Market research is a sleepy backwater within the broader advertising and communications industry. Media owners, agencies and brand clients need to target the right audiences and track the effectiveness of their efforts, but nobody wants to pay more than necessary to do so.

Ipsos, Kantar and NielsenIQ-GfK are the global incumbents that provide an integrated research offering to the biggest bluechip clients.

Twenty years ago, YouGov came in as a challenger to the big providers, offering quicker and better survey-based research at far lower prices. Their original insight was to assemble an online panel of consumers. This allowed them to generate results rapidly and cheaply. They also proved, not least via amazingly accurate election result predictions, that their quality was equal to or better than traditional face-to-face or phone survey methods.

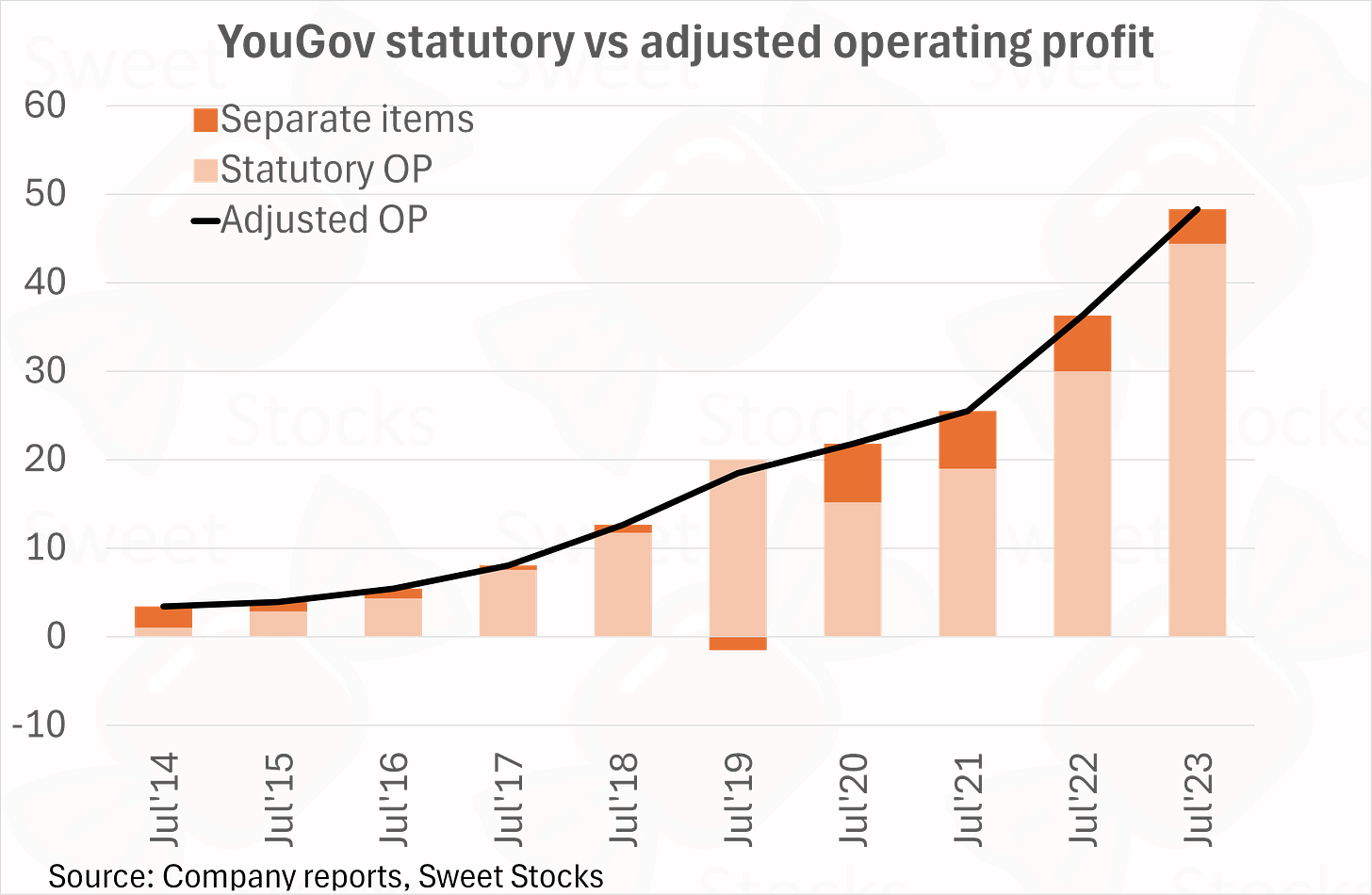

As my chart below shows, YouGov bootstrapped sales at a 28% CAGR to reach over £250m. Profitability also shot up, and the market cap peaked at over $2bn in 2021.

All this was obliterated a fortnight ago, on June 20, when the company issued a terse profit warning. A sales slowdown and high costs translate to a 38% cut to the full year EBIT projection – a shocking magnitude of downgrade just six weeks before the financial year end.

One key root cause? YouGov itself is now being undercut by even newer, hungrier rivals.

In this post I tell the story of YouGov’s founding and long run of success, as well as the warning and the path forward.

My conclusion is that the shares are not obviously cheap on new estimates. And absent a bargain price, I am not comfortable buying the shares right now, in the post-warning information vacuum, as they face increased competition, higher costs, uncertain management change and unknown debt.

At the least, I will wait for the year-end trading statement due on July 31 or the full-year results due on October 15.

It is possible that I will choose not to participate at any point, as I am not sure whether YouGov has a sustainable competitive advantage or a reliable path to profitable growth.

Feedback is very welcome. Is it possible to catch falling knives such as YouGov within a disciplined investing framework?

Background

Stephan Shakespeare and Nadhim Zahawi founded YouGov in 2000. Shakespeare’s background was in teaching (including a spell as headteacher) and politics (serving the Conservative party as an adviser, pollster and candidate).

While political opinion polls were the original product that made YouGov famous, commercial market research was the key business driver from the start – contributing two-thirds of the miniscule £2.9m revenue in FY05, for example.

In April 2005 YouGov floated on the AIM market, raising £3m. From 2006 to 2008 YouGov went on an M&A spree, with poor timing and near-disastrous results. They spent £24m on businesses in Dubai, Germany, Denmark and the US. Fortunately these were funded by a £26m equity raise. Still, they gave the young company severe indigestion, as profits and free cash flow hovered around zero for the next four years to FY12.

When Zahawi left to become an MP in 2010, Shakespeare became CEO. He assembled an entrepreneurial and scrappy team that righted the ship, honed the product line-up, and instigated a remarkable run of profitable growth through to FY23.

In August 2023, Shakespeare passed the CEO baton to Steve Hatch, whose background in Meta and WPP makes him the first external executive of any note at YouGov. Shakespeare remains on the board as non-executive chair. The CFO, Alex McIntosh, is a company veteran who first joined in 2007.

The recent profit warning raises obvious questions about who is responsible for what went wrong, and who is empowered to fix it. Can the new CEO work effectively alongside the founder in the chair and the CFO with 17 years of service? Does he need to bring his own people in?

Products and services

YouGov sells syndicated data products as well as customised research services. In the past these were reported in three segments, as follows.

Data Products are at the heart of YouGov’s profitable growth story. Margins are potentially very high because the same products can be sold to many clients at no incremental cost.

· BrandIndex is the key data product that tracks and analyses brand perception across 16 vital brand health metrics. This is a subscription product that provides daily updates, based on 25,000 interviews conducted each day, allowing clients to react to changes and make prompt decisions. The product is delivered digitally via access to a dashboard. Both brand owners and agencies might subscribe.

· Profiles is the second key data product: an audience intelligence tool that allows clients to use an extensive profiling database of thousands of consumer metrics. This product is especially purchased by large agencies that will rely on the profiles in their work with all their clients.

Data Services is the segment offering fast-turnaround research, giving clients speedy answers to urgent questions within 24 hours or less based on a custom survey. Margins can be lower given the degree of hand-holding and service required, and the non-recurring nature of any single request. However, clients often repeat these studies across different geographies or at later dates, which bumps up the margins as the initial set-up work has already been done.

Custom Research is the segment carrying out any kind of deep-dive research project, akin to what Ipsos, GfK and Kantar offer. Custom trackers are a profitable subset of custom research, since the main cost is at set-up and a contract would typically run on a multi-year basis.

In FY23 YouGov reported a £59k average revenue per client, emphasising that these are enterprise-grade products and services.

Segment financials

Going forward, YouGov will combine Data Services and Custom Research into a single segment called “Research”. This makes sense, as both have in common an element of customisation and lower margins compared to Data Products. For simplicity, I also present past data showing the combined Research segment.

My two charts below show the ten year track records for the two segments on the same scales. It is clear that Data Products, though much smaller in sales terms, reached far higher margins than the Research segment, thanks to its inherent operating leverage.

My next chart shows both segment profit contributions together, along with the large central cost line, which includes panel costs. More on this below.

Regional and sector splits

The US has become by far the most important geography for YouGov in sales and profit terms. Shakespeare has told the FT he wants to relist the business in the US, although any such redomicile is off the table after the warning.

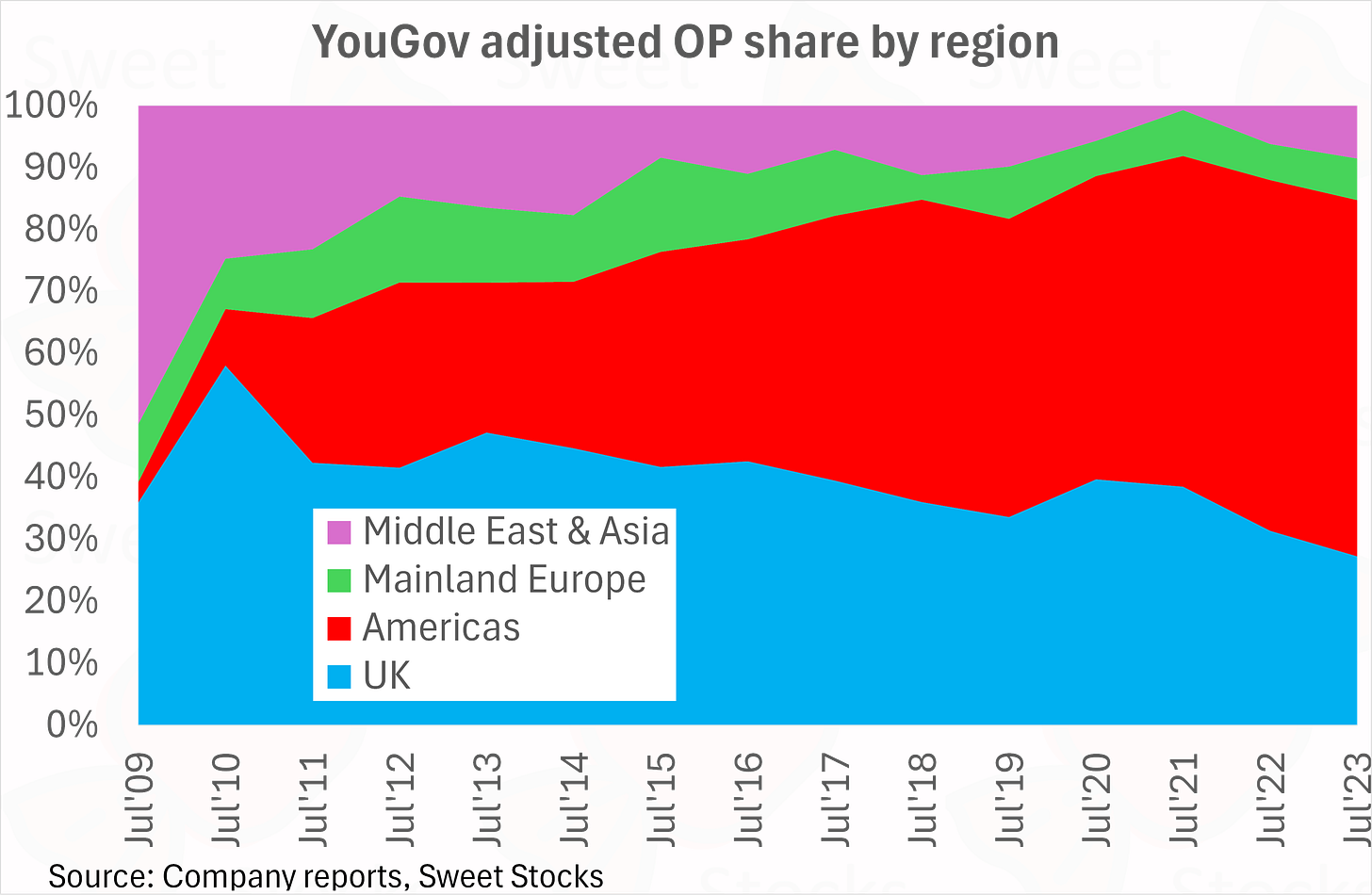

My chart below shows Americas contributing 57% of total profit in FY23, with the US accounting for essentially all of this.

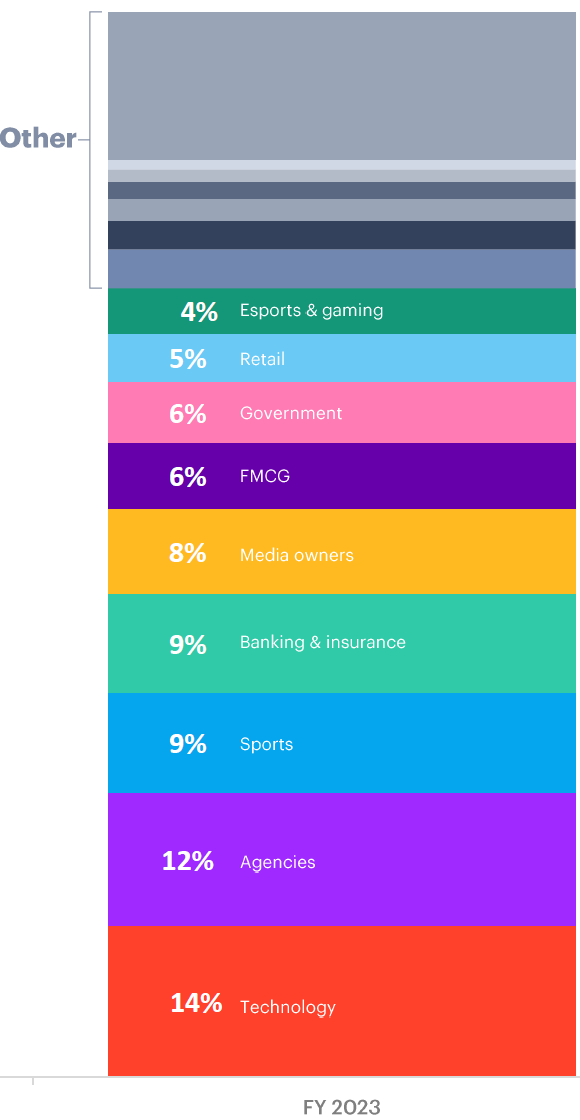

By sector, YouGov has a distinct profile compared to the industry. It under-indexes to big spenders such as FMCG companies and automakers (less than 10% combined), which have tended to stick with the traditional providers.

Instead, YouGov is strong in niches such as sports (9% of total) and what they call ‘Banking & insurance’ (also 9%). The latter includes sales to hedge funds, who may hope to glean alpha from the daily BrandIndex product. See FY23 split below.

Panel mechanics

At the heart of all YouGov’s products is its proprietary panel of 26 million members in 59 countries worldwide. People join the panel to earn some money, or possibly because they are bored and enjoy taking surveys and sharing their opinions. The incentives are modest: a ten minute survey might award 50 points, and 5,000 points are required for a £50 payment.

The cost to YouGov of running its own panel is two-fold. Panel incentives are accrued and expensed in cost of goods sold. A provision on the balance sheet reflects incentives due but not yet paid out. For example, in FY23 YouGov expensed £19m of panel incentives, and paid out £18m during the year, leaving an £18m balance at the year end. This was only 42% of the maximum potential liability of £43m, based on their historical experience that many panel members give up before reaching the minimum threshold where they can cash out their points. (12-month panel retention was 59% in FY23, illustrating the hefty ongoing recruitment effort that is needed just to maintain a panel at the same size.)

Aside from reward payments, YouGov also incurs expenses to manage and enhance the panel, some of which it capitalises and then amortises through the income statement. In FY23 YouGov capitalised £16m of intangibles, about half of which related to panel enhancements. It amortised £21m of intangibles.

It is critical for profitability that all parts of the business use the internal panel as their data source whenever possible. From time to time, YouGov purchases data from external sample providers, e.g. for a country or demographic their own panel cannot cover. These external data collection costs are always dilutive to gross profit margin.

My chart below shows the evolution of gross margin over time, with internal panel incentive expense static and external data costs falling over time as the two components of COGS.

Panel fraud and data quality issues

In the last couple of years the risk of panel fraud has become a hot industry-wide topic.

At worst, ever-more-sophisticated bot farms are suspected of systematically infiltrating survey panels by the thousand, in order to harvest the rewards on an industrial scale, providing meaningless survey responses along the way. A cat-and-mouse game of countermeasures is in train.

At the less drastic but still serious end, individual respondents may “straight-line” or “speed-run” surveys, or generally not engage with the questions in good faith, leading to poor quality data.

YouGov has attempted to position itself as an industry thought leader in addressing these issues. (For example, it recently started removing BrandIndex results from panelists that claimed not to be familiar with brands like Google or Nike while being familiar with less-well-known peers. Remarkably, such implausible answers were previously not filtered out, if no other hallmarks of fraud were present.)

YouGov’s vertical integration gives it far greater control than peers that outsource sample to third party providers. Nonetheless, the whole discussion may have provoked widespread client unease about the use of survey research in general. Stricter controls could also lead to higher costs (if genuine, high-attention panelists demand higher rewards).

Bolt-on acquisitions

Over the last ten years, YouGov has acquired a dozen small bolt-ons to add new technologies or regions. Typically YouGov pays a low up-front consideration with a higher element of contingent consideration, deemed to be staff compensation costs under IFRS. See my table below for details.

Some of the acquisitions have been more successful than others. Portent in particular morphed into two valuable parts of the product offering: YouGov Signal, which offers proxy TV show ratings across linear and streaming, and YouGov Safe, which merges behavioural data such as browsing / streaming with panel survey data.

SMG, on the other hand, has taken a disappointing turn. In the two years post acquisition, SMG delivered strong results ahead of plan. YouGov paid £18m in total consideration, most of this going to Frank Saez who remained with YouGov, first as MD of YouGov Sport and then (from May 2021 to November 2023) as Chief Revenue Officer for the entire group.

Most recently, Frank Saez has left YouGov, and has joined two former YouGov colleagues in launching an ambitious new data intelligence agency for the sports and sponsorship industry. In my view, this is an unfortunate development that suggests the SMG book of business may not be deeply embedded at YouGov. The new start-up may pose a significant headwind if it is able to tempt clients across from YouGov.

Two different members of YouGov’s sports team, Scott Horowitz and Tracy Schoenadel, also left YouGov to start their own separate sports research boutique in 2022.

Examples like these reduce conviction in YouGov’s differentiation in a fragmented industry where barriers to entry are sometimes low and relationships matter.

YouGov excludes contingent consideration expense from adjusted operating profit, reporting it instead as a separate item. In my view, these start-up-style acquisitions are similar to acqui-hires. I prefer to focus on the statutory profit, since the contingent consideration paid is a cash cost incurred in growing the business. The difference has been material, at around 15% on average – see my chart below. In FY24E, there will be a huge separate item of >£20m reflecting CPS acquisition costs. There will also be meaningful amortisation of acquired intangibles for the first time from FY24E on.

Free cash conversion has been excellent, as long as one uses statutory profit as the denominator. See my chart below showing 103% cumulative conversion over the past decade.

However, the modest absolute amount of free cash generated by YouGov to date was completely out of proportion to the high market cap of recent years. FCF only just reached £39m in FY23 on my definition, supporting a market cap of maybe £1bn if one generously paid a 25x multiple on the promise of good growth. This implies that the peak share price and market cap seen back in 2021 were always absurd, and hence should not be anchored on as a potential rebound target.

Instead, the large profit warning means it will be some time until the existing business can even return to £39m of free cash flow.

GfK Consumer Panels

In July 2023 YouGov announced by far its biggest acquisition ever – the €315m purchase of GfK’s Consumer Panel Services (CPS). The deal completed on January 9 2024, funded by a £50m equity raise and a €280m four-year debt facility.

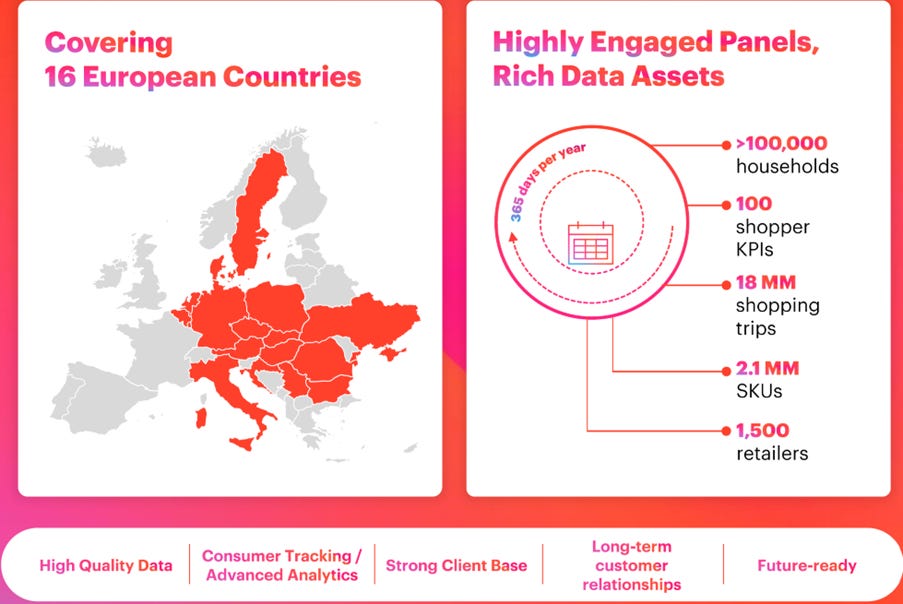

CPS is a household purchase data business. A panel of >100k households in 16 European countries scan QR codes to upload details of what they buy from 18 million shopping trips per year. This behavioural data is much sought after by the longstanding FMCG and retailer clients, with 66% of revenue from recurring subscription business and strong revenue retention.

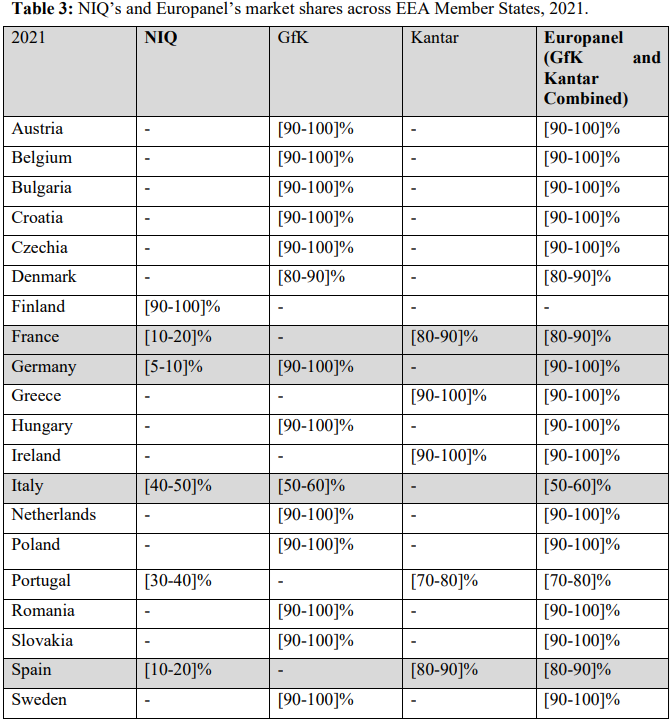

CPS has been established for over 60 years and has an extremely favourable entrenched position in its markets. In fact, its only competitor in most cases is NielsenIQ, with CPS typically in a much stronger position than NIQ.

Advent-owned NIQ announced its intention to merge with KKR-owned GfK back in July 2022. The European Commission launched a full market investigation, and determined that the CPS business must be divested – specifically to a buyer with experience in the market research sector, but not so big as to raise competition concerns – in order to permit the merger.

This forced disposal explains why such a high quality asset was available at an eminently reasonable price. YouGov got a bargain. The €315m purchase price equated to a sub-10x multiple of trailing FY22 EBITDA pre-synergies. Revenue and adjusted PBT in the year to December 2022 were €134m and €24m. A trailing 2.4x EV/sales multiple for an 18% EBIT margin business was attractive given the high quality entrenched quasi-monopoly characteristics. (The EU’s report, linked above, gives extensive details of just how difficult it would be for any would-be entrant to build a rival panel to challenge CPS.)

YouGov has provided no figures for CPS’s historic growth rate. We should assume it has been a mature asset. YouGov wants to re-accelerate growth by combining CPS data with its own data such as on financial transactions. YouGov also ambitiously hopes to replicate the CPS offering in the US. The latter plan is unlikely to work in the near term, in my view, given the high barriers to entry.

CPS does not cover all of Europe. It is strong in Germany, Italy and a host of smaller countries in central and eastern Europe, but it has no panel in France, Spain, Portugal, Greece or Ireland (or the UK).

Instead, as per the table below, CPS has a longstanding co-marketing arrangement called EuroPanel with Kantar, whose complementary household panels cover the countries CPS is missing. This serves the many customers who want data covering the whole of continental Europe.

YouGov enjoys a transitional services agreement with GfK, running for 12+6+6 months (at YouGov’s option), to ensure a smooth separation and integration process. This was mandated by the EU to maximise the chances of the divested business thriving as a strong competitor to NIQ-GfK.

However, YouGov will want to integrate CPS onto its own platforms as quickly and efficiently as possible. From a technology point of view this will doubtless be a significant challenge for YouGov’s IT team. AlixPartners is engaged as the external consultant advising on the overall integration.

Street expectations for CPS are varied. Deutsche Bank forecasts £28m of FY25E EBIT, and UBS goes for £23m, compared to the £20m historic figure for 2022. The lower number looks more realistic to me, considering the maturity of the asset and potential teething pains from the integration.

The profit warning

On June 20, YouGov issued a brief but devastating warning. For the full year to July 2024, total adjusted operating profit was to be £41-44m. Prior consensus was £68, meaning a downgrade of 38% at the mid-point.

However, the first half was long since complete. Therefore the downgrade applies to H2 alone, which makes it even bigger in percentage terms. As per my chart below, the warning implies a c.63% downgrade to H2 profit, compared to the prior consensus forecasts.

With hindsight, the company’s prior target was wildly over-optimistic. The H1 result for the core business was already down sharply yoy, as shown by the dotted blue line in my chart above. Only a first-time contribution from the big CPS acquisition enabled them to report growth.

By segment, Data Products is the worst affected. After it reached an adjusted OP margin of over 40% in FY23, YouGov started complaining of intensified price competition from nimble competitors that raised a lot of money in 2021 and now need to deliver growth. Specifically, YouGov flagged the issue on the H1 analyst call in the following key exchange.

Hannah Jethwani (IR)

And then on Data Products margin, there's -- you talked about gross margin pressure. Why is that happening? And is that temporary or meanwhile?

Steve Hatch (CEO)

I think it is temporary. We have seen a bit of pricing pressure, and that is in part. We have one competitor in our profiles product, and one competitive to BrandIndex, where both raised significant amounts of money in 2021, 2022. And what we're seeing is they're reducing their prices pretty dramatically as they're trying to trade through those valuations and that, of course, is impacting us. We are seeing clients looking at getting better at comparing prices […].

What we do see, if we lose out to those other competitors is actually clients do come back later on when they understand the difference in quality. It's often a very difficult thing for clients to understand when you're assessing a new product is one is the actual underlying quality when you start using it in [earnest ], are you getting the insights that you would be expecting and we do have strong confidence that our products continue to be the highest quality in the market.

Since the warning, there has been no public investor call or transcript. But according to UBS’s Beatrice Allen, who has spoken to YouGov management, the two culprits in question are GWI on the Profiles side and Morning Consult on the Brand Index side (in the US only).

GWI is a UK-based business with five offices worldwide. Previously known as Global Web Index, it was founded in 2009 by Tom Smith. In February 2022 he raised $180m from Permira’s growth fund (and promptly splurged on billboards in London and New York!). GWI’s revenue was £55m in the year to March 2023, and the accounts mention “over 650 people”. But the operating loss was £18m, and EBITDA was also negative by £12m. On Glassdoor the company recently confirmed it has been restructuring with the loss of over 40 jobs.

Morning Consult raised $60m at a $1bn valuation in June 2021. At that point its run rate revenue was “more than $100m”. Already by January 2023 it laid off 47 staff, followed by more in June 2023 and another 90 in January 2024.

Deep discounting by GWI and Morning Consult has been discussed by the company and the sellside as if it’s a new issue in 2024. But interestingly, back in September 2021, a former YouGov employee (Sanford Cameron, Former Global Head, Sales, New Business at YouGov plc until April 2020) discussed the same issue on a Third Bridge call. The relevant extract is below.

What do clients like about Morning Consult? What do they like about GWI on the profile side?

SC: Morning Consult, specifically, as I said, was a later entrant into the market, probably 6-7 years ago.

They’re cheap. They’re significantly less expensive than YouGov, so, if you’re paying a premium, and YouGov is able to demand that, and still is able to demand that, for years and years and years because there wasn’t any apples to apples competition, and Morning Consult comes in, and, again, is good enough or fit for purpose, you can pay 30% of what you’re paying with YouGov. You’re okay with them not having a proprietary panel, and you’re okay with not being able to do re-contacts, and you’re okay with a variety of things that YouGov is able to provide that they are not, then they did a good job of slipping in and locking up some key accounts, certainly on the political side and media side.

YouGov’s got its Bloomberg and Huffington Post, and, I believe, its CBS. Morning Consult locked up NBC, and the things that line up against Bloomberg and Huff Post, so they got in very, very quickly, they got some really big wins which gave them credibility, so they’re somebody to deal with if you’re YouGov. GWI a little less so. It’s profiles only. Again, they don’t have their own proprietary panel, which is something we used to sell against them. The number of variables they provide in their profiles is significantly less than YouGov, so you can’t slice and dice the data quite as well. If the data they have is what you’re looking for, it is significantly cheaper, and they’re a bit of a thorn in our side, particularly internationally. [Third Bridge Forum, September 2021]

If the discounting has been going on for at least four years, and is now beginning to bite in terms of sales and margin impact, then it is tough to have confidence in a rapid rebound in Data Product margins.

A profit warning of this size must have multiple causes. Beyond the Data Products weakness, YouGov also called out “challenges in EMEA, particularly in the DACH region”. This is surprising, given that the whole of Mainland Europe was only 21% of sales and 7% of profits in FY23, with Germany and Switzerland a subset of this.

A key component in that region is the December 2021 LINK acquisition, shown in my deals table above. This Swiss business appears to be troubled, based on a number of flags.

· The last annual report contained a £2.9m reduction in the value of LINK customer contract intangible assets “due to information gathered within the first year of operating LINK”.

· LINK was noted to be dilutive to the Custom Research segment margin in FY23.

· YouGov engaged KPMG to conduct a post-acquisition review of LINK, which suggests there are issues with the business that require review (see schedule from AR23 below).

· Benedikt Lüthi, LINK’s CEO, was promoted to YouGov’s CEO for EMEA in November 2023, while continuing as LINK chair. However he left the group altogether in May 2024, shortly before the profit warning announcement, according to his LinkedIn profile.

From the sheer size of the warning, one suspects that there are other sales pressures across different regions — perhaps linked to high turnover of key staff.

Beyond the sales and margin weakness in Data Products and beyond, YouGov warned that it had “invested in the business to set up for an acceleration in growth in H2”. When that acceleration never came, the cost increase weighed heavily on profits. The well-briefed UBS analyst explains that the new CEO made a number of strategic hires and expanded the sales team in the US, in the name of improving “commercial rigour”. Budget requests for additional research, marketing, IT and legal headcount were also approved across the group. UBS understands that those investments resulted in a whopping c500bp of the margin dilution.

In addition, increased use of third party data for material contracts with important tech clients were said to cause a c200bp impact on gross margin.

Estimates and valuation

The warning gave us new FY24 numbers. But there is total uncertainty about FY25E and beyond. Sell-side analysts have a wide range of guesses, with FY25E EPS anywhere from 27p to 42p, and FY26E from 33p to 49p.

I strike my estimates towards the low end of the range.

· In the near term, the appalling H2 run-rate that we reviewed above poses risks for H1 of FY25E.

· In the mid term, I am hesitant to forecast a return to strong sales and profits for YouGov, in case the competitive environment remains tougher than expected. Can we blithely assume that GWI and Morning Consult will stop discounting so heavily? Or that clients will be disgusted with their product quality and return to YouGov at higher prices?

On this basis, I put the stock on 19x adjusted P/E in FY25E, falling to 16x in FY26E – see my table below. This is not super-cheap, especially as I made the point above that I would rather penalise for some of the adjusting items and look at an even lower earnings per share figure that is closer to the statutory EPS.

Meanwhile, the balance sheet had £163m of net debt at January 2024. The leverage ratio was 1.6x, including a pro forma allowance for CPS EBITDA of £23m.

The company made no comment whatever on debt or cash flow in the profit warning statement, which is not reassuring. Free cash flow in H2 is likely to have been minimal if not negative, given the low implied profits and cash costs of CPS integration. With a sharp reduction in 12 month EBITDA, the leverage ratio might rise to as high as 2.2x at July 2024, in my view.

YouGov’s new debt package has covenants. The company has not disclosed the levels: 3.0x would be customary.

My base case is that debt does not become a serious problem for YouGov. But high and uncertain debt does reduce my comfort level to step in early and play for a potential recovery, even if I was otherwise so inclined.

Annex – broader competitive universe

YouGov declared themselves part of the $48bn market for ‘Established Research’ in their May 2023 Capital Markets Day. That gives them an approximately 1% market share.

The key long-term question for potential investors to decide is whether YouGov, as a tiny player in a fragmented and overall slow-growing market, have a differentiated positioning and a sustainable competitive advantage.

In exploring that question further, it may be worth exploring the offerings and track records of the many broad peers. I provide two resources as a starting point.

Below is my own selection of peer logos, large and small, that overlap with YouGov in some way.

For further discussion of competitors and innovators, I commend the GRIT Green Books, which are freely available online. GRIT provides an annual ranking of the 50 most innovative suppliers in the industry, based on a poll of >2,000 industry participants.

The 2022 edition ranks YouGov in 49th position (see table below), an improvement from 2021 and 2023 when it was unranked. The low ranking likely reflects YouGov’s low unaided awareness in the US, an issue that the CEO mentioned on the H1’24 analyst call.

My feeling is that the uncertainty of the elections in the US, also in the UK and Europe; coupled with the fear of companies to continue investing even for fear of a recession has paralysed the purchase of YouGov services.

Because in the end the company's big bet is the US, where a large percentage of its income and investment comes from.

On the other hand, when analysing other comparable companies, there has not been such a slowdown (YouGov's fiscal year is as of 31 July), although they have commented that the US market is weak.

By the way, great article!

Have you looked at System1 Alex? It could also be nibbling away at Brand Index for example.