Daiwabo is Japan’s top IT wholesale distributor. This is an excellent business that has delivered an 18% profit CAGR over the last ten years, thanks to market share gains, efficiency-driven cuts to SG&A, and a new cloud subscription management service.

These drivers remain in place, setting up a 12% profit CAGR in the next three years to March 2027, according to my estimates.

Meanwhile, stagnant fiber and machinery divisions accounted for less than 10% of sales and profits, but have weighed on Daiwabo’s results at group level, and have given an impression of a hopeless conglomerate to the casual observer. Last month Daiwabo disposed of the fiber division, reducing group headcount by more than 50%. The disposal will transform Daiwabo’s balance sheet and returns profile for the better.

The new slimmed-down balance sheet will first be revealed in three days’ time, on Thursday May 9th. Alongside the publication of full year results and next year’s forecast, I see a strong chance that Daiwabo may announce a new buyback at the same time.

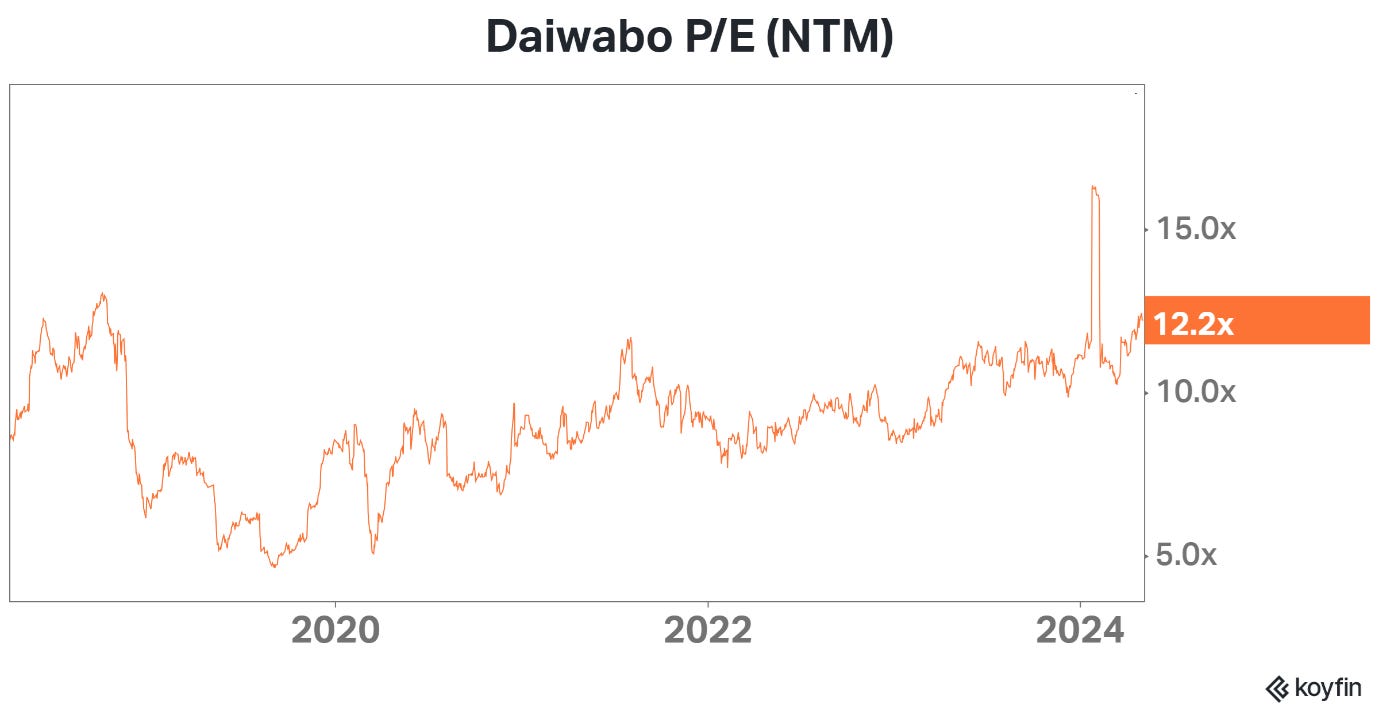

At c10x Mar’25E P/E, the stock is absurdly cheap relative to the quality growth on offer. Unlike other Japanese net cash plays, Daiwabo already has a strong track record of compounding earnings and the stock price at double-digit rates, as well as attracting new investors and gradually re-rating. All this looks set to continue.

For the stock to keep working nicely from here, no major inflection or miraculous change of heart by management is required. I expect an IRR of c15% plus any additional tailwind from re-rating.

Disclosure: I am a holder of Daiwabo, having followed the name closely for a number of years.

As always, feedback is most welcome. I will follow up on Twitter after Thursday’s results — find me at this link.

Background

Daiwabo was established in 1941 through the merger of four cotton spinners. In the 1950s fiber profits were strong. But as the fiber business matured, Daiwabo sought to diversify. The company began operating bowling alleys in 1963, hotels in 1971, and golf courses in 1975.

Fortunately, Daiwabo Information System (DIS) was founded in 1982 to diversify away from textiles, and it was a great success. In 1997, DIS was separately listed as an equity method affiliate of Daiwabo’s.

In 2007, the aggressive Murakami-linked fund Effissimo accumulated a 43% stake in DIS, in what looked like greenmail-type tactics. Daiwabo resolved the situation by paying a premium to delist DIS and bring it back into the group as a 100%-owned subsidiary.

DIS immediately contributed 61% of group operating profit in the year to March 2010. This rose to 91% by Mar’23, as DIS profits grew seven-fold while the fiber and machinery divisions flatlined.

DIS business model

DIS is Japan’s #1 IT wholesale distributor. DIS sits between 1,400 vendors and 19,000 sales partners who are its direct customers. These sales partners include resellers, system integrators, mass retailers, ecommerce operators and any other business that sells IT equipment to end users.

DIS plays an essential role in the value chain. It handles logistics, billing and value-added services such as kitting and setup of PCs according to the end customer’s specifications. Most of all, DIS acts as a single platform to efficiently connect the vendors and sales partners, who would not be able to do business directly without incurring significant unwanted overheads on both sides.

DIS has a network of 94 sales bases nationwide, allowing it to be close to its sales partners. This is a key point of differentiation from its main rivals, who focus on the Tokyo and Osaka metropolitan areas.

In terms of logistics, DIS has five distribution centres, including two huge and highly automated warehouses serving the Tokyo and Osaka regions. DIS holds around 30,000 products in inventory out of 2.4m total listed SKUs, allowing it to offer next-day delivery for popular items.

DIS has an outstanding long-term track record. For the charts below, I have knitted together DIS’s results as a separately listed affiliate from 1999 to 2009 with the post-2009 segment results under 100% Daiwabo ownership.

It is clear that an already respectable performance accelerated meaningfully in the last decade. Three key drivers were responsible. I discuss each in turn below.

Driver #1: market share gains

DIS distributes a full range of IT products. The sales breakdown is 45% PC main units (including PCs, laptops, servers, tablets, smartphones etc), 39% peripherals and services, and 17% software.

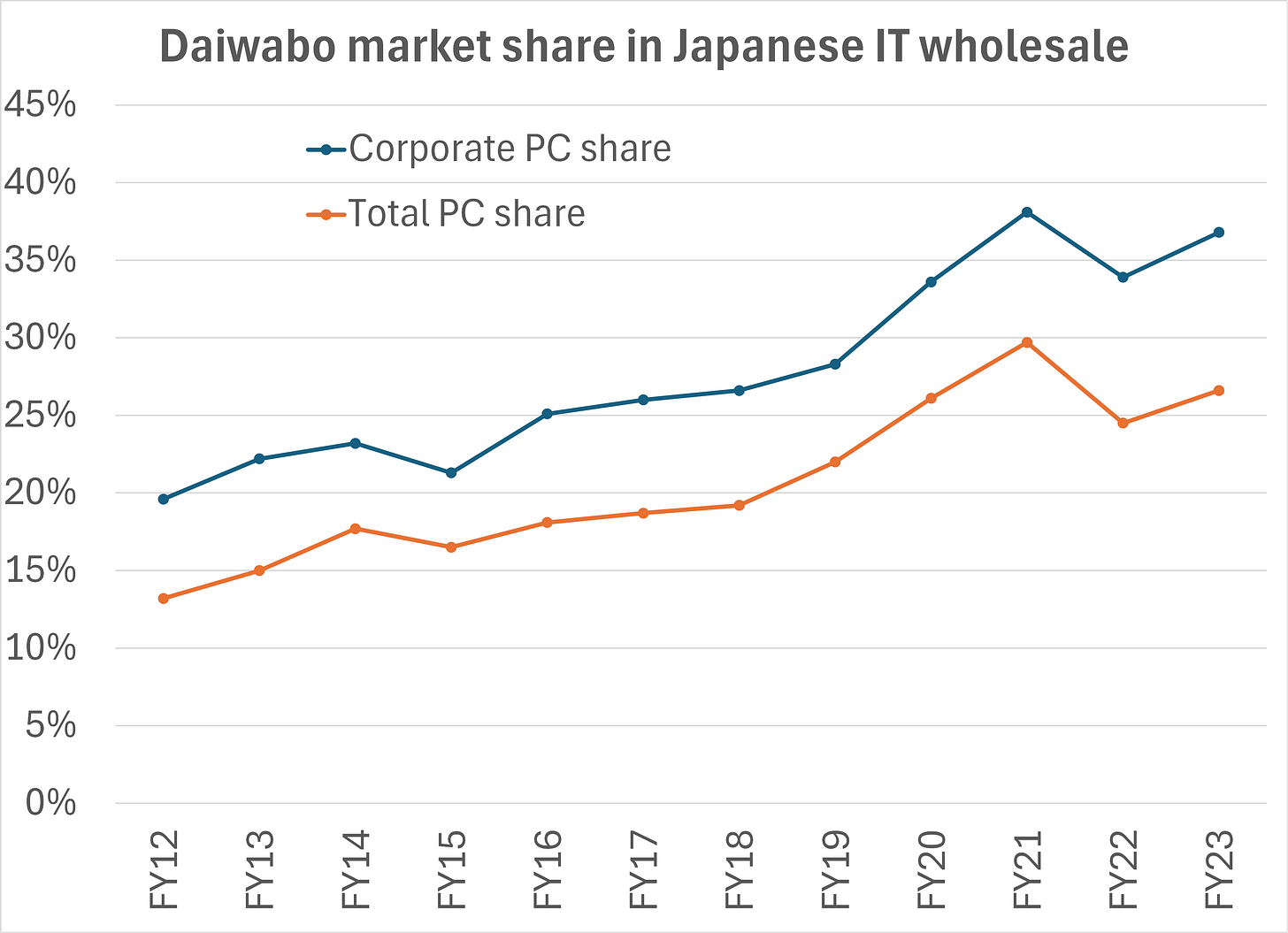

For PC volumes, where market share data is available, DIS has a 37% share of the corporate market and 27% share of the total market. The chart below shows that DIS roughly doubled its share over the last decade.

Daiwabo’s explanation for this remarkable market share success story is given below.

“Daiwabo believes that its market share has expanded over the past 10 years largely because an increasingly high number of vendors have recognized the value it provides (sales channels providing connections to its 19,000 partners and heightened efficiency of sales operations) amid a period of restructuring in the PC industry. Particularly high was the number of foreign vendors that, instead of relying on direct sales, adopted sales strategies utilizing the company’s sales channels in Japan as the share of domestic PC sales attributable to PCs marketed under foreign brands expanded. The company’s market share expanded as growth in the number of vendors with whom it maintains a business relationship led to an increase in partner companies.”

(Source: Shared Research’s report. This is commissioned and authorised by Daiwabo, and effectively serves as additional English-language IR materials.)

DIS’s key competitors are Softbank’s SB C&S business and TD Synnex’s Japanese subsidiary, as well as Otsuka (4768.T) and Canon Marketing (8060.T). It’s worth a closer look at the #2 and #3 players to assess the competitive intensity that DIS faces.

SB C&S has been owned by Softbank Corp (9434.T) since May 2017, when it was transferred from Softbank Group (9984.T) for Y107bn as part of the larger internal reorganisation. We have sales and profit data for the business from 2018 onwards. SB C&S was 38% smaller than DIS in the year to March 2023 (revenue of Y517bn compared to Y829bn). In profit terms, SB C&S enjoys a higher margin than DIS (4.7% compared to 3.1%). It has a relatively greater exposure to the consumer segment, compared to DIS which is tilted to the corporate segment.

TD Synnex in Japan is much smaller than DIS. The listed US parent does not break out the Japan revenue, but revenue was Y97bn in the year to November 2018, and Y119bn in Nov’20. Headcount has grown by c25% since then. The history of this business dates to 2010, when Synnex acquired the Marubeni Infotec business from Marubeni Corp. Revenue was $1.1bn on acquisition. Total consideration was just $119m, suggesting a loss-making business that had to be restructured post acquisition.

Driver #2: efficiency-driven margin gains

My chart below shows DIS’s gross margin, SG&A ratio and operating profit margin over time. The gross margin has been flat in the last decade, while it is the falling SG&A ratio that has driven the impressive operating margin improvement.

Daiwabo deserve credit for a deliberate drive to cut expenses and improve efficiency. Fittingly, DIS’s own software system, DIS-NET, is said to be in excellent shape, allowing DIS to handle increased volumes without significant headcount increases. Warehouse automation has also contributed to efficiency gains. Clearly the market share gains and the SG&A improvement are linked, with good operating leverage achieved over fixed costs.

Driver #3: cloud software services

DIS has developed a cloud software distribution business called iKAZUCHI. This innovative platform allows DIS’s sales partners and their end customers to easily manage their cloud software subscriptions from multiple vendors. Consolidated billing and automated updates are key advantages for the customers. For Daiwabo’s shareholders, iKAZUCHI revenue is recurring and also comes at a higher-than-average gross margin, making it a highly attractive driver of growth and also of earnings quality over time.

iKAZUCHI revenue is not disclosed on the face of the financial statements, but is provided in Daiwabo’s presentation materials. I’ve collated the quarterly sales and yoy growth in my chart below.

iKAZUCHI’s sustained 35-40% yoy growth rate is impressive. The number of vendors on the platform has expanded from 65 at March 2021 to 120 at September 2023, which in turn attracts more sales partners to use iKAZUCHI.

iKAZUCHI amounted to 3.2% of total DIS sales in the nine months to December 2023, a figure that will continue to grow over time.

An additional 8% of total DIS sales is classified as other subscription revenue. This line has been growing at c.10% per annum, which is also helpful.

Fiber disposal and impact

A year ago, in May 2023, Daiwabo announced that it was considering spinning off the fiber business. Then in November 2023, Daiwabo announced the disposal of the business to a private equity firm, Aspirant, after a competitive process. The sale completed on March 27, 2024, just six weeks ago. The consideration was Y9.5bn in cash for an 85% stake. (The purpose of retaining a 15% stake was to enable a period of cooperation for a smooth transition.)

The significance of this disposal is hard to overstate. It was the founding business of the group, and despite contributing just 5% of profits, it had 2,840 employees, more than half the group total.

Daiwabo’s adviser on the transaction, Houlihan Lokey, puts the sale in useful context as follows:

Over the years, the main business has shifted from the fiber business, the original foundation of the group (currently 7% of total revenue), to the IT infrastructure distribution business (92% of the same), due to the gradual decline of the Japanese textile market. Despite this, its capital expenditure in FY18–22 accounted for 51% of the total, resulting in low capital efficiency of the overall Daiwabo Group. This led to [the] decision to divest Daiwabo as part of its ROIC-oriented corporate strategy, and to further focus on the IT infrastructure distribution business.

My chart below illustrates their point about excessive capex at the Fiber business. Y24bn of capex from FY10 to FY23 was not money well spent. Free cash flow will be appreciably stronger without this drain going forward.

The disposal has triggered a write-down of the business’s carrying value, for an Y18bn extraordinary loss for the year to March 2024. Total assets of Y63bn and net assets of Y32.5bn will be deconsolidated.

Capital allocation and corporate governance

Back in May 2021, Daiwabo published a mid-term plan that was commendable for its clear focus on ROIC. The target was to maintain ROIC at 11-12%, a level that was initially exceeded only thanks to the COVID boom in IT spending. See chart below. This is my own calculation, with a harsh denominator that does not credit the cash on hand.

The recent disposal of the historic and founding fiber business was a big step, and a solid demonstration that Daiwabo is prepared to take difficult decisions to improve ROIC as per its stated strategy.

(For those readers who are less familiar with Japanese value investing – this proof is a big deal. It is by no means a given that a company will actually follow through on the warm words placed on paper in a mid-term plan!)

Daiwabo’s plan also contains a cash allocation policy that includes share buybacks. In the three years since, Daiwabo has conducted buybacks amounting to 2.8% of the total shares outstanding.

Daiwabo had net cash of Y32bn, equivalent to 13% of market cap, at December 2023 (see chart below). This was before completion of the fiber disposal. Year-end net cash, to be revealed on Thursday, should be stronger. A new share buyback would be a logical and welcome announcement.

Valuation

My estimates are shown below.

Note that I show underlying earnings for FY24E. The company will in fact report an exceptional write-down of the fiber business, and a very low but positive EPS on a statutory basis.

For FY25E, the strong expected growth reflects the end of the post-COVID adjustment phase (after record IT equipment volumes were shipped in 2020-21). There is also a benefit from inflation, including the additional imported inflation that results from yen weakness.

In FY25E and especially in FY26E, there will be an additional benefit due to Microsoft ending support for Windows 10 on October 14 2025. Typically the support end date results in a forced upgrade cycle to Daiwabo’s benefit. Previous instances were when Windows 7 support stopped on January 14, 2020, and when Microsoft ended extended support for Windows XP on April 8, 2014.

My estimates put the stock on just 10.6x Mar’25E P/E, or 8.5x if adjusting for net cash. This looks far too cheap, in my view. To those who would argue that a Japanese IT wholesale distributor should always trade on a low multiple, I would make a couple of points.

First, as the valuation history chart below shows, Daiwabo has already been re-rating steadily for several years, from absurdly low single-digit levels. I conclude that mistrust of Daiwabo’s earnings quality was initially extremely high, and they have been steadily winning over the doubters, a process that is likely to continue in my view.

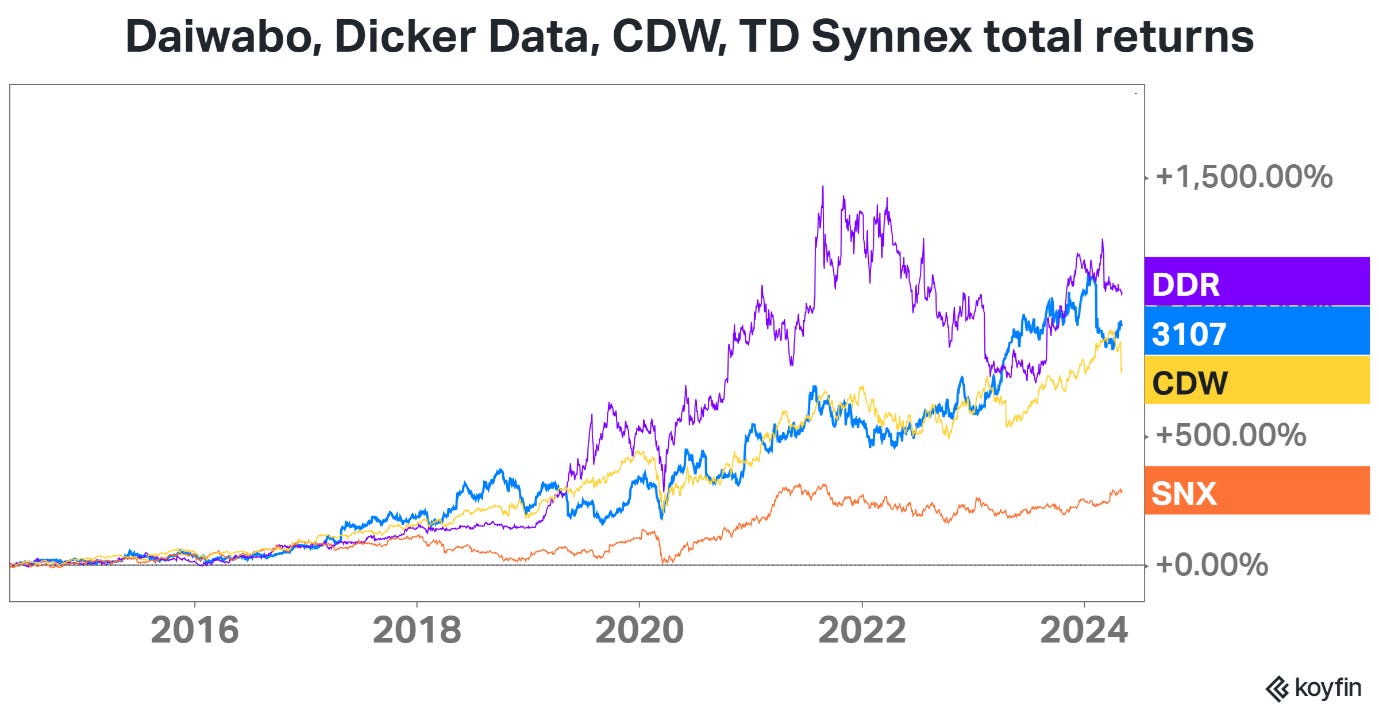

Second, in terms of relevant global comps, I would point to Dicker Data of Australia. Dicker Data operates the same business model of a wholesale distributor, and has achieved a similar track record of excellent earnings growth over time. Dicker has used the same playbook as Daiwabo: gaining market share over time thanks to operational excellence, and adding software and value-added services at higher margins. Dicker Data trades at 21x Dec’24E P/E. This suggests plenty of upside to Daiwabo’s 10x multiple, if it can finish its transition to a pureplay wholesaler and continue to execute well.

TD Synnex of the US trades at a low multiple but is not such a relevant comp. While it tries to operate the same business model, its earnings have been pancake-flat. I suspect that TD Synnex and US peer Ingram Micro (which is due to IPO very soon) are being beaten by CDW, a category killer business in the US which has been able to disintermediate the wholesale distributors in part. (CDW is also a major customer for TD Synnex and Ingram.) Crucially, CDW is not present in Japan, and there is no equivalent available, as this Reddit thread confirms.

Great writeup Alex! Well researched and summarised. Thank you for writing it

Was there a management shift that led to a greater focus on profitability from 2013 onwards? Coincides with the weakening of the Japanese yen.