Tapping America: Reece and the race to consolidate US plumbing wholesale

(REH.AX, USD11.7bn market cap, USD7.7m ADVT, 32% free float)

This post is a profile of Reece of Australia, a plumbing wholesaler. Next week in a follow-up I’ll cover Beijer Ref of Sweden, a wholesaler of heating, ventilation and air conditioning (HVAC) equipment.

Reece and Beijer Ref both have outstanding track records in their home regions, and have each bootstrapped from microcaps to substantial midcaps valued at either side of $10bn.

Both have recently planted their flags in the US, with bold initial acquisitions and plans for more to come.

To win in America, Reece and Beijer Ref must compete directly against the giant incumbents, Ferguson and Watsco, with outstanding track records of their own.

I was sceptical that Reece would be able to translate its Australian success into the US, given the cultural divide. Having now done the work, I’ve changed my mind – I think Reece has every chance of compounding its US presence at an attractive rate for decades to come.

Unfortunately, the high current valuation is offputting and keeps me on the sidelines. The stock tends to be volatile, so a better entry point is highly likely.

Regardless, I like the Reece story as a case study.

It is a family-controlled business that has departed from conventional corporate governance yet delivered superb capital allocation and great returns for long-term holders.

It is also a great example of a focused industrial distributor. This unsexy sector can provide excellent long-term winners. Well-known US examples include Fastenal in fasteners, POOLCORP in swimming pool supplies wholesale and W.W. Grainger in diversified maintenance, repair & operations (MRO) items.

The recipe is not fool-proof. Travis Perkins in the UK has delivered terrible shareholder returns for decades despite a potentially strong market position. Weak corporate culture and poor execution trump potentially sound economics.

Reece history

Reece was founded in 1920 as a plumbing hardware store in Caulfield, Victoria. The stock was listed way back in 1954, still with just two stores. The Wilson family became controlling shareholders and took over management of Reece in 1969, and they retain full control to this day with a 68% stake, four of six board seats and the CEO position.

The Wilsons have proved fabulous stewards for minority shareholders over the last 55 years. They have opened new greenfield stores year after year and and acquired other businesses to reach a nationwide presence by 1997. They branched out from plumbing into adjacent areas such as waterworks and civil, irrigation & pools, and HVAC supplies. They bought into New Zealand in 2006. In February 2014 Reece acquired Actrol for AUD280m, becoming the #1 HVACR wholesaler in Australia. And in 2018, Reece made their biggest move yet by entering the US market, on which much more below.

Australia & NZ track record

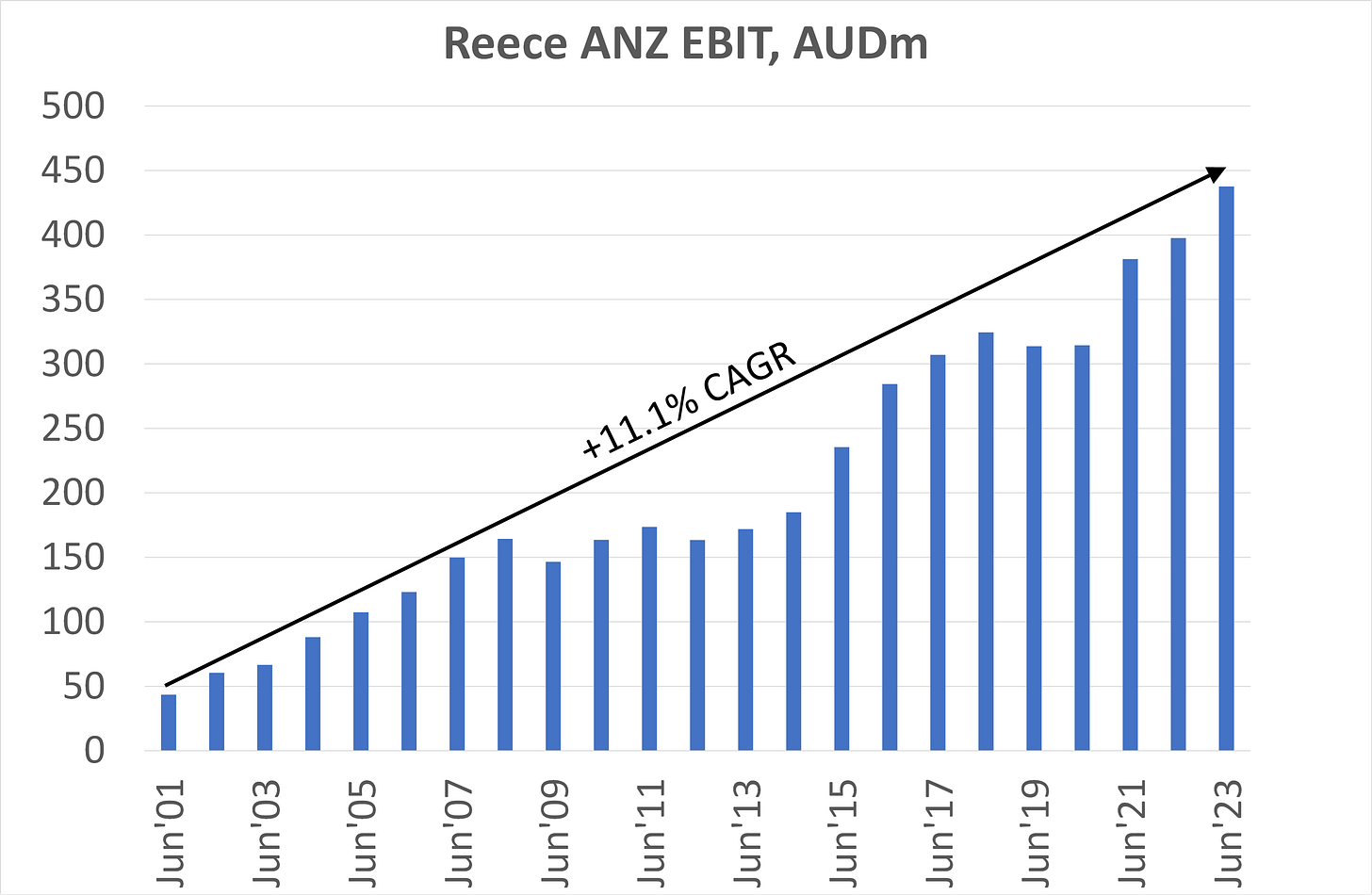

Reece’s home business in Australia and New Zealand contributed 44% of sales and 60% of profits in FY23. My chart below shows home sales grew from AUD533m in FY01 to AUD3.85bn in FY23, for a 9.4% CAGR.

The ANZ EBIT margin has increased from 8% to 11% over the period, resulting in an 11.1% EBIT CAGR.

The business depends on the physical branch network for proximity and service to the tradie customers in each area. Reece had 655 branches in Australia and New Zealand by June 2023, with average sales of AUD6m per branch – see chart below.

The majority of branches are branded as Reece Plumbing Centres, with some locations also doubling as Irrigation, Pool, HVAC and/or Civil branches. In addition, there are consumer-facing Reece Bathroom Life showrooms, as well as c.100 separately branded Actrol and Metalflex branches (for HVAC equipment and spares), and some niche brands covering pipes, swimming pool supplies, etc.

See below for photos of some typical branches in the Melbourne area.

Market position and competitors - Australia

Plumbing wholesale is typically a fragmented industry, but in Australia Reece have done a great job of consolidating it. Reece’s 2013 market share was 20%, according to a 2014 antitrust report from the Australian Competition and Consumer Commission, based on data from proprietary market research firm IBISWorld. The full 2013 market share breakdown is shown below. IBISWorld’s current website mentions Reece’s market share has risen to “nearly 40%” by 2023, a dominant position. Doubling their market share in a decade underscores their above-average growth.

The number two player in Australia is Fletcher Building’s TradeLink business, a plumbing supply retailer with >100 bathroom showrooms and 230 branches. Fletcher has grown TradeLink’s market share since 2013, but has struggled badly with profitability – Fletcher assumed just a 2.4% EBIT margin for TradeLink in its most recent annual report when it tested the associated goodwill for impairment.

Fletcher, which is listed in New Zealand, announced last month that it plans to sell the TradeLink business. It will be interesting to see who buys it, given the evident difficulty of competing successfully against Reece. If a financial buyer takes on TradeLink and switches emphasis from growth to margins, that could prove beneficial for Reece.

Wesfarmers by contrast operates through its Bunnings DIY business, the Australian equivalent of Home Depot – a different model that does not have to compete head-on against Reece.

How and why has Reece been such a big winner in a competitive market?

Reece’s Australian market share and margin are outstandingly high. We need to understand why this is the case to assess whether the position is sustainable.

While it’s hard to prove quantitatively, my understanding is that Reece’s management have consistently done a better job than rivals of understanding their customers’ needs, and responding with the right offering of product range, service quality and pricing to meet those needs.

In Australia, Reece has exclusive rights to many brands and products, either as the direct importer of private brand items or as the exclusive Australian wholesaler for international OEMs. This is an outcome of the moderate size and remote geography of the Australian market, as well as Reece’s full market coverage.

Reece does not disclose the share of exclusive products, but a local fund manager estimated in 2018 that it could be as high as 40% to 70% in key categories – far higher than the equivalent exclusive share for Ferguson in the US or for other #1 players in different plumbing wholesale markets.

Reece tracks its Net Promoter Score internally. The most recent published score in February 2023 was +60% for Australia, which is outstanding. (For comparison, Ferguson’s last published NPS was +52% in FY21 for the US business, since when they have stopped reporting it.)

The key slide below from the 2018 Morsco acquisition presentation sets out the reasons for Reece’s success in their own words.

Morsco acquisition and entry into US

In July 2018 Reece acquired Morsco from Advent International for $1.44bn / AUD1.9bn, a 14.4x trailing EBITDA multiple. The transformative deal was initially funded by AUD1.3bn of new debt and a AUD600m equity raise. In April 2020, given COVID uncertainty, Reece de-risked the balance sheet with an additional AUD647m equity raise. (See further details in the section on Wilson family control.)

Based in Texas, Morsco had 2,500 staff and 171 branches across 16 Sun Belt states at the time of acquisition. It spanned plumbing, waterworks and HVAC, matching Reece’s Australian verticals.

Morsco history

Morsco’s origin was as Morrison Supply, a small and long-established Texas business that was purchased by Advent in 2011 as the core of a new roll-up vehicle. The group reached $1bn of revenue by 2014, and was renamed as Morsco in 2015, going on to make further acquisitions across the southern US before the sale to Reece in 2018.

Back in 2011, Advent chose Chip Hornsby, the former CEO of Ferguson and Wolseley, as founder and CEO for the Morsco project. Hornsby was group CEO of Wolseley from 2006 to 2009, a difficult period for any company caught with too much leverage during the financial crisis. His tenure at the helm of the UK plc was seen as a failure at the time. However, far more relevant in judging his capabilities as an operator is his long period of success in building up the Ferguson business from 1978 to 2005.

Regardless, the Morsco project has been a success, and Hornsby has stayed with the business throughout. In 2019 he transitioned to Executive Chairman of Reece USA, which is still paid as a full-time role but which looks like more of an advisory role or a halfway house to retirement.

Immediately on closing the acquisition in 2018, Reece sent a trusted deputy from Australia to Texas to oversee Morsco. This was Sasha Nikolic, the former CFO and an accountant by background who joined Reece in 2009. From 2014 to 2016 Nikolic was MD of Actrol, Reece’s biggest acquisition prior to Morsco. His experience in integrating Actrol into the group and embedding the Reece culture is clearly relevant. In 2019 he was formally named as CEO of Reece USA, and has continued in that role to date.

Nikolic was awarded an Executive Long Term Incentive cash plan on appointment to the Reece USA role. This was worth AUD11m by June 2023, based on five years of outperformance against targets for US sales and EBITDA growth, according to the FY23 annual report. This demonstrates Reece’s internal satisfaction with progress to date in the US business.

Reece track record in the US since 2018 acquisition

Reece have grown their US business from USD1.7bn in 2017, the last full year before acquisition, to USD3.35bn in FY23, for a 12.9% CAGR – see chart below.

This decent growth has been achieved by a combination of bolt-on acquisitions, greenfield branch openings, good volume and market growth, plus a contribution from inflation.

Reece’s Sun Belt region of Texas and the surrounding Southeast and Southwest states has a structurally faster-growing and more favourable construction market than the Northeast and Midwest where Reece has no presence.

See below for the change in branch numbers since acquisition. An acquisition added 12 branches in FY23, and Reece sees 15 per year as the sustainable number of organic branches they can open in the US.

At the same time, they’ve increased margins impressively from a low base. I show both the EBITDA and the EBIT margins, each showing a clear positive trend with c.200bp of margin improvement to date. There is plenty of headroom for further gains, though Reece never expects to match its >11% ANZ margin in its US business.

Morsco integration into Reece

In operational terms, Reece has been making changes behind the scenes. A key focus has been on foundational cultural work, with basic systems and training to reinforce what Reece stands for. This is a long-term work in progress: Reece management talk about a decades-long journey for the US business.

Specifically, they’ve strengthened branch-level management to instil the high service standards that Reece aims for. In the short term this is an added operational expense, which makes the margin improvement shown above all the more impressive.

Morsco had a high 80% skew to new construction sales (both residential and commercial) and just 20% exposure to the more resilient R&R (repair and remodelling) or RMI (repair, maintenance and improvement) market. That is much lower than Reece wanted, as their Australian business is mainly geared to R&R. They have therefore developed an R&R-focused US format which they are rolling out as greenfield builds in Texas - see pictures below. They are also taking other steps to capture the R&R market such as Saturday openings.

Another step was the recent opening of a new and improved Texas distribution centre to fulfil the needs of an expanded business with better service levels.

In 2023 Reece started to rebrand the US stores, which previously traded under a variety of different legacy brands, to the Reece name. The rollout of the Reece brand had reached 62 stores by February 2024. Management have been clear that they do not expect any short-term payoff in trading from this step. It is a long-term move that is expected to aid recruitment, strengthen Reece’s negotiations with US suppliers, and eventually pay dividends in terms of brand recognition and association with Reece’s aspirations for a high standard of customer service.

Market position and competitors – US

Plumbing distribution in the US is highly fragmented. The latest rankings from trade journal Modern Distribution Management are below. Ferguson, the leader, estimates its own market share at c.20%. Reece / Morsco is in second place, despite not yet having a nationwide presence. (Note that the idiosyncratic MDM rankings do not show the plumbing revenue on which they are constructed, but only the total company revenue. Winsupply and Grainger are large businesses but across several different verticals, and are ranked as smaller than Reece in plumbing sales.)

Ferguson plc

Ferguson has a fascinating history. It is a great US business that was successfully incubated within an otherwise-mediocre UK listed company.

Ferguson was founded in 1953 by three chaps called Ferguson, Lenz and Smither. The original branches were in Washington DC, Alabama and Virginia. In 1959 David Peebles joined, and became the CEO and driving force. By the early 1980s he had built the business up to $140m in sales and 76 locations in 11 states.

Faced with succession issues and the need for new capital, Ferguson planned to go public. But instead, the UK-listed Wolseley jumped in with a proposal to buy the business and leave its management entirely to the existing US team.

Peebles, Lenz and Smither quickly agreed, and the rest is history – with Wolseley’s capital and the capable US management team, Ferguson expanded aggressively and profitably to reach over 500 branches in 49 states by the end of the 1990s.

This century has seen more of the same (in part under Chip Hornsby’s leadership as above). Ferguson today boasts 1,700 branches and a huge $30bn of sales, of which $28bn in the US and $2bn in Canada. My chart below shows the strong sales and margin track record of Ferguson’s US business, using segmental disclosures to strip out the noise of the since-disposed non-US units.

Wolseley gradually realised that every business except Ferguson was hopeless. They sold their multitude of UK and European businesses off from 2010 to 2021, while renaming the listco from Wolseley to Ferguson in 2017, moving the primary listing from London to New York in 2022, and winning recognition from the SEC as a domestic equity in 2023. Ferguson will finally move its corporate domicile from the UK to the US later in 2024, eliminating the final remnant of its UK past.

Winsupply is a privately held Ohio-based group. It is a major competitor in both HVACR and Plumbing, and is highly acquisitive. Winsupply has a unique shareholder structure with an emphasis on minority co-investment and equity incentives for all business leaders. This model potentially makes Winsupply a buyer of choice in the space for independent firms.

Hajoca is a privately-held plumbing wholesaler. Based in Pennsylvania, it has 400 locations in 40 states. It emphasises entrepreneurial spirit and profit-sharing with branch managers.

QXO is a new building materials rollup announced with a big splash by Brad Jacobs. His track record in running acquisition vehicles at United Rentals and XPO precedes him. The announcement was in December 2023, and a reverse IPO into a stock called SilverSun (SSNT) is due to be completed sometime during 2024. QXO will start with $1bn of equity capital and aims to deploy a multiple of this with leverage, shooting for $5bn of revenue within three years of launch. QXO has not been specific about which verticals within building materials distribution it is aiming at. If they pursue plumbing acquisitions then this may be inflationary to market multiples for bolt-on M&A. Beyond that it is too early to say whether QXO will impact Reece and Ferguson – but worth watching.

Wilson family and Reece corporate governance

Why is Reece a listed company? For 49 years the Wilson family didn’t raise any fresh capital from the market, but in 2018 and again in 2020 the listing came in useful, as Reece was able to raise external capital quickly and cheaply to support their growth ambitions. The Reece family shareholding stood at 76% prior to 2018, and they were diluted down to 74% in the 2018 raise and then to 68% in 2020. Disclosure was minimal prior to 2018, and has grudgingly improved a touch since then, but the company’s annual reports and presentations remain light on detail compared to peers.

As mentioned, four family members control the board. Alan Wilson and Peter Wilson are the father and son that have executive control, while Andrew Wilson and Bruce Wilson sit as non-executives.

The Wilson family is fond of retaining wise heads on the payroll. After over fifty years of leadership of Reece, Alan Wilson moved roles from Executive Chair to Executive Director in September 2022 at the age of 81. He continues to draw a AUD495,000 annual consulting fee for his expertise and advisory role as a Founder – Plumbing.

Peter Wilson also draws a substantial remuneration, with AUD5.2m total pay in FY23. The remuneration reported attracted a substantial protest vote at the AGM, with proxy advisory companies recommending a vote against due to both the quantum and the structure of remuneration.

Reece established a ventures arm called Superseed in 2018, with the aim “to invest, incubate and partner with start-ups across trade and construction tech”. Minority investments in a number of associates have resulted, including a Texas-based job management software startup called FieldPulse and an Australian business loans investment firm called True Pillars. The website lists nine investments. The total sum invested is c.AUD25m to date, from what I can gather – formal disclosure is limited. This is another example of an unconventional activity for a listed plumbing smallcap. (Amusingly, Reece’s Superseed seems to be a carbon copy of Ferguson Ventures, which was established a few months earlier!)

Altogether, Reece deviates from corporate governance best practice in several ways. Yet this surely misses the point, which is the excellent total return that the Wilson family have delivered to minority investors via their successful stewardship of Reece to date.

The strategic and operational continuity of the last 55 years looks set to continue as Peter Wilson is set to be elevated from his current CEO role to Executive Chairman, from which role I expect him to continue to exert his tight grip on the business.

I would be happy to invest alongside the Wilsons in this structure if the valuation opportunity returns.

Financials

Reece’s return on capital employed averaged 27% in the ten years prior to the Morsco acquisition, with a downward trend, and fell to the mid teens post Morsco – see my chart below.

The 2014 Actrol acquisition weighed on returns, as did Morsco in 2018. The extremely high ROCE of the original organically-built Reece business has been diluted by the larger M&A required to scale up. That M&A is still clearly value-creating over time, if Reece management are able to work their magic and deliver organic growth and profit improvement in the acquired businesses for many years subsequently.

The Morsco deal whacked ROCE down to 13% in FY19, given the full multiple paid for an initially low-margin business. Reece has rebuilt ROCE to above 15% in FY23. ROCE should continue to recover, driven by US margin improvement and the incremental investments in greenfield branches with higher returns.

Reece’s working capital to sales requirement also rose significantly in recent years, from 14% to 19% - see chart below. The increase took place in Australia in the years prior to the Morsco acquisition. Higher working capital will have depressed free cash flow and ROCE, all else equal.

The working capital increase was driven by higher inventory days in Australia from FY11 to FY18 – see chart below. Reece views in-stock availability and a wide product range as key to providing good service, and took a deliberate decision to invest in inventory to improve availability during the previous decade. Subsequent improvements in the central DC setup have brought inventory days back down.

The investment in higher inventory in Australia from FY11 to FY18 did coincide with a 200bp gross margin expansion in the same period – see chart below. Morsco was significantly dilutive to the group gross margin on acquisition, which can be seen bullishly in terms of the significant opportunity for Reece to expand the US gross margin over time as they bring service levels and R&R share up to their own standards. For comparison, Ferguson has a 30% gross margin, far higher than the approximately 24% level of Reece USA.

As described above, Reece initially used a lot of debt to buy Morsco in 2018. In April 2020 they raised additional equity to de-risk the balance sheet, which has remained moderately geared since then. Incremental growth capex and bolt-on M&A is comfortably covered by free cash flow, given the 40% dividend payout ratio.

Recent trading and forecasts

Reece’s stock is up 24% YTD, on top of a strong 2023 performance. This has been driven by a rebound from a depressed start point, due to the combination of poor construction statistics and recession fears for both Australia and the US, as well as Reece’s excessively conservative guidance in response.

Both Australia and the US have seen dramatic slowdowns in newbuild construction starts in the last 18 to 24 months. US new housing permits and starts have fallen sharply since 2022: see chart.

Back in August 2023, Reece guided conservatively that this would likely result in falling volumes and margins for the current financial year – at the same time as deflation in commodity-linked products such as copper and plastic-heavy lines would pressure sales.

Sell-side estimates were therefore struck cautiously at 54 cents of earnings per share, which would have required a 14% year-on-year fall.

Instead, the first half results came in far stronger, with a 6.4% increase in adjusted NPAT. This was driven by better-than-expected volume resilience in both markets, as well as a surprising 60bp gross margin improvement which flowed down to the bottom line.

The sell-side have responded by increasing their full year EPS estimates to a 65c average, a 20% upgrade from where they started the year. Reece management continues to insist that macro weakness and pain is in the pipeline, and analysts have continued to factor H2 weakness in.

For my purposes, to understand how the stock is trading at such a rich current multiple, I show a more sanguine set of forecasts (below) that assumes management is still being over-conservative, and Reece will continue to trade strongly through the tough market. My EPS estimates are 20% above the consensus average for FY25E and FY26E.

Investment conclusion

Even my optimistic forecasts leave the stock on a still-expensive 31x June ’26E P/E multiple. One likely needs to believe in my estimates or even higher in order to buy the stock today.

Reece has traded at wildly varying multiples of next 12 month consensus EPS in the recent past – see below. It is obvious with hindsight that 2022 offered a great buying opportunity for Reece. It also seems obvious that now is not a good time to buy.

As mentioned at the top, Reece trades too expensively for me today. I will follow its progress with great interest.

Ferguson looks far more reasonably valued, at 21x forward P/E assuming no earnings growth this year. It is a lower-risk proposition than Reece. The long process of divestment and relisting from UK to US means that Ferguson is still a less familiar name to US investors than would otherwise be the case.

If I had to buy one of the two stocks today it would be Ferguson. For the time being I hold neither.

Next week

Beijer Ref and Watsco make for a great contrasting pair. The key difference in HVAC wholesale is far greater power held by a concentrated group of OEMs than is the case in plumbing wholesale.

For those who have had more than enough industrial distribution already, please be patient and wait a fortnight for something completely different!