ve just re-started a position at around the current price. I intend to average in over several months for an expected long-term holding period.

As always, feedback is most welcome, especially on any bear points not discussed below.

Business model

An intra-Asia specialist, SITC operates small container vessels on point-to-point routes with high frequency. SITC has direct and long-lasting relationships with its industrial customers, who value the high service quality. This includes land-based value-added services as well as tailored offerings for blue-chip customers.

Two examples of tailored offerings from the IPO prospectus are helpful.

· “Working with Itochu, we have enhanced our temperature-controlled container service capabilities on designated routes to accommodate fresh food delivery”

· “Working with Toyota, we have adjusted our port calling and voyage frequency to ensure on-time delivery”

The fleet

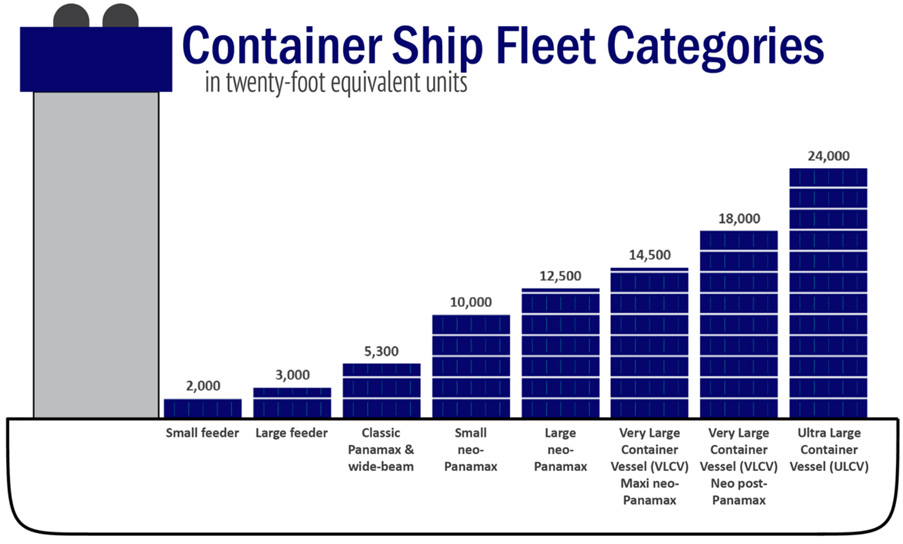

SITC’s fleet comprises 103 container ships with average capacity of c.1,600 TEU. These are very small ships, in the “small feeder” category at the extreme far left of the chart below.

SITC adopts key fleet practices that are similar to Ryanair. (My comparison, not theirs.)

· Young, fuel-efficient fleet. Average age was 7.9 years at the end of 2023.

· Uniform fleet for high flexibility in allocating vessels to different routes. In SITC’s case they operate just three sizes of vessel – 1,000 TEU, 1,700 TEU and 2,700 TEU.

· Lowest cost purchaser – in SITC’s case thanks to management’s strong grasp of the industry cycle and skill at striking bargains when new-build or second-hand prices are low.

The use of small ships is counterintuitive. While unit costs are slightly higher, the small vessels allow SITC to construct a dense, frequent network with a much higher than average utilisation rate and therefore higher profits.

The network

SITC’s network includes 76 trade lanes across 79 major ports in mainland China, Japan, Korea, Taiwan, Hong Kong, Vietnam, Thailand, the Philippines, Cambodia, Indonesia, Singapore, Malaysia, Brunei, Bangladesh, Myanmar and India. The service is high frequency: SITC makes 443 port calls per week. See the network map below.

SITC’s network model is different to most container shipping companies, which operate global hub-and-spoke models. The diagram below from SITC’s 2010 IPO presentation illustrates the advantages.

Customers

SITC has customers based in all countries served. Diversification is good, with the biggest customer at 2% of sales. The chart below shows the revenue split by country.

SITC enjoys a relatively balanced trade, with two-way flows of goods on most routes. This is a critical advantage for SITC’s utilisation rates, typically around 70%, compared to the global container liners who focus on Asia-to-Europe and Transpacific services which carry mainly empty boxes on the return legs.

For example, cargos shipped from the PRC to Japan and Korea include food, textile products, minerals and chemical products, while cargos shipped from Japan and Korea to the PRC include automobile parts, industrial parts and chemical products.

Market share and competitors

SITC is a tiny player in the global context. The Alphaliner ranking below shows it to be the 13th biggest liner by capacity, with a 0.6% market share.

Just like Ryanair in the European shorthaul market, SITC faces myriad competitors in intra-Asia short-haul, including the global players and regional specialists. Most competitors have dismal track records.

Wan Hai (2615.TW) is the closest peer. Its $3.9bn market cap is much smaller than SITC’s, despite a far bigger fleet of about 150 (larger) ships. This is due to its weak profitability, unfocused strategy and poor capital allocation. While intra-Asia is the majority, Wan Hai also re-entered long-haul transpacific services in 2020 with services to the US west and east coasts, ordering and purchasing 13,000 teu containerships in the process. [source]

Wan Hai was loss-making in 2023.

KMTC (private Korean) is the other close peer. Its volumes and revenue are similar in size to SITC, though with a slightly different geographic footprint. KMTC has access to Korean customers and has rights to operate Korea-Japan service, which is a closed shop to SITC. (All other trades in Asia are liberalised.)

RCL (listed in Thailand), Samudera (listed in Singapore) and Heung-A (listed in Korea) are smaller players that have poor long-term track records of losses or low profits.

COVID shipping spike

Container shipping is a notoriously cyclical industry. For the first ten years of SITC’s listed life, the cycle was generally in the doldrums. SITC thrived regardless, thanks to its sticky and loyal clients.

From 2020 to 2022, COVID caused the mother of all container shipping booms. On the demand side, consumers ordered physical goods in unprecedented volumes to while away lockdowns. Meanwhile, supply was tight thanks to industry consolidation and many years of low newbuildings. Port congestion and COVID testing and incubation procedures also tied up ships.

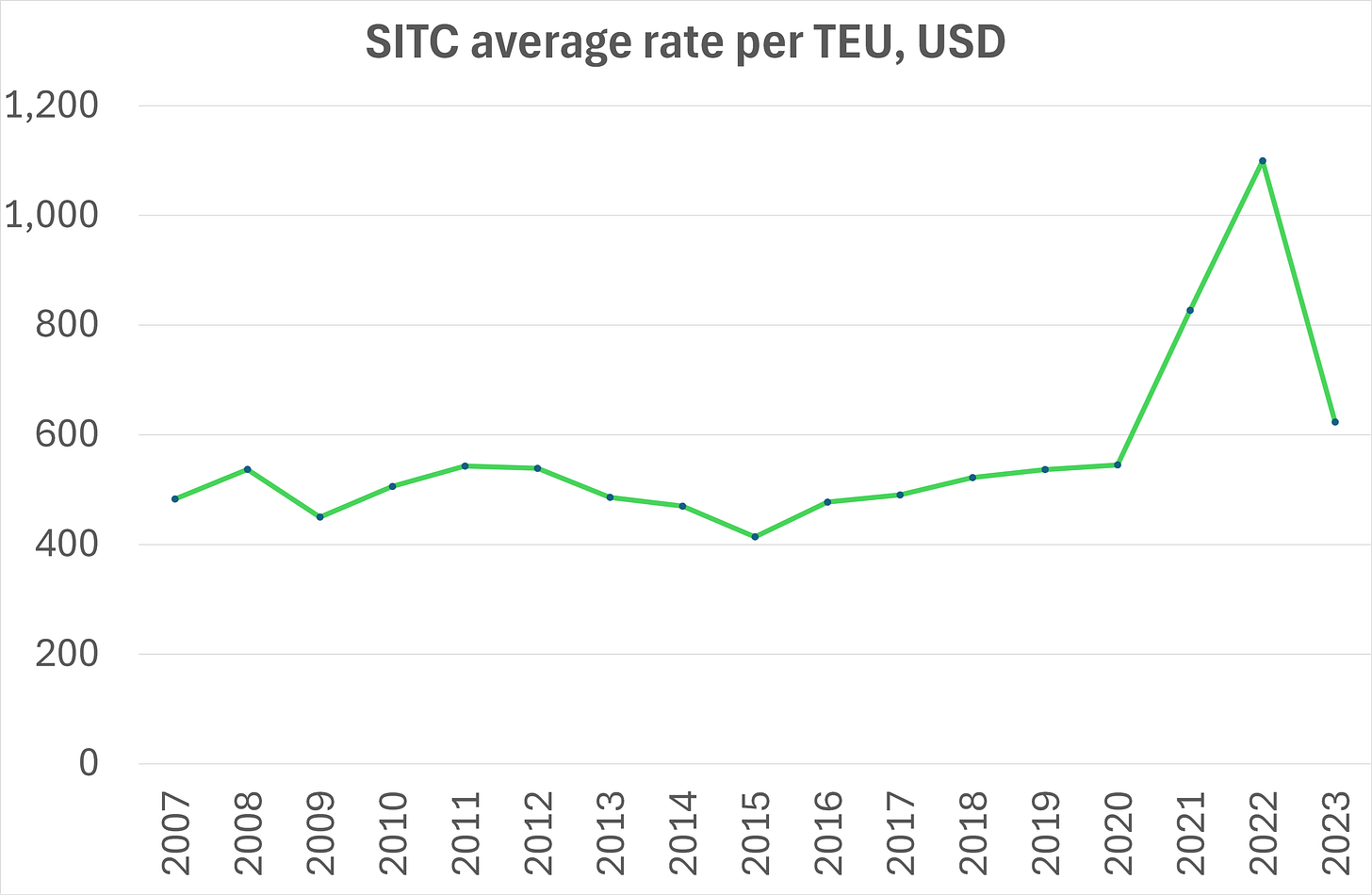

SITC’s average freight rate in 2022 was double the 2019 rate. While this move was less extreme than on longhaul routes, it was enough to boost earnings ninefold. SITC took in nearly $3bn of windfall profits and free cash flow, which it mainly paid out to shareholders with $2.9bn of dividends from 2021-23 inclusive.

Liners flush with cash ordered lots of new ships. Fortunately, the ordering was concentrated in the larger categories. The supply picture in SITC’s category of small 1-3k TEU vessels is reassuring. Norwegian listed tonnage provider MPC Container provides the chart below, indicating a low order book and plenty of older vessels for promising demolition prospects in this category.

Ownership, management and corporate governance

SITC was founded in 1991 as Shandong International Transportation Corporation, a state-owned freight forwarder. The business model has been largely unchanged since 1992, when they first launched their own container shipping routes between PRC and Japan. The business was privatised in 2000.

The controlling shareholder is Mr Yang Shaopeng, with a 41.3% stake. He led the privatisation in 2000 and is therefore viewed as the founder. Aged 66, he recently handed over the executive chairmanship to Mr Yang Xianxiang, who joined SITC in 1997, served as CEO since 2008, and owns a 9% stake.

SITC’s corporate governance and capital allocation have been demonstrably outstanding, evidenced by the track record. The icing on the cake was the disciplined payout of virtually all windfall COVID cashflow to shareholders. (Other container shipping lines failed the same test, and splurged parts of the windfall on acquisitions and/or excessive ship purchases.)

SITC is a rare Chinese company that faces no restrictions on making payouts to shareholders, thanks to its hard currency earnings. The post-COVID payouts were a pleasing demonstration that SITC can and will convert profits and cashflow to dividends.

Financial profile: growth and ROIC

The IPO took place in Hong Kong in 2010, giving us a track record period from 2007 to 2023. During this time, the fleet grew from 32 to 103 vessels, for a 7.6% CAGR. See chart below.

Containers handled per year grew slightly faster at an 8.7% CAGR, thanks to a gradual up-gauging. (They started out with almost entirely 1,000 TEU ships, and have gradually added in the slightly larger ones as some routes are mature enough to fill the larger vessels without impacting on load factors or frequency and speed.) See chart below.

The average freight rate has been range-bound in the period, with the exception of the post-COVID spike, discussed below. By the end of 2023, rates had returned to within spitting distance of pre-COVID levels. See chart below.

The revenue, margin and net profit charts (below) are distorted by the COVID spike, but the underlying upward trajectory is also clear. SITC has achieved high-single-digits sales CAGR and high-teens profit CAGR, thanks to careful network growth and benefits from operating leverage.

SITC has a track record of strong double-digit ROIC, even excluding the COVID boom years of 2021-22. This impressive return in an asset-intensive business is the acid test of SITC’s quality. See chart below.

Growth has been self-funded, with strong free cash flow even prior to the COVID boom.

SITC runs a conservative balance sheet with net cash, unlike the generally over-leveraged peers – another parallel with Ryanair. See net cash chart below. NB the cash is not held in renminbi – SITC earns hard currency which it is free to pay out to shareholders.

Forecasts and valuation

Just as with airlines, SITC’s estimates are subject to significant error in any given year due to the unpredictable moving parts, especially freight rates. Nonetheless, I see the valuation as being in an attractive ballpark, on fairly realistic market estimates.

My forecasts are shown below. For 2024 I factor in another down year to reflect the full normalisation of freight rates, which fell during 2023. I sit 11-17% below consensus, which still looks too optimistic. For this stock I doubt one can afford to wait for the end of the downgrade cycle before starting a position.

SITC’s recent multiple history compared to the total return chart (both below) reflects the adage that you should buy cyclicals on high P/Es and sell them on low P/Es. The current multiple is reassuringly off the bottom, reflecting the fact that sellside analysts have finally put through some decent downgrades.

Endnote

John Armitage of Egerton is an example of a quality investor who owns Ryanair. His recent interview on the Value Investing With Legends podcast is recommended listening throughout. His quotes on Ryanair are as below.

We think they’re in pole position in Europe. They’ve got very low cost operations. They’re run by someone brilliant who’s got some outstanding people around him. They’ve got a strong balance sheet they can pay back debt from cash… they’re going to generate a lot of cash… they’re on about 9x earnings and I think those earnings forecasts are really low.

Why so cheap? Sometimes you get a visceral reaction and people don’t want to rate stocks more highly. Sometimes companies are anchored by the valuations of what people compare them to. The sector’s consolidated massively. Having the best economics is integral to the investment case.

Thanks Alex, interesting read! As supply chains have been increasingly moving away from China to countries like India, do you think this could affect SITC's business in the long-run?

Wondering how much does the chairman Yang Shaopeng still involves in running SITC, or he's retired fully? Chairman is now on the board of Hisense Group and one of the top 10 shareholder - do you think he only has financial interests in Hisense?

I don't think I have come across this shipping stock before... I included your write-up in my Emerging Market Links + The Week Ahead (April 29, 2024) for today: https://emergingmarketskeptic.substack.com/p/emerging-markets-week-april-29-2024