Vita Life Sciences – healthy returns

(VLS.AX, USD86m market cap, USD20k ADVT, c.30% free float)

Programming note: happy Easter!

With markets shut for the long weekend and then asleep for the school holidays, today’s write-up is just for fun. The idea was prompted by a photo I found in Croda’s 2009 annual report, as shown below, while researching last week’s Croda write-up.

Vita is an Australian microcap with an attractive profile of high quality, steady growth and very cheap valuation. Unfortunately, the stock is closely held by its long-term major shareholders. Average daily value traded is therefore a miniscule c.$20k per day, with larger blocks by appointment only. Consider it as a name for the godchild’s account. Full disclosure: I have a tiny and meaningless exposure to the name myself, after some test buys last week resulted in a grand total of a 15bp position.

Normal service will resume from next Monday, with actionable write-ups that have sensible daily liquidity in the $mm range.

Executive summary

Vita Life Sciences is an Australian seller of premium branded vitamins and health supplements. Its Herbs of Gold and Vita Health brands are sold in Australia and in several Asian markets.

At IPO in 2007, Vita had just AUD11m sales. It has bootstrapped its way to AUD74m of sales with an 11% organic CAGR. Profitability, returns on capital and free cash flow are strong. Vita has no debt and AUD24m of cash on its balance sheet.

A capable and committed management team is in place, backed by supportive long-term shareholders. Corporate governance has been conservative and shareholder-friendly.

Vita has a clear growth path in Australia, where it is expanding from its health food shops base to the much bigger pharmacy channel, and also in China, where its partner handles cross-border e-commerce at low risk to Vita. Malaysia and Singapore are cash cows with steady growth potential.

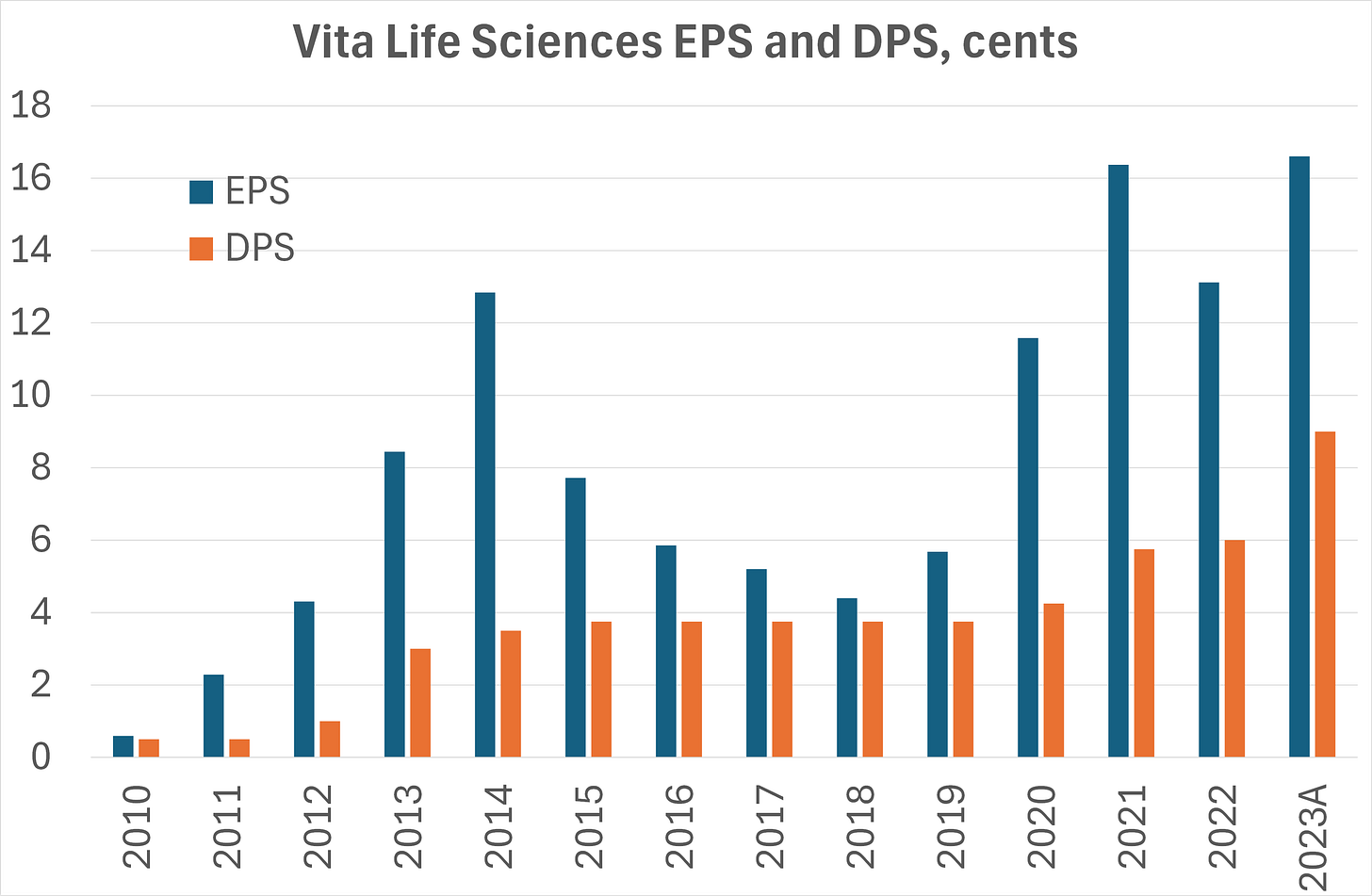

The stock trades at 13.3x current P/E and 7.8x EV/EBIT, for a business that should be able to compound earnings at a double-digit rate for years to come. The dividend yield is 3.8% at the current 50% payout ratio. The free cash flow yield of c.8% is more representative of the potential shareholder payout, given the capital-light model and no appetite for M&A.

Business description

Vita Life Sciences develops and markets vitamins and supplements, using its own team of product developers, nutritionists, naturopaths and pharmacists. All manufacturing is outsourced to a number of different contract manufacturers, with a 25% cap on any single manufacturer to reduce dependence and risks. Distribution is via selected retail partners in each country.

In Australia, Vita sells under the Herbs of Gold brand, founded in 1989. This is a premium brand, known for high-strength formulations. It was originally distributed in health food retailers. More recently, the company has also introduced the Herbs of Gold brand to the much bigger independent pharmacy channel, with five times as many doors across Australia. (Herbs of Gold is still not available at mass discount channels such as Coles, Woolworths or Chemist Warehouse.) Vita also operates a direct ecommerce store, but only sells at full price in order to protect the interests of its loyal health food and pharmacy retail partners.

Within the Australia segment, Vita includes export sales to China for the cross-border e-commerce (CBEC) channel. Vita itself has no presence in China. All sales are conducted via a single strong distributor partner, who is responsible for selling on all the major e-commerce platforms, to avoid the channel conflicts that are otherwise typical. China export sales have grown strongly in the last few years, reaching 17% of the group total in 2023. Vita is paid in Australian dollars and receives 50% of the cash upfront, thus minimising currency and credit risks. In addition, there is a limited amount of Daigou activity (grey market exports from Australia to China), but Vita is able to keep a lid on this.

Malaysia and Singapore are the home of the Vita Health brand, launched in 1973. Vita Health is positioned as a universal brand and sold in all channels, including supermarkets and department stores. A full range of around 150 SKUs per country is offered. Turmeric-based products are strong sellers at present.

Track record

Sales development by country is shown in my chart below. It is clear that after rapid growth up to 2013 or so, Vita hit a wall at the A$30-40m level that it struggled to break through for several years.

The profit margin also went backwards during the period of stagnation, as shown below.

A change of management turned things around. The MD since IPO, Eddie Tie, retired in December 2016. His successor was Andrew O’Keefe, an internal promotion from CEO of the Herbs of Gold business. He appointed a new senior management team, including the CFO Chin Khoo. O’Keefe and Khoo remain in place to this day, and deserve credit for returning Vita to profitable growth.

O’Keefe conducted a strategic review. The key decisions were to expand from health food stores into the pharmacy channel, and to bolster brand recognition by investing more in marketing. O’Keefe also appointed the single Chinese e-commerce partner in 2019, which has grown strongly to AUD12m sales in 2023.

The pharmacy channel has been transformative to Vita’s growth in Australia, and it still has years to play out. They started in late 2018 with individual pharmacies, then small chains, and only now are they signing contracts with some of the bigger mid-sized chains such as Priceline (acquired by Wesfarmers in 2022), Blooms and Terry White. Each new retail partner is a slow burn, typically starting with just two shelves, then four shelves, then a whole section. And they’ll start out with a listing in just 50 stores, then 100 and eventually reach all 200 or 300 stores.

Competitor landscape

Vita is tiny in market share terms, with only 1-2% of the market in Australia. The top three players each have 14-15% share, implying a fragmented long tail of other players.

The leader is Blackmores, with ten times Vita’s revenue. Blackmores mainly sells under its own mass-market brand, but it also owns Bioceuticals, the top-end premium practitioner brand in Australia. Blackmores was listed on the ASX until it was acquired by Kirin of Japan last year for AUD1.9bn. Kirin is listed as 2503.T with an $11bn mkt cap and a limited growth profile.

Swisse is another top player. It is owned by China’s H&H Group, listed as 1112.HK, with $866m mkt cap. H&H reported AUD1bn sales for the Swisse brand in 2023, but the stock is getting crushed by double-digit declines in its infant formula segment, due to the collapsing birthrate in the PRC.

PharmaCare is a family-owned business with multiple brands including Nature’s Way, Bioglan and Sambucol.

Nature’s Own is owned by Sanofi since its AUD560m acquisition in 2008. It will be part of the proposed spin-off of Sanofi’s Consumer Healthcare business in Q4’24.

Metagenics is a US PE-owned company that markets the Ethical Nutrients and Inner Health brands in Australia.

Note that Vita has no exposure to multi-level-marketing business, and no exposure to medicinal cannabis, two low-quality and risky categories found in other more speculative consumer health names.

Financial profile and forecasts

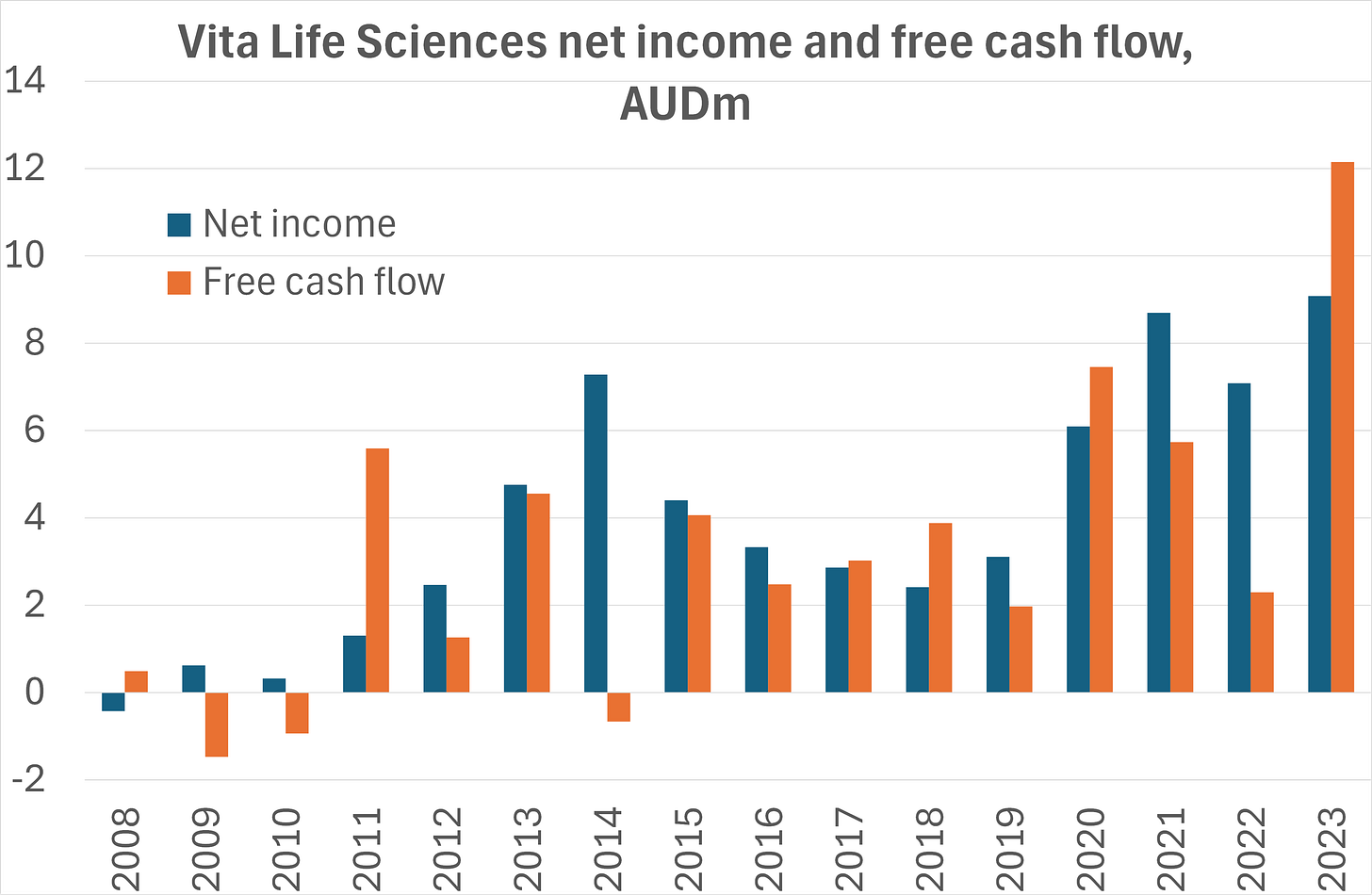

Vita has enjoyed consistently positive free cash flow, as my chart below shows. The model is asset-light given the outsourcing to contract manufacturer partners.

Net working capital is 19% of sales, due to c.150 days’ inventory which is needed to service all accounts in each country. Inventory on water is also included in the total, with some products manufactured in Europe and the US. Receivable days at 50 are well under control.

The company has a proud record of profitability and dividend payment stretching back 15 years. This is unusual for a microcap.

The asset-light model generates high returns. Below is the after-tax return on total assets, which is excellent in the mid to high teens. Return on capital employed would be far higher when adjusting for the large net cash.

I forecast the top and bottom lines to grow at a blended 10% per year. This is driven by a 12% CAGR for Australia, 9% for Malaysia and 6% for Singapore. Vietnam is a promising market for the future but will remain immaterial for the next few years. As for margin, I forecast it to be held steady at 16%, with any benefits from operating leverage reinvested into promoting brand growth.

The obvious risk would be a market-driven slowdown. Consumers should keep spending on their health and well-being even in tough times, but there is a discretionary element to the products. In any case, the company has indicated that 2024 got off to a good start, and they are cautiously optimistic.

Shareholders and liquidity

As mentioned at the top, Vita stock is thinly traded with average daily liquidity of just $20k. This is a positive reflection of its quality. Vita’s existing shareholders are happy to take a long-term view on their investment. Meanwhile, daytraders find Vita far too dull to bother with, compared to heavily promoted speculative mining and technology plays.

Notable shareholders include the Teoh family with a 15% stake. Vicky Teoh is the Taiwan-born wife of reclusive Malaysian billionaire David Teoh, the entrepreneur behind TPG which just merged with Vodafone’s business in Australia. Her entrepreneurial sons Jack and Shane Teoh have taken turns to serve as non-execs of Vita Life.

Former CEO Eddie Tie retains a 7% stake. Current management own 4-5%.

Annex: history

Vita’s calm and steady approach since the 2007 IPO is perhaps a reaction to its traumatic pre-history, when it managed to survive the twin near-death experiences of a fraudulent CEO and a mass product recall.

Vita Life Sciences was first listed in April 2000, with the long-established Vita Health brand of vitamins and supplements in Singapore and Malaysia as its mainstay business. It reported a profit of AUD5.25m for the year 2000. In 2001, it acquired the Herbs of Gold brand in Australia for AUD5m, and hit a market cap of AUD140m at peak in mid 2001. However, the wheels fell off in spectacular fashion. The founder, KS Pang, died in 2001. His son, the CEO Pang Meng Seng, was found to be treating the company’s funds like a piggybank. The ASX suspended the shares in March 2002, and then delisted the company in June 2003. Pang Jr’s messy fraud trial in Singapore ultimately resulted in a guilty verdict and the forfeiture of his stake in the company.

Separately, Vita was hit by Australia’s largest ever medicines recall. The top contract manufacturer, Pan Pharmaceutical, failed a Therapeutic Goods Administration audit in February 2003. This led to mass recalls of vitamins and supplements that hit the whole industry, including Vita’s Vita Health and Herbs of Gold brands. (Only Blackmore had no exposure to Pan, by pure luck. The incident was the making of Blackmore, which gained a lot of market share and never looked back.)

The clean-up operation and salvaging of shareholder value from this double whammy counts as a great achievement.

The current CFO, Chin Khoo, first joined Vita in 2003-04, at the beginning of the rebirth. He returned as CFO in 2017 when the current MD took the helm, having spent a total of 14-15 years with the company across two spells.

Note. The author spoke to Vita Life Sciences in order to understand the background to the business. All opinions and estimates are the author’s own.

This is a very thorough write-up, thank you. As a current shareholder I can't add very much to your analysis except to bring up some interesting observations:

1. Management is very much of the "no hype' type, and are conservative in their guidance. I believe the CEO was previously with Blackmores and knows the industry well.

2. The ongoing brand building that is taking place by investing increasing sums in sales and marketing is keeping a speed limit on earnings growth. However this is aimed to keep the top line growing strongly from gaining market share - according to management.

3. The absence of their products in Chemist Warehouse Australia is part of their strategy to align with retail partners who do not discriminately discount products, but rather earn reasonable and stable gross margins in a win win scenario for supplier and retailer.

4. Another ASX listed vitamins company EZZ Life Sciences (ASX: EZZ) is also having success accessing the Chinese consumer. However EZZ tend to rely moreso on social media platforms such as Douyin to promote their products. They spend vast sums on marketing - which I presume to be due to the use of influencers on the various platforms.

5. Recent share sales from the Chairman and the CEO are a concern.

Once again thank you!