Campari update – after the profit warning

(CPR.MI, $8.1bn market cap, $35m ADVT, 43% free float)

Running update. It’s good to be back after my running break. I completed 58 yards / 242 miles in the backyard ultra championship, which got me second place in the UK team. A full race report is here.

Programming note. The next Sweet Stocks reports will be published on a fortnightly rhythm, i.e. on 18th November and 2nd December. This is because I will be interspersing my Substack write-ups with private research commissioned by a fund management client for its internal use.

Contract research. If your organisation would also be interested in commissioning me to write research on names of your choice, then please get in touch by replying to this email, or via LinkedIn.

In August I published an enthusiastic write-up of Campari. I mentioned I had just started a position. The stock price at the time was €8.12.

Now, after a shock CEO exit and a nasty profit warning, it is €6.20. The sharp fall demands an update, which I provide below.

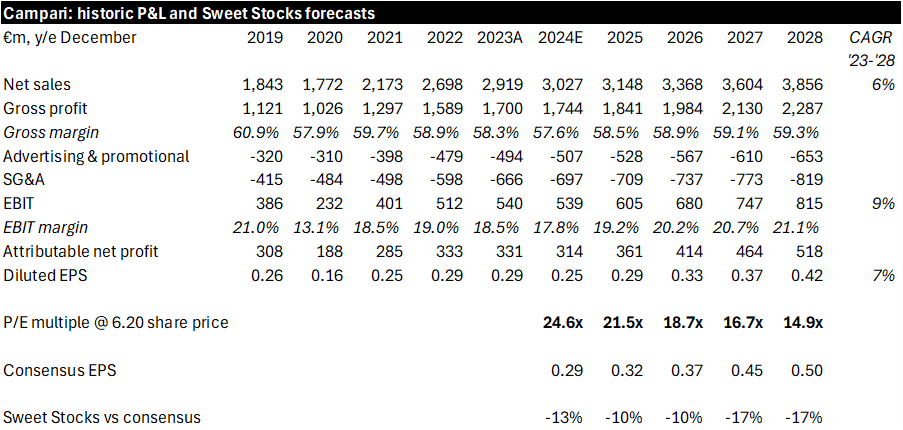

In terms of my own trading, I added to my small starter position in September after the CEO exit, and again last week after the profit warning. I view the valuation as more attractive now than in August, given that the 24% share price fall has outpaced the c.18% average cut I have made to my earnings per share estimates. Estimates should also now logically be closer to the trough.

The major controversy for both Campari and its spirits peers remains the extent to which structural rather than cyclical pressures might be at work. In the US context, cannabis and GLP1 weight loss drugs are discussed, while reduced drinking by the younger generation is a globally applicable fear. I see no specific new evidence in favour of structural threats to spirits. However, only the arrival of a convincing cyclical rebound will quell the doubts.

Feedback is welcome as always.

Surprise CEO departure

In September, Campari’s CEO Matteo Fantacchiotti abruptly resigned after less than six months in post. His successor has not yet been announced. For the time being, veteran CFO Paulo Marchesini is serving as interim Co-CEO, alongside the equally veteran General Counsel Fabio Di Fede, who has been with Campari since 1999. The chairman and majority owner Luca Garavoglia continues to preside as always.

Fantacchiotti’s exit came days after a fuss over comments he made at a Bank of America conference. He spoke bearishly about a “very soft” industry environment, which took the stock down 6%. At the time, a spokesperson explained the comments away as nothing new and not specific to Campari.

In light of the recent profit warning, we can see that the former CEO’s comments did in fact contain signal rather than noise. His dismissal was likely related to more fundamental matters beyond merely speaking out of turn.

Profit warning

Fast forward to last Tuesday night, and Campari released dire Q3 results. Organic sales fell by 1.4%, adjusted EBIT fell by 18%, and the outlook for the rest of 2024 and for 2025 was lowered drastically.

Two specific factors behind the weak Q3 sales were Hurricane Beryl’s impact on Jamaican rums, and poor weather conditions and destocking in Italy. Beyond this, almost every market and brand was slightly weaker than hoped or expected, with “softness across the board”.

Campari was at pains to argue that the softness was industry-wide, with Campari Group brands outperforming or in line across different markets. The company deployed a tsunami of data comparing shipments to sell-out trends by country and brand to make this point.

Reassuringly, the three key brands I spotlighted in my report, which account for nearly half of sales between them, did perform solidly in Q3. Aperol was flat, Campari brand +4% and Espolòn tequila +13%.

Of course, this implies mathematically that the other half of the portfolio collectively suffered a 5.6% fall in Q3. This was led by Jamaican Rums down 19% on the hurricane impact, while Wild Turkey fell 12% and underperformed the category as Campari tried to hold onto price despite intensifying competition. Grand Marnier and Skyy vodka were also weak.

Campari announced a reorganisation of its brand management model into four ‘Houses of Brands’: namely House of Cognac & Champagne, House of Aperitifs, House of Whiskeys and Rum, and House of Tequila. This entails something of a management reshuffle, with appointments to head up each House currently underway. It also prompted speculation that the underperforming Skyy vodka brand might be sold, given the conspicuous absence of a ‘House of Vodka’. However, Marchesini clarified in the Q&A that Skyy is not for sale.

Courvoisier has now been inside the Campari perimeter for five months. It contributed €8m of revenue in May and June, followed by €27m in Q3. This is a very low quarterly sales figure indeed compared to Courvoisier’s stated historic annual sales of USD249m in 2022, or even compared to the 33% decline that was mentioned for the first ten months of 2023. It certainly looks like Campari chose the wrong time and / or paid the wrong price for the Courvoisier deal.

My updated chart below puts the -1.4% organic sales fall in peer context. Pernod Ricard posted a -5.9% fall in the same July to September period, while Diageo and Brown-Forman are yet to update. Remy Cointreau, not shown on the chart, had a grisly -16.1% organic fall for the same quarter. Certainly in sales terms, Campari is not necessarily doing worse than any other industry peer.

Given this context, Campari’s top line performance does not cause too much concern.

However, the margin impact is more severe, given the effects of operating deleverage and some ill-timed cost step-ups.

Gross margin fell by 10bp on a reported basis in Q3, and is guided to be weaker again in Q4, due to unfavourable mix and lack of absorption of fixed production costs. I now assume a 57.6% gross margin for 2024 as a whole, which would be the weakest since 2016.

Advertising and promotional costs were already below 17% in 2023, and will remain below 17% this year, before returning to above 17% in 2025E or 2026E. It would be tempting in the short term, but a mistake in the long term, to skimp on A&P spend in order to hit profit targets.

SG&A cost is where the real damage to margins was done. The SG&A ratio jumped by 210bp in Q3, as the large capacity expansion projects I described in my first write-up added to depreciation and operating expenses. This will repeat in Q4, before a cost-cutting programme aims to roll SG&A back by 200bp in the three years from 2025 to 2027.

Combining all the above effects, the adjusted operating margin will fall by nearly 200bp in 2024 as a whole, having already fallen by 170bp in the first nine months.

If there’s a silver lining, it is that exceptional items (which Campari calls other operating income and expenses) were lower in Q3’24 compared to a year earlier. Q4 should also see lower exceptionals vs the high comparator. This softens the fall in the statutory EBIT margin, which I use in my model, to just 80bp year-on-year.

It is worth noting that Campari provided rather detailed guidance and modelling inputs for 2025E, as part of the lengthy conference call following the profit warning. This was a bold attempt to reassure, which will pay off only if the numbers remain the same in February when Campari next reports.

I now model 3% organic growth for 2025E, followed by a recovery to 7% growth in the outer years. This is obviously a key assumption: if the industry slump became so prolonged and steep that organic growth was flat or negative throughout 2025E and into 2026E, then the stock would continue to underperform from here.

My new estimates, below, reflect cuts of c18% to EPS for each year. I now sit roughly 11% below consensus for the three main forecast years. (Consensus for FY27 and FY28 comprises a much smaller number of contributing analysts, and may be stale.)

The stock has de-rated to below 20x next twelve month P/E on the basis of consensus, even if certain analysts may not yet have updated their numbers.

On a five year view, the profit warning has erased Campari’s prior outperformance against peers, and returned it to the middle of the pack.

Is declining alcohol consumption a recent thing? I'm a little surprised how much attention it is getting now the stocks go down. Looks like the Courvoisier acquisition has been a complete disaster.

The more recent minority acquisition in Capevin Holdings for EUR 82.6M shows that the company might continue down that path (or it was the reason the CEO was sacked).

The Aperitif segment is clearly the crown jewel. Not sure I like their Diworsification strategy into competitive fields in which they do not have a clear competitive advantage.

Congrats on the 58 yards, Alex! Spectacular achievement. Well done.