This write-up was also published as a guest post on Investment Talk, where Conor writes about a wide range of investment topics, with particularly strong coverage of consumer-facing businesses. Many thanks to Conor for hosting me.

After a warm-up week of swimming, rowing and archery, the Olympics has now kicked into top gear with the start of the athletics.

Among the hottest of track and field gold medal prospects is Armand ‘Mondo’ Duplantis of Sweden. Later this evening (Monday 5th August), the 24-year-old will contest the men’s pole vault final as the defending champion from Tokyo. Duplantis is by far the greatest pole vaulter of all time: his 6.24m world record is eight centimetres higher than anyone else has ever vaulted.

What’s the relevance to today’s stock write-up? As the photos below show, Duplantis achieved his previous triumphs wearing kit supplied not by Nike or Adidas, but by Craft.

Craft is a Swedish sportswear brand owned by New Wave. It is attempting to follow the playbook that Hoka and On Running used with such spectacular success to take share from Nike. This includes sponsoring grassroots athletes, gaining distribution in the specialty running channel, and offering distinctive running shoe products with niche technical performance claims.

Craft revenue was €200m in 2023, and New Wave has a target to double this by 2027. If they succeed, the stock would have multibagger potential. For comparison, Hoka revenue was $223m in the year to March 2019, and reached $1.8bn by Mar’24. The market cap of Hoka’s owner, Deckers Outdoor, went from c.$4bn to c.$22bn on the back of this growth.

Can Craft scale to become anything like as successful as Hoka? They have a chance, but the odds must be against them.

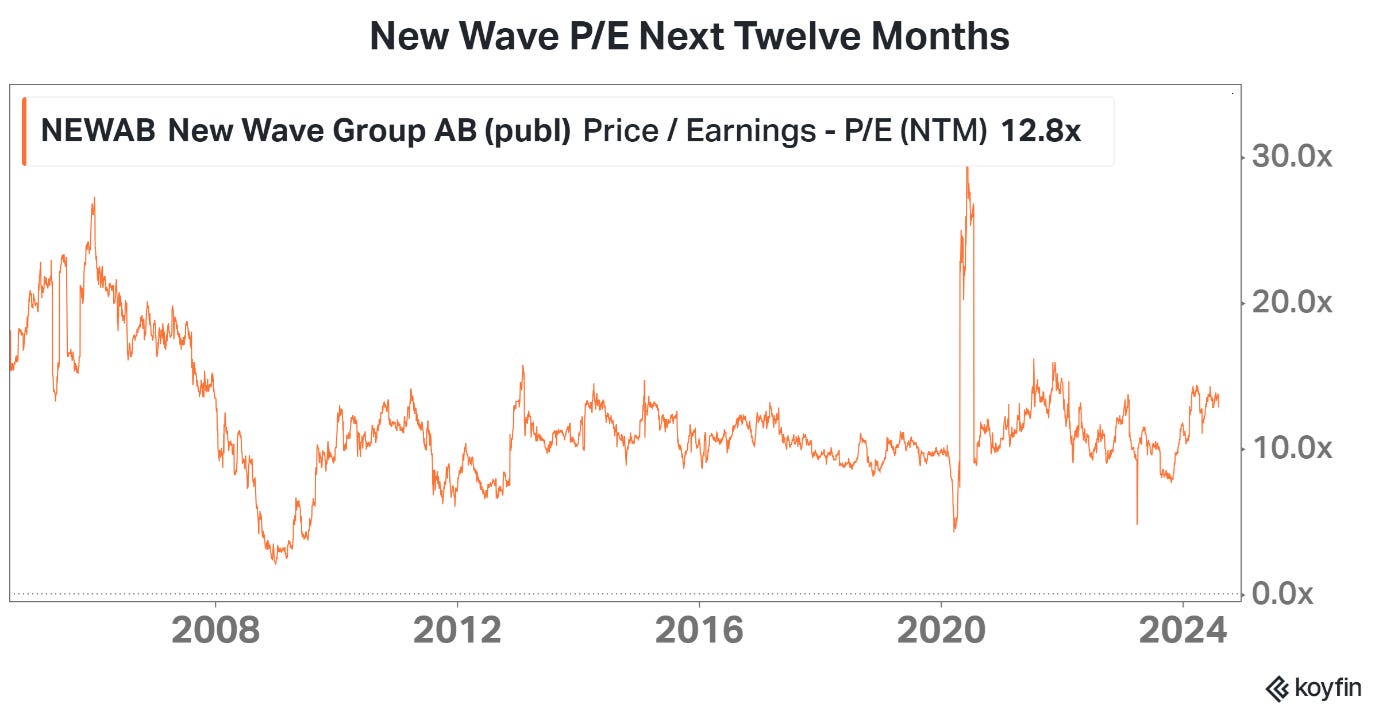

Fortunately, New Wave’s core business is a profitable and cash-generative operation that underpins the stock’s modest 13x P/E valuation without any heroic assumptions about Craft’s growth.

In this post I cover New Wave’s background, its business model, and the ambitions for Craft.

I do not own New Wave shares. I see Craft’s likelihood of hitting the jackpot à la Hoka as low. Meanwhile, the core business saw margins jump recently in impressive fashion. This sets up possible downside risk in any economic slowdown.

Nonetheless, I consider it a business of fundamentally decent quality. It is virtually unknown and unowned outside of Sweden, which could change if they keep executing well. I’ll continue to track their progress with interest.

What is New Wave?

New Wave is a supplier of premium branded products into the corporate promo and retail markets.

See my 4imprint write-up for a description of the two-sided promotional products industry structure. Suppliers like New Wave are responsible for designing, importing and fulfilling orders, while distributors like 4imprint are responsible for winning orders from customers.

New Wave was founded in 1991 by Torsten Jansson, who remains the controlling shareholder and CEO. The IPO was in December 1997.

Jansson now owns 34% of the capital and 82% of the votes. This is thanks to the split A share and B share structure. Jansson owns all of the A shares, which carry ten votes each. The B shares that are listed and traded carry one vote each.

New Wave is a rarity in Europe for still being founder-controlled after over thirty years. Jansson has built an impressive track record that suggests he is a skilled manager and capital allocator.

New Wave follows the decentralised model that is familiar to admirers of the Swedish serial compounders. The group is made up of around 65 operating companies.

Key acquisitions have contributed to New Wave’s development. Craft itself was acquired in 1996. In 2007 they bought Cutter & Buck, which was listed on Nasdaq at the time. This provided a strong platform for New Wave’s US business.

However, M&A takes second place to organic growth for New Wave. For example, the group undertook no meaningful acquisitions between 2011 and 2022, during which period it achieved strong organic growth.

Jansson has set out clear values for New Wave, which have remained consistent over twenty years from the 2003 annual report to the 2023 edition.

· Find cheap and simple solutions: a penny saved is a penny earned

· It takes hard work to outperform competitors

· Employees in a decentralised organisation must dare to take initiative and learn from their mistakes

· Customers must be happy

The track record

My chart below shows that New Wave has sustained an excellent 10% revenue growth rate over 23 years since the turn of the century. The recent doubling of profit margin is also shown.

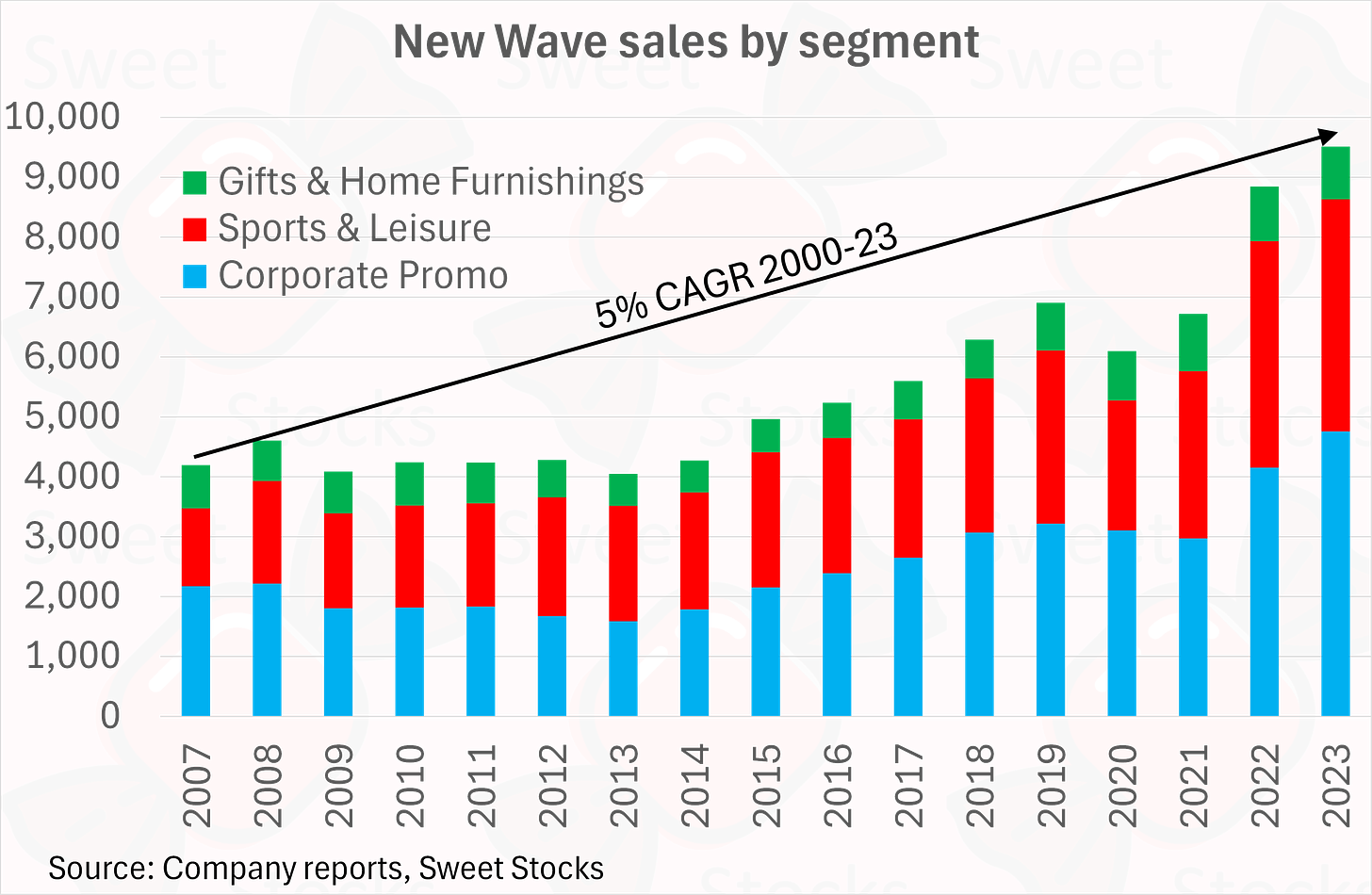

Sales by segment are shown in my next chart from 2007. The Corporate and Sports segments both contributed well to growth. (The overall growth rate was just 5% over this period, as the business went through a prolonged post-GFC stagnation before resuming a growth trajectory from 2014.)

My next chart shows segment profit. Again, the Corporate and Sports segments pull their weight, while Gifts is shown to be marginal to the group.

The final sales split is by region. My chart below shows that Swedish and Nordic sales have gone from half the total in 2007 to less than a third today, with the rest of Europe and North America both delivering disproportionate growth. (Canada is the most important contributor to Other.)

Corporate Promo

New Wave’s proprietary brands in the Corporate segment are shown below. They cover a range of clothing, bags and accessories that can all be embroidered or printed with the end customer’s corporate logo. Uniform and workwear is a specific niche that is offered.

New Wave acts as a wholesaler, selling these items to promotional goods distributors for onward sale to their corporate end-customers. Success factors include relationships, a high price-quality ratio of the products, and New Wave’s high inventory and service levels, with an ability to ship products in all sizes and colours to end customers within 24 hours.

The various European promo markets are fragmented by country, so it takes patient and focused efforts to translate the strong #1 position in Nordic markets to meaningful success in the Benelux countries, or in Italy, for example.

Items are purchased from third party suppliers in China, Bangladesh, Vietnam, India and Egypt according to New Wave’s own designs. New Wave has its own purchase offices in each of these countries, with a total of 177 staff to monitor production and ensure quality control.

Sports & Leisure

This segment includes Craft, as well as the US golf brand Cutter & Buck, and a number of specialised brands shown below. (Ski gloves are a strong point.)

Different to the Corporate segment, 71% of Sports sales are through regular retail channels rather than the promo market. This includes Craft runnning shoes and apparel sold through specialty run stores around the world. Several New Wave brands also have a strong position in sports retail chains in Sweden and other Nordic countries.

The 29% of Sports sales that go through the promo market are mainly teamwear for sports clubs of all kinds. This is an attractive business where individual athletes (or their parents) must buy the strip from the club’s nominated supplier.

Six key European teamwear competitors are shown below. All are privately held.

Craft growth strategy

Craft’s heritage as a Swedish sportswear brand dates back to the 1970s. It was originally renowned for its performance underwear and base layers. The launch of running footwear came far more recently, within the last five years.

In February this year, New Wave held a capital markets day. The presentations, transcripts and videos can be found here. The centrepiece was the Craft presentation, with the ambition to become a global running shoe brand alongside Hoka, On, Brooks or Merrell.

New Wave doesn’t systematically disclose Craft brand revenue. But we know it was €120m as of August 2019, and €200m as of October 2022. Revenue was still said to be >€200m as at February 2024, implying a flattish last 18 months.

Craft position themselves as “the gravel bike of running shoes”, with hybrid trail / road shoes that are suitable for multiple terrain types in a single run. A tie-up with Vittoria, the renowned bicycle tire brand, backs up this claim.

Craft’s various models of running shoe have gained some awards and credibility. See, for example, the range of reviews and discussions on Reddit’s RunningShoeGeeks board.

Craft shoes are currently sold at a discount to the high prices commanded by Hoka and On.

Craft continues to sponsor national federations, with the logo currently being worn by Finnish and Danish athletes at the Paris Olympics. (Ironically, Sweden has switched from Craft to Puma.)

Craft has also assembled an Elite Run Team of sponsored athletes who compete at UTMB, Western States and other renowned ultramarathon races. Their YouTube channel features typical inspirational documentaries.

Unfortunately, nothing that Craft is doing is guaranteed to lift it from an also-ran brand into the top tier. Right now there is a lack of evidence of rapid growth that would confirm an exciting trajectory.

Financials

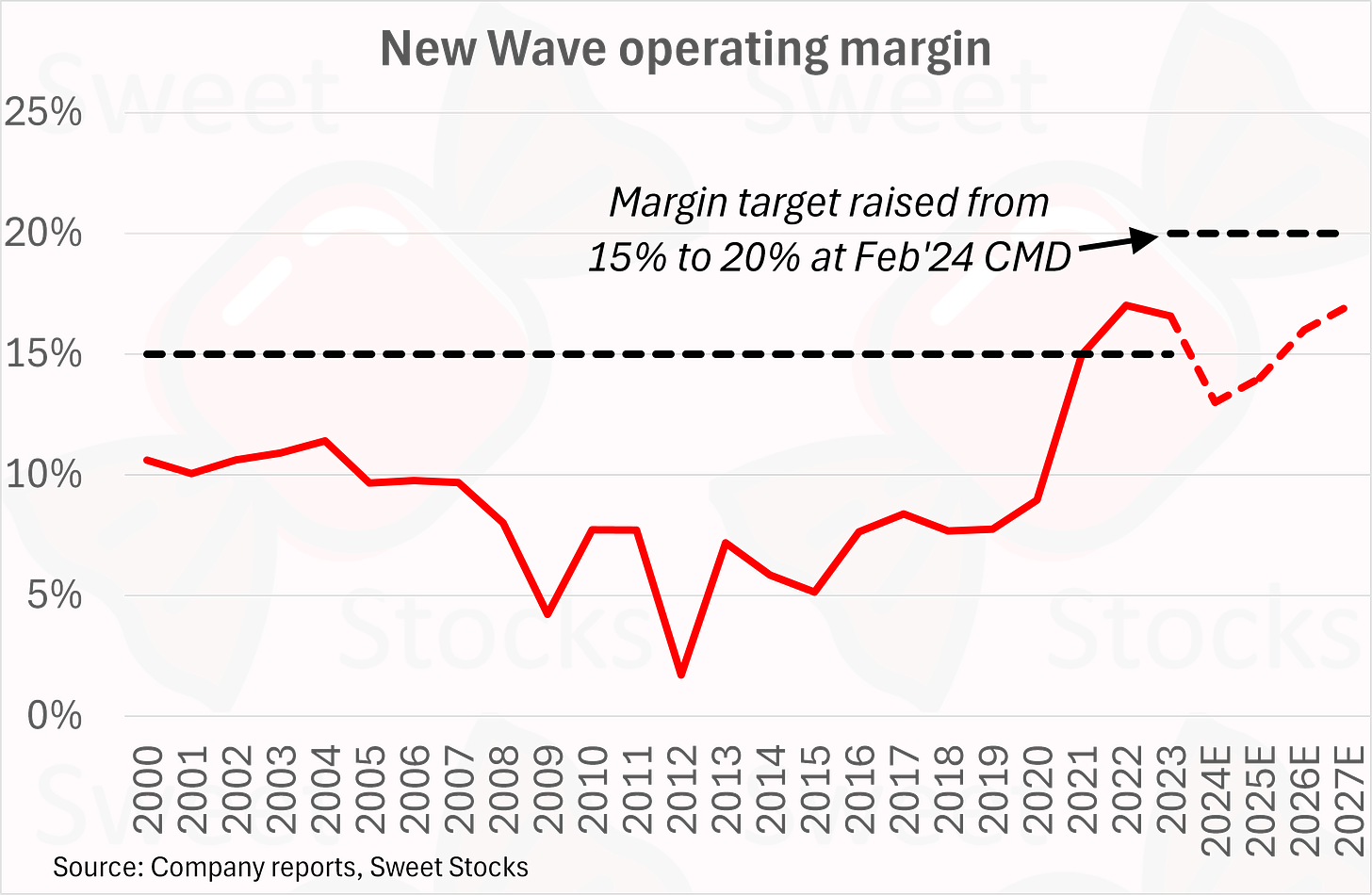

The correct normalised operating margin is a key issue for New Wave. Ever since IPO, the target was a 15% margin, but this was never reached in practice.

In the most recent three years, from 2021, New Wave finally exceeded its longstanding 15% margin target. Management promptly raised the target to 20% at the Capital Markets Day held in February 2024. I illustrate this on my chart below.

The ambition is admirable. And if management could actually deliver a 20% margin in the near term then the stock would be a great buy.

However, I see the recent 17% margin as a short-term peak that carries near-term downside risk. In Q1 of 2024, the operating margin already fell from 14.7% to 9.3%. While the timing of Easter had an impact, I forecast a fall in full-year margin to 13% for 2024E. I then pencil in a gradual recovery to the the prior 17% level in the outer years, but note this is a low-conviction assumption in a name I do not hold.

Working capital is another key issue. As mentioned above, New Wave holds a lot of inventory. This is a deliberate strategy to secure sales with 24-hour delivery. The company is careful about avoiding fashion risk, and ensuring the stock is in evergreen products.

Specifically, the inventory days are above 400, as shown in the chart below. This is a somewhat alarming number.

New Wave’s strong margins ensure decent free cash flow and satisfactory ROIC despite the high working working capital. Free cash flow is shown below. Despite evident lumpiness, the business has delivered encouraging levels of cash in recent years.

New Wave’s return on invested capital was sub-par until 2021, when the much stronger profitability restored it to a respectable mid-teens level. If New Wave can sustain margins anywhere close to the new, high level then it will clearly be creating value well above its WACC.

New Wave’s balance sheet looks strong, with a modest net debt balance of around one times EBITDA. See my chart below.

At the end of 2019, debt was higher in relation to the business at that time, but New Wave was able to negotiate the Covid shock smoothly and without any need for an equity raise. In general the share count has been flat or declining ever since the 2007 purchase of Cutter & Buck, with all subsequent growth internally funded.

Estimates and valuation

I show my estimates in the table below.

As discussed above, 2022 and 2023 look like peak years for margins. I see 2024-25E as a consolidation period, which likely means there is no rush to own the New Wave stock.

Craft’s potential to deliver serious growth as a global challenger running shoe brand is the wild card. My model above shows Craft was an estimated 25% of group sales in 2023. I pencil in just a single-digit CAGR for Craft, as it will be tough for them to reach their ambitions in such a crowded marketplace.

However, if Craft could double its sales by 2027E as per the stated ambition, then Craft would become 38% of group sales, probably at attractive margins. This would generate a high level of excitement around the stock that would likely trigger a re-rating.

New Wave currently trades at 13x the consensus P/E estimate for 2024E, but 17x my lower estimate. My chart below shows that historically, New Wave has typically traded at a modest 10-13x P/E, as befits a small, illiquid and little-known promotional goods wholesaler. Fast-growing consumer sportswear brands typically trade at far higher multiples.