UPDATE: Web Travel Group and Webjet Group post demerger

(WEB.AX, USD2.0bn market cap, USD8m ADVT and WJL.AX, USD272m market cap, future liquidity unknown)

Programming note: in a departure from normal practice, this week’s post updates on a past write-up, something that will become necessary on occasion as time passes and significant changes take place. Normal service should be resumed with a new post next week.

Back in June, in my Webjet initiation post, I highlighted the Australian travel group’s proposal to separate its two divisions via a demerger.

Just three months and some swift work later, the separation is complete. The new spinco stock started conditional trading last Monday, September 25. Its first full day of normal trading is tomorrow, October 1.

This post provides updates on Web Travel Group (WEB.AX), now the home for WebBeds, as well as Webjet Group (WJL.AX), the new microcap pureplay Australian online travel agent.

A nasty profit warning in August, as well as higher-than-expected incremental corporate costs, have given both stocks a tricky start to independent life.

The share price at the time of my original post in June was A$8.84, equivalent to USD5.90. Today, the two demerged stocks trade for a combined price of A$8.35, equivalent to USD5.79. The USD-denominated investor has suffered only a 2% loss, which represents a fortunate outcome given the hefty August profit warning.

My own current positions in WEB and WJL are small and microscopic, respectively. The August warning has shaken my confidence in WebBeds’ growth trajectory. I reserve judgement on whether to bail out of these stocks at an early point, or possibly to build meaningful positions if a more compelling value opportunity opens up.

Please refer to the original post for the full and colourful background and fundamentals on both businesses. I’ll avoid repeating that material today.

Demerger booklet and corporate cost allocations

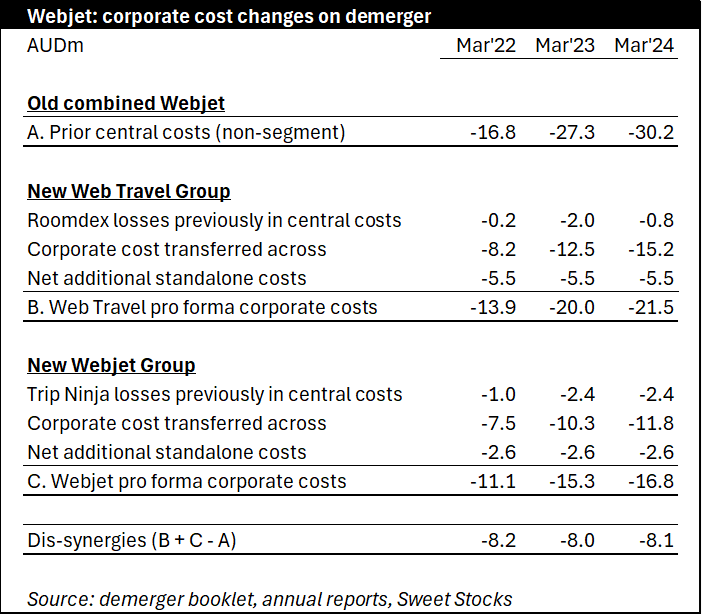

The Demerger Booklet provided pro forma financials for each business on a standalone basis. Compared to the segment data we already had, the main difference is an estimated net A$8m of additional standalone corporate costs.

This reflects the duplication of corporate functions to support a listed entity, board of directors costs, company secretarial costs, ASX listing fees, share registry costs, insurance and other incremental costs.

See the table below for details of the new corporate cost picture at each new entity.

Web Travel Group - WEB.AX

Web Travel Group, the WebBeds owner, retains the WEB ticker and the historic track record. It has a current market cap of USD2.0bn as a standalone business. As expected, John Guscic has stayed on as the MD of Web Travel Group.

The key incremental news for Web Travel Group was a negative update on WebBeds’ trading at the AGM on 29th August. Three unanticipated headwinds impacted Europe trading in June and July.

· The collapse of German tour operator FTI Group “resulted in approximately $2bn hotel inventory distorting the market and impacting margins”.

· Paris Olympics impaced demand for France.

· The UEFA Championship reduced German outbound travel.

As a result, and regardless of a rebound in August, the YTD progress of the business as at 25 August was significantly downgraded, compared to the position as at 19 May 2024.

In May, bookings and TTV were previously up 35% each, but in August they were up only >20% and >25% respectively. EBITDA was previously “significantly ahead” but by August was only “tracking ahead”. The TTV/Revenue margin for H1’25 will now be c.7%, a sharp decline vs the 8.3% level delivered in H1’24. They “anticipate margins to improve” in H2’25.

Needless to say, the update was disappointing, especially from a business that was seeking to establish its credentials as a reliable grower worthy of a high multiple. Major sporting events, as well as bankruptcies of weaker rivals, are normal events that should not knock a strong business off course.

To be fair to WEB, the broader environment for travel businesses has also been uncertain. Booking (BKNG) fell in early August after it provided weak Q3 guidance. In the same month Expedia (EXPE) also called out a “softening in travel demand” and cut its guidance.

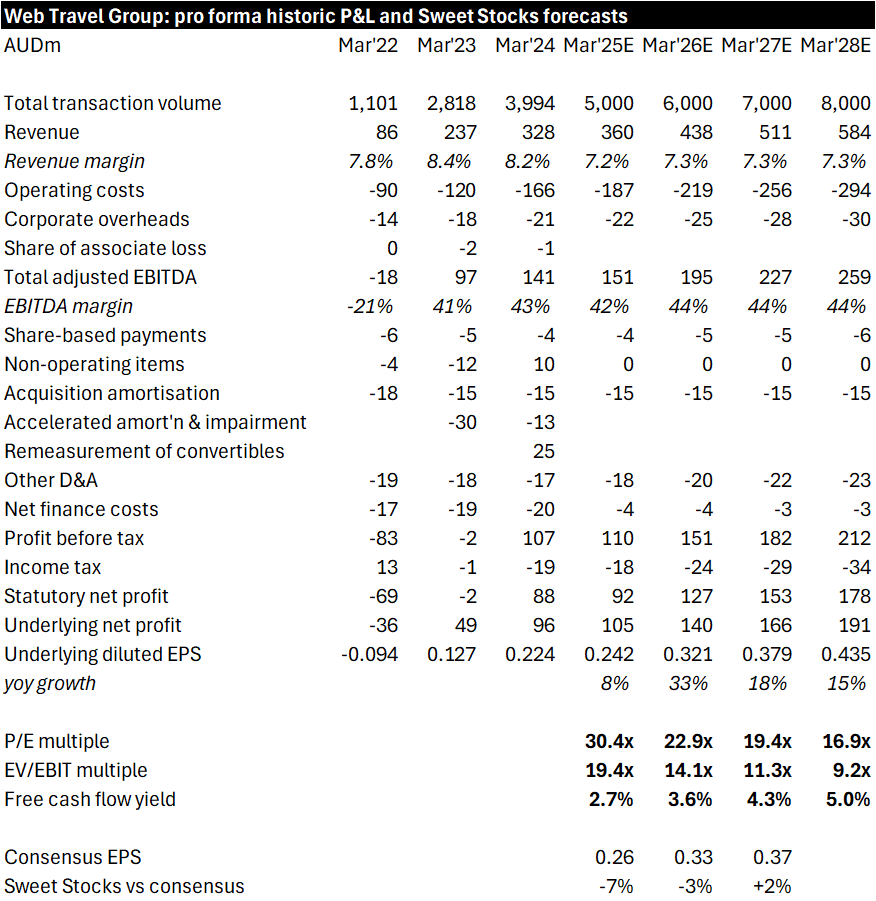

My new estimates for Web Travel Group on a standalone basis are shown below.

My new adjusted EBITDA for the years FY25E, FY26E and FY27E sits c.31% below the B2B segment EBITDA that I previously published in June. The allocation of corporate costs explains 30% of the downgrade, while lower TTV and a lower revenue margin explain the majority.

Specifically, I previously forecasted TTV growth of 31% in FY25E and for the revenue margin to remain at 8.2%. Instead, after the August warning, I now forecast 24% TTV growth and a lower revenue margin of 7.2%. Together, these cuts generate a A$70m downgrade to FY25E revenue. I am assuming a 71% drop-through to adjusted EBITDA, given the high fixed cost nature of the model.

As for valuation, I had anticipated that WebBeds as a standalone growth business would re-rate to the high 20s, and exactly this has happened – the new Web Travel Group now trades on 28.0x 12 month forward P/E based off new consensus forecasts, as shown below. Unfortunately, the EPS estimate in question is far lower than it could have been, due to August’s profit warning.

Webjet Group - WJL.AX

The Australian OTA business has been spun off into a new entity, with the ticker WJL and the name Webjet Group. This becomes a microcap with a current market cap of USD272m as a standalone business.

The new CEO of Webjet Group is Katrina Barry, who was previously a non-executive director. Her announcement in June was a surprise to me: I had expected David Galt, the CEO of the Webjet OTA business, to take the helm. He remains in charge of Webjet OTA, alongside his opposite number Darren Linton who remains in charge of the far smaller New Zealand business GoSee.

I doubt such a small, simple entity needs a fulltime group MD on top of the CEO of the main operational business. And top-heavy executive compensation costs are no longer affordable to a company that will have to adjust its mindset from being a billion dollar business to an order of magnitude smaller.

The new management team undertook a roadshow at the start of September to introduce themselves to investors. The presentation gives away little in terms of the likely strategy or direction that Webjet OTA will take. The slides on ‘Growth Strategy’ are not convincing given the business’s mature profile. “Focus on cost efficiencies” is also referenced and is a more convincing route to earnings progress, in my view.

At the AGM in August, Webjet OTA also suffered a disappointing update. The company warned of subdued bookings and price deflation in international flights. The YTD progress of the OTA business as at 25 August was worse, compared to the position as at 19 May 2024.

Progress in bookings deteriorated from flat to down 5%. TTV worsened from down 5% to down 10%. EBITDA is still tracking ahead of the same period last year, but presumably with less cushion, given the TTV deterioration.

Total corporate costs are far more onerous for Webjet than for Web Travel Group, given its much smaller size. The A$2.6m of “net additional standalone costs” equates to an 8% haircut to FY25E EBIT. Total corporate costs of A$16.8m are far higher than I would have expected, and represent a 30% haircut to the segment EBITDA of A$56m.

My valuation table below reflects unchanged flat segment EBITDA compared to my June estimates. Net profits and EPS are lower than I anticipated due to the higher corporate costs.

(Note that Webjet Group has 392m shares outstanding, with no potential dilution from the convertible bond, which stayed with Web Travel Group. Some data services may have missing or incorrect information in this regard.)

Webjet Group trades at c.18x current P/E multiple, somewhat richer than I would want to pay. This partly reflects the starting dowry of A$80-100m of net cash and no debt. The EV/EBIT multiple looks much more reasonable at 10x FY25E, reflecting the cash. Webjet Group will not pay a dividend until FY26, which is a curious delay.

I boldly forecast a 10% EPS CAGR. This is driven by 1% revenue growth, 3% segment EBITDA growth, a steady reduction in the inflated corporate costs (an optimistic assumption on my part), and operating leverage over fixed costs.

As for the new stock: WJL’s first day of conditional trading was September 23. The first day of normal trading will be tomorrow, October 1. The share price has already ranged from A$0.80 to A$1.21, a level of volatility that is not unusual for a new spinco.

It is interesting to note that the current share price of A$1.00 appears to be below the level that management expected (or hoped for), based on a range of A$1.20 to A$1.60 that they used in the Demerger Booklet for a sensitivity analysis. (This was required for a technical accounting issue, namely to calculate Web Travel Group’s gain on demerger.)

It is typical for the much smaller company in a spinoff situation to experience early selling pressure, as many former Webjet holders, who were mainly interested in the WebBeds business, may consider the new Webjet stock to be too small or uninteresting for their strategy.

In addition, holders in certain jurisdictions and small retail holders were either required or eligible to refuse to accept the spinco shares, in which case a Selling Agent will sell those shares in the market and pay them the proceeds. I have not seen any disclosure as to how many shares fell into this category, nor how long the Selling Agent may take to finish selling them, but this could add to the initial technical pressure on the stock.